Analysts Reach Consensus on Unifi, Stock Target Price of $25

December 28, 2022

Trending News 🌥️

Yes, analysts reached a consensus on Unifi ($NYSE:UFI), Inc. stock on Tuesday, setting a target price of $25. Unifi, Inc. is a global textile solutions provider and one of the world’s leading innovators in manufacturing synthetic and recycled performance fibers. This target price was based on a variety of factors, including the company’s financial performance, industry trends and potential future growth opportunities. The consensus amongst analysts is that Unifi’s stock is undervalued and has potential for significant growth in the future. Unifi also has a strong dividend yield at the moment, which is another attractive feature for investors. In addition to the consensus target price of $25, analysts have also highlighted the potential risks associated with investing in Unifi’s stock.

Factors such as changing consumer trends and increasing competition in the industry could affect the company’s profitability in the future. Investors should be aware of these risks before making any decisions about investing in Unifi’s stock. Overall, analysts have reached a consensus on Tuesday that Unifi’s stock is undervalued and has potential for significant growth in the near future. The target price of $25 is seen as both achievable and reasonable by analysts who follow the stock. Investors who decide to purchase Unifi’s stock now should be aware of the potential risks associated with the investment.

Market Price

The news about the stock has been mostly neutral recently. On Wednesday, UNIFI stock opened at $7.9 and closed at $7.9, up by 0.3% from the prior closing price of 7.9. This indicates a slight increase in stock value, but analysts are still expecting it to reach the target price of $25. Analysts believe that the stock will reach the target price over the next few months, as the company’s fundamentals and financials remain strong. The company has been able to maintain its profitability despite the challenging economic environment.

In addition, the company has a strong balance sheet, with minimal debt and a healthy cash position. Analysts are also positive about UNIFI’s long-term prospects, as they believe the company is well-positioned to take advantage of any potential market opportunities that may arise. The company’s continued innovation and focus on cost containment will further strengthen its competitive advantage. With its strong fundamentals and financials, analysts believe that the stock is likely to reach the target price over the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Unifi. More…

| Total Revenues | Net Income | Net Margin |

| 799.28 | -1.34 | -0.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Unifi. More…

| Operations | Investing | Financing |

| 10.3 | -43.88 | 33.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Unifi. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 557.83 | 209.53 | 19.34 |

Key Ratios Snapshot

Some of the financial key ratios for Unifi are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.2% | -5.3% | 1.5% |

| FCF Margin | ROE | ROA |

| -3.9% | 2.2% | 1.4% |

VI Analysis

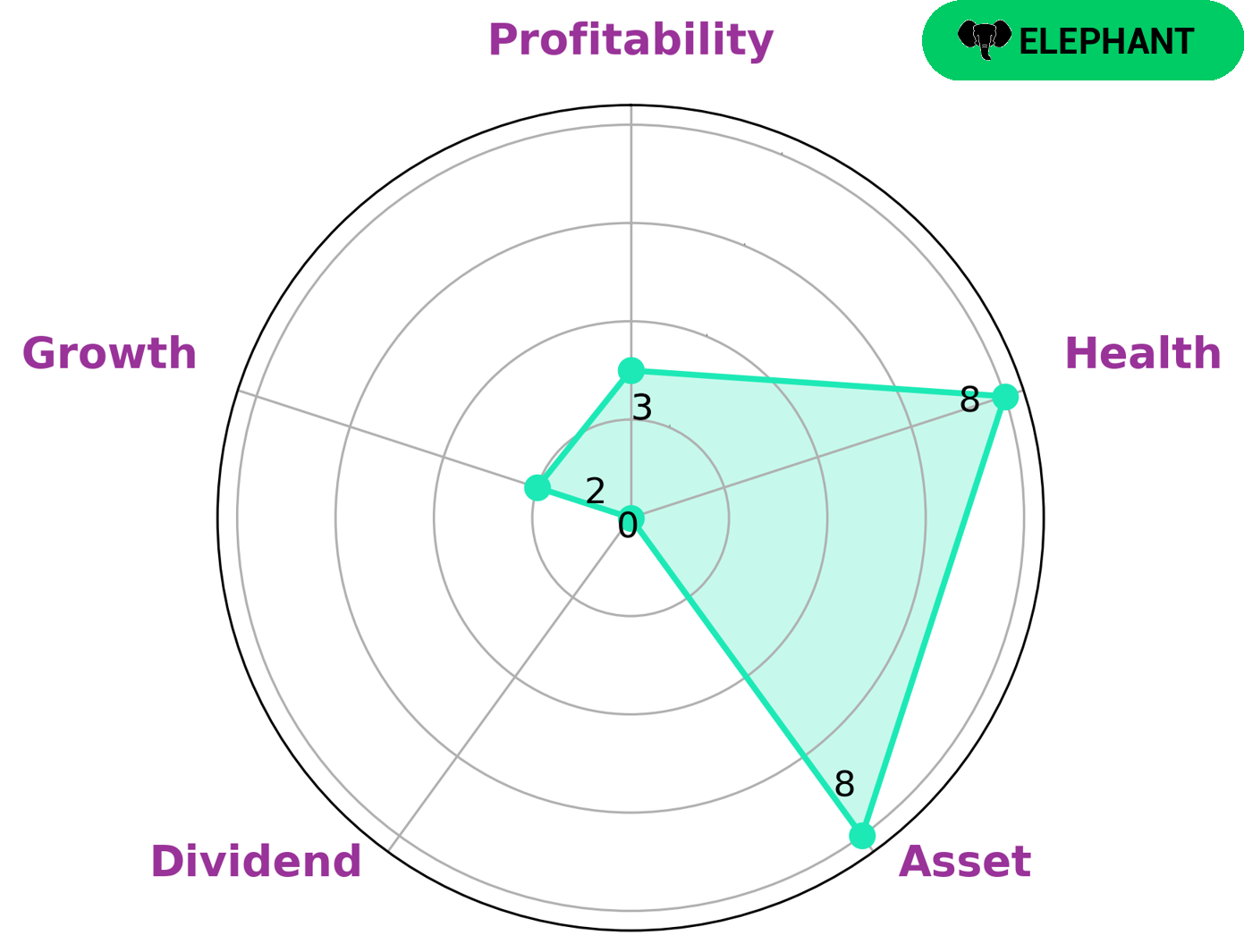

Company fundamentals are key to understanding the long-term potential of a business. The VI app makes it easy to analyze companies like UNIFI. According to the VI Star Chart, UNIFI is classified as an “elephant” – a company that has a large amount of assets after deducting liabilities. This type of company is attractive to investors looking for long-term investments and stability. UNIFI has a high health score of 8 out of 10 when it comes to cash flow and debt, indicating that it is well-positioned to sustain operations even in times of crisis. Moreover, UNIFI is strong in terms of assets, but weak in other areas such as dividend, growth, and profitability. These factors make UNIFI a great long-term investment for investors who are looking for stability and appreciate the value of a strong asset base. As UNIFI continues to grow, it is likely to become even more attractive to investors looking for a stable asset that can provide a steady stream of income over time. More…

VI Peers

The company has a diversified product portfolio and a wide range of customers. Unifi‘s competitors include Valson Industries Ltd, Pioneer Embroideries Ltd, and Hsin Sin Textile Co Ltd.

– Valson Industries Ltd ($BSE:530459)

Valson Industries Ltd is a publicly traded company with a market capitalization of 189.22M as of 2022. The company has a return on equity of 2.05%. Valson Industries Ltd is engaged in the manufacture and sale of textile products. The company’s products include fabrics, garments, and home furnishings.

– Pioneer Embroideries Ltd ($BSE:514300)

Pioneer Embroideries Ltd is a publicly traded company with a market capitalization of 1.15 billion as of 2022. The company has a return on equity of 7.28%. Pioneer Embroideries Ltd is engaged in the business of manufacturing and marketing embroidery products. The company’s products are sold under the brand names of Pioneer, Janome, and Husqvarna.

– Hsin Sin Textile Co Ltd ($TPEX:4406)

Hsin Sin Textile Co Ltd is a textile company that produces a wide range of textile products, including fabrics, yarns, garments, and home textiles. The company has a market cap of 547.67M as of 2022 and a return on equity of 2.47%. Hsin Sin Textile Co Ltd is a publicly traded company listed on the Taiwan Stock Exchange.

Summary

Investment analysts have come to a consensus that Unifi, Inc. stock is currently trading at a target price of $25. The stock price has been relatively stable and mostly neutral in recent news. Investors should consider analyzing the company’s current financials and performance, as well as their long-term plans and goals, before deciding whether to invest in Unifi, Inc. It is important to consider how the company is likely to perform in the future, as well as its competitive landscape, before investing in Unifi, Inc. Additionally, investors should keep an eye on the industry and sector developments, as well as any potential risks, before investing in Unifi, Inc. stock.

Recent Posts