Sunoco LP: A Low P/E Stock with a Market Cap of $3.818 Billion Makes for a Good Investment

January 30, 2023

Trending News ☀️

Sunoco ($NYSE:SUN) LP is a publicly traded energy sector stock with a remarkable market capitalization of $3.818 billion. It offers investors an attractive low forward price-to-earnings ratio of 7.96, making it a great option for those looking to invest in a well-established energy sector stock. Sunoco LP is well-known for its excellent customer service and reliable delivery of fuel. This gives investors the assurance that the company is well-positioned to manage through any economic downturns in the future. The company’s strong financials, reliable customer service and excellent fuel delivery make it an attractive choice for investors looking to diversify their portfolios.

Price History

At the time of writing, news coverage on the stock is mostly positive. On Thursday, Sunoco LP opened at $45.2 and closed at $45.1, down by 0.2% from the previous closing price of $45.2. The company’s stock price has been relatively stable over the past year, with occasional spikes. Sunoco LP is a leading retail fuel and convenience store operator in the United States, and its stock offers investors a solid dividend yield and a low P/E ratio. The company has a solid balance sheet with strong cash flow and an impressive portfolio of convenience stores, gas stations, and other retail locations.

Furthermore, Sunoco LP has a long history of providing excellent customer service and is well respected in the industry. The company’s diversified portfolio of products and services, along with its reliable income stream, makes it a good choice for investors looking for a low-risk stock with steady returns. Overall, Sunoco LP is an attractive investment option due to its low P/E ratio, strong dividend yield, and reliable income stream. The company’s positive news coverage and stable stock price make it a good pick for investors looking for a safe bet in the stock market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sunoco Lp. More…

| Total Revenues | Net Income | Net Margin |

| 24.77k | 442 | 1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sunoco Lp. More…

| Operations | Investing | Financing |

| 605 | -387 | -228 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sunoco Lp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.57k | 5.6k | 11.68 |

Key Ratios Snapshot

Some of the financial key ratios for Sunoco Lp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.8% | 23.6% | 3.0% |

| FCF Margin | ROE | ROA |

| 1.7% | 46.7% | 7.0% |

VI Analysis

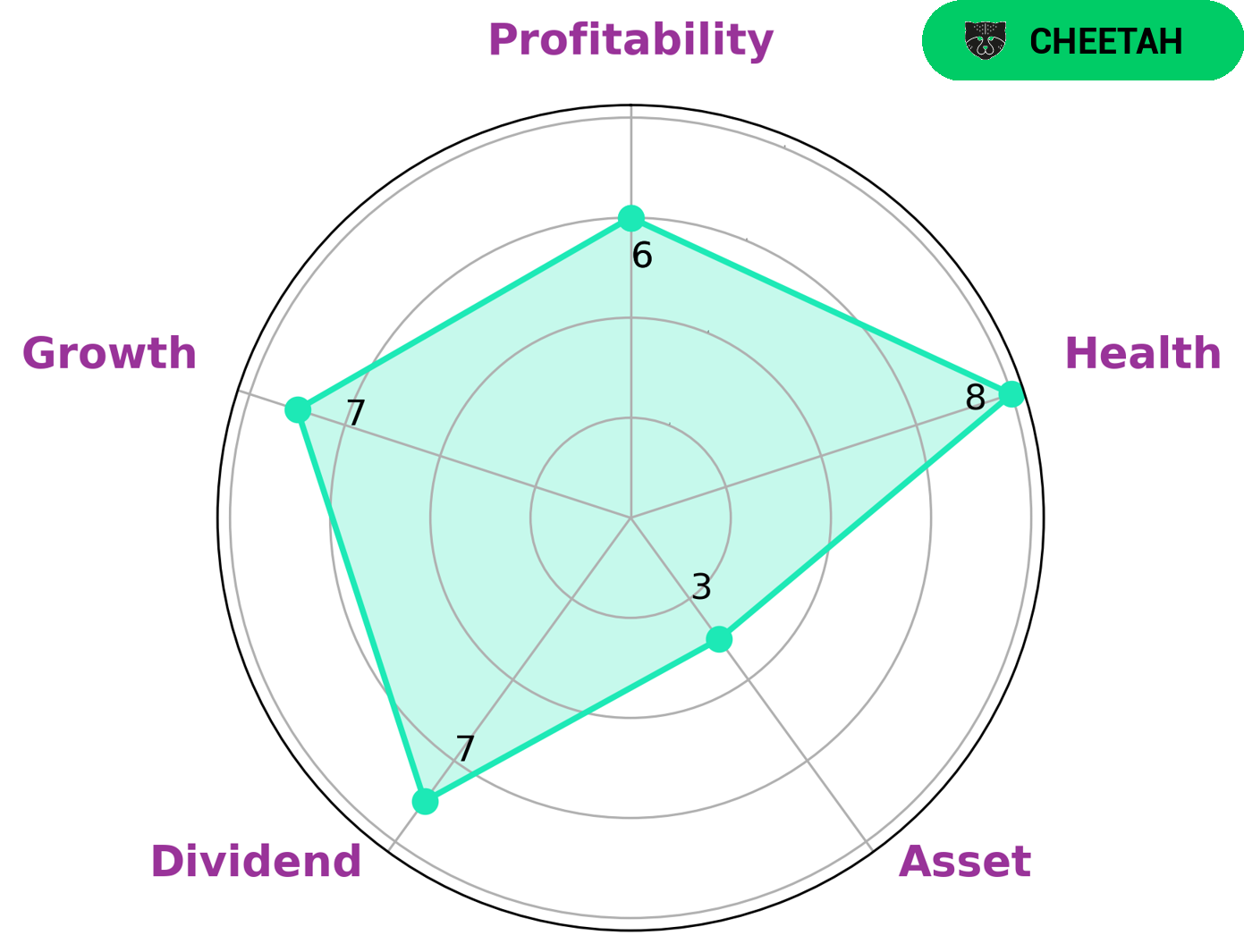

VI app’s Star Chart gives SUNOCO LP a health score of 8/10, indicating that its cashflows and debt are strong enough to sustain future operations even in times of crisis. SUNOCO LP has a strong dividend and growth, medium profitability and weak asset. It is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are seeking for higher returns may be interested in SUNOCO LP given its potential for high growth. These investors may have an appetite for taking on higher risk in exchange for higher returns. Those investors who are looking for a more stable investment may not be attracted to SUNOCO LP given its lower profitability and lower asset score. Investors should also take into consideration the potential volatility of the company’s stock price and the possibility of capital loss. Overall, SUNOCO LP presents an attractive investment opportunity for investors who are looking for higher returns with higher risk. They should however do their own due diligence and assess their risk tolerance before investing in the company. More…

VI Peers

Headquartered in Dallas, Texas, Sunoco LP has approximately 5,000 employees and operates more than 1,300 convenience stores and gas stations in 35 states. The company’s primary competitors are Delek US Holdings Inc, HF Sinclair Corp, PTT Oil and Retail Business PCL.

– Delek US Holdings Inc ($NYSE:DK)

Delek US Holdings Inc is a diversified downstream energy company with assets in petroleum refining, logistics, asphalt, renewable fuels and convenience store retailing. The company operates through two segments: Refining and Logistics, and Retail. The Refining and Logistics segment includes refining operations and logistics assets that support the transportation, storage and distribution of refined products. The Retail segment consists of convenience store and fuel retailing operations. Delek US Holdings Inc is headquartered in Brentwood, Tennessee.

– HF Sinclair Corp ($NYSE:DINO)

Sinclair Broadcast Group, Inc. is one of the largest television broadcasting companies in the United States. The company owns or operates, programs or provides sales services to more than 190 television stations in 89 markets. Sinclair’s television group reaches approximately 38.9% of U.S. television households and includes FOX, ABC, CBS, CW, MyNetworkTV, and Univision affiliates. Sinclair also owns or operates four radio stations in the Pacific Northwest.

– PTT Oil and Retail Business PCL ($SET:OR)

PTT Oil and Retail Business PCL is a Thai oil and gas company with a market cap of 292.8 billion as of 2022. The company has a return on equity of 11.75%. PTT Oil and Retail Business PCL is involved in the exploration, production, refining, and marketing of oil and gas. The company also has a retail business that operates a chain of gas stations and convenience stores in Thailand.

Summary

Sunoco LP (NYSE: SUN) is an attractive investment opportunity due to its low price-to-earnings ratio and large market capitalization. At the time of writing, news coverage is mostly positive and the stock has been steadily increasing in value. Financial analysis indicates that Sunoco LP has a strong balance sheet, low debt levels and a healthy dividend yield of around 8%.

The company is also well-positioned to benefit from rising energy prices in the near-term. Although there are some risks associated with investing in Sunoco LP, such as volatile energy markets and geopolitical uncertainty, the long-term outlook for this company looks promising given its size, stability, and attractive valuation.

Recent Posts