April Brings Relief from Rising Used Auto Prices at AutoZone

May 6, 2023

Trending News ☀️

AUTOZONE ($NYSE:AZO): April saw a welcomed reprieve from the steadily rising used auto prices at AutoZone, one of the largest automotive parts and accessories retailers in the United States. The decreased used auto prices in April indicate a decrease in inflation, which is good news for many consumers. The data also showed that used car prices had been steadily increasing since February, making April’s decrease particularly significant. This drop in prices is especially positive for AutoZone, as the company stands to benefit from the increased demand for used cars and parts. Thanks to the lower prices, customers can now afford to purchase the necessary parts and tools from AutoZone at more reasonable rates.

This could lead to an increase in sales for the company, providing a much needed boost to its bottom line. Overall, April saw a welcome reduction in used auto prices, which should be beneficial to AutoZone and its customers. The decrease in inflation is likely to be beneficial to car owners across the board and should help AutoZone stay competitive in the ever-changing automotive parts market.

Price History

April marks a welcomed relief from the increasing prices of used cars at AutoZone. The stock opened at $2665.2 on Friday and closed at $2691.6, up by 1.1% from the last closing price of $2661.6. This increase in stock price marks a steady upward trend as AutoZone continues to provide affordable used cars to consumers. The company’s commitment to providing quality used cars at lower prices is allowing customers to find the perfect car for their needs without breaking the bank.

As the used car market continues to slowly recover, AutoZone is sure to be a major player in the industry. With their focus on affordability and customer satisfaction, AutoZone is sure to be a major player in the used car market for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Autozone. AutoZone“>More…

| Total Revenues | Net Income | Net Margin |

| 16.89k | 2.42k | 14.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Autozone. AutoZone“>More…

| Operations | Investing | Financing |

| 3.22k | -706.79 | -2.46k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Autozone. AutoZone“>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.55k | 19.73k | -226.58 |

Key Ratios Snapshot

Some of the financial key ratios for Autozone are shown below. AutoZone“>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.8% | 13.6% | 19.5% |

| FCF Margin | ROE | ROA |

| 14.8% | -51.2% | 13.2% |

Analysis

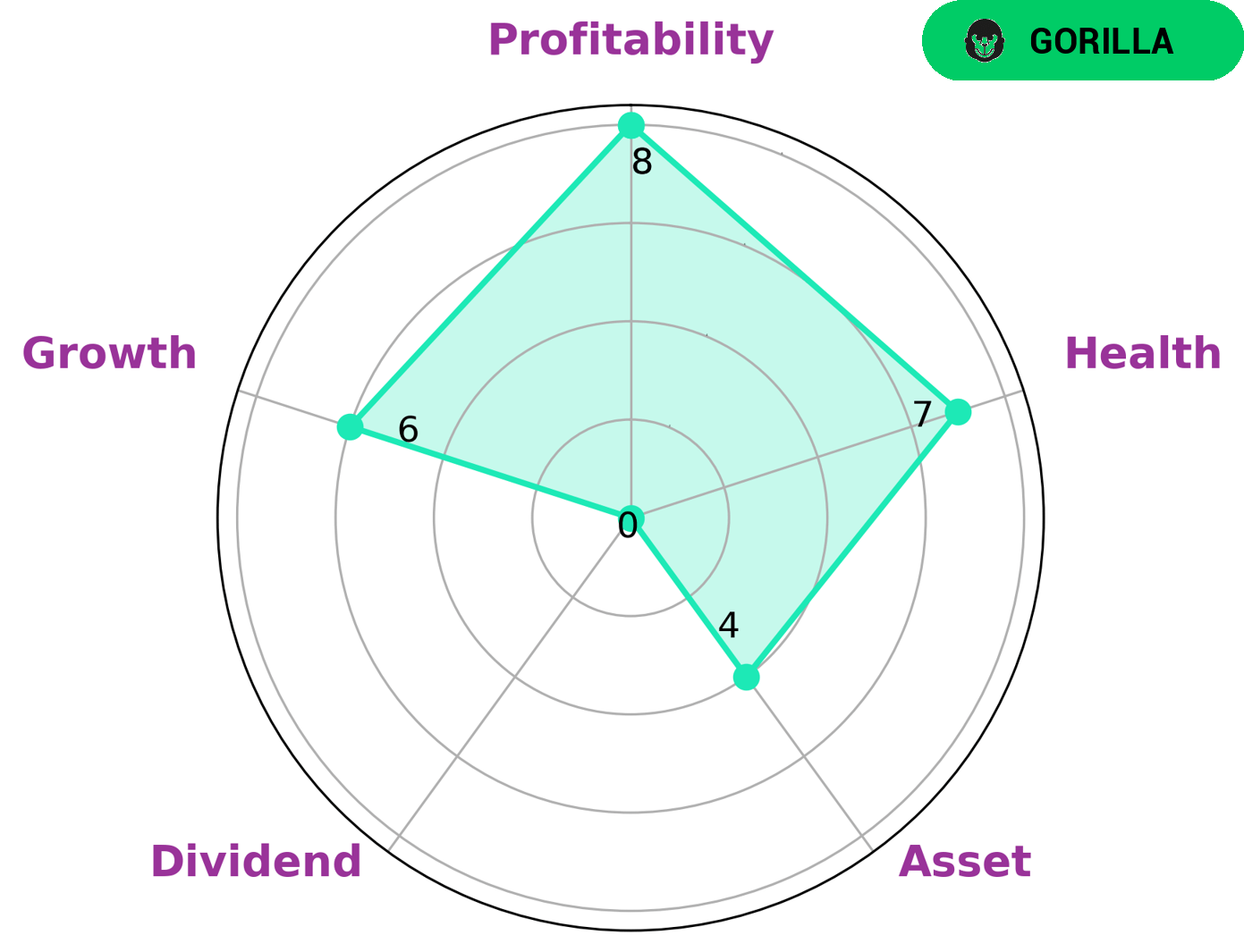

GoodWhale’s analysis of AUTOZONE‘s fundamentals revealed positive results. According to our Star Chart, AUTOZONE scored highly in terms of profitability, medium in asset, growth, and weak in dividend. It was also revealed to have a high health score of 7/10, indicating that it is capable of paying off debt and funding its future operations. Furthermore, AUTOZONE was categorized as a ‘gorilla’, a type of company that is characterized by its stable and high revenue or earning growth due to a strong competitive advantage. With such promising results, we believe that AUTOZONE may be attractive to many investors. Those who seek long-term investments with steady returns may find AUTOZONE’s fundamentals appealing. Furthermore, those who are looking for companies with a strong competitive advantage may be interested as well. Investors who value strong cash flows and debt management may also want to take a closer look at AUTOZONE. More…

Peers

AutoZone Inc. is an American retailer of aftermarket automotive parts and accessories, the largest in the United States. Founded in 1979, AutoZone has over 6,000 stores across the United States, Mexico, and Brazil. The company is based in Memphis, Tennessee.

AutoZone is the leading retailer of aftermarket automotive parts and accessories in the United States. With over 6,000 stores across the United States, Mexico, and Brazil, AutoZone is the go-to destination for all your automotive needs. From oil changes to new tires, AutoZone has everything you need to keep your car running smoothly.

Advance Auto Parts, Inc. is an American automotive aftermarket parts provider that is headquartered in Raleigh, North Carolina. Advance Auto Parts operates in approximately 3,700 stores and 150 Worldpac branches in the United States, Puerto Rico, and the Virgin Islands.

O’Reilly Automotive, Inc. is an American chain of auto parts stores founded in 1957 by the O’Reilly family. It operates more than 5,000 stores in 47 states.

Five Below, Inc. is an American discount store chain selling products that cost up to $5. Among the merchandise sold are toys, games, fashion accessories, bath and body products, candy, snacks, room décor, school supplies, books, and novelty items.

– O’Reilly Automotive Inc ($NASDAQ:ORLY)

O’Reilly Automotive Inc is a publicly traded company with a market cap of 46.99B as of 2022. The company has a Return on Equity of -312.91%. O’Reilly Automotive Inc is a retailer of automotive aftermarket parts, tools, and supplies in the United States. The company operates through four segments: Retail, Commercial, e-Commerce, and Other.

– Five Below Inc ($NASDAQ:FIVE)

Five Below Inc is a publicly traded company with a market capitalization of 7.79 billion as of 2022. The company has a return on equity of 18.02%. Five Below Inc is a specialty retailer that offers a variety of merchandise for teenagers and pre-teens at prices that are “five dollars and below.” The company was founded in 2002 and is headquartered in Philadelphia, Pennsylvania.

– Advance Auto Parts Inc ($NYSE:AAP)

Advance Auto Parts is a leading retailer of automotive parts and accessories in the United States. The company operates over 5,000 stores across the country and employs over 70,000 people. Advance Auto Parts is a publicly traded company on the New York Stock Exchange and has a market capitalization of over $10 billion as of 2021. The company has a strong history of profitability and has a return on equity of over 16%. Advance Auto Parts is a well-run company with a strong balance sheet and a commitment to customer satisfaction. The company is a great choice for investors looking for a stable and profitable business.

Summary

Its stock is traded on the New York Stock Exchange under the ticker AZO. AutoZone also gained market share across the U.S. in terms of store sales and store count. The company’s impressive growth has translated into double-digit returns for its stockholders over the past year. Looking ahead, analysts anticipate that AutoZone’s same store sales and revenue growth will continue to increase in the coming quarters. This makes AutoZone an attractive investment option for long-term investors.

Recent Posts