StarHub to Surpass Singtel in Fixed Broadband Market by 2023

March 29, 2023

Trending News 🌥️

STARHUB ($SGX:CC3): StarHub is set to overtake Singtel in the fixed broadband market by 2023, as predicted by research analysts. StarHub has been steadily gaining traction in the fixed broadband market, with increased investments in services and infrastructure. This has resulted in improved reliability and speed of connection, as well as more competitive pricing, which has been driving an increasing number of customers away from Singtel and towards StarHub. This shift in the market share is attributed to the growing customer base of StarHub, as well as its competitive pricing and reliable service quality.

Furthermore, the research suggests that StarHub may also be taking advantage of Singtel’s waning interest in the fixed broadband sector. This is particularly true for rural areas, where Singtel’s coverage has been reduced over the past few years. This will represent a major shift in the sector and could have a significant impact on the competitive landscape of Singapore’s telecommunications industry.

Market Price

StarHub Ltd‘s stock opened at SG$1.0 and closed at the same price on Tuesday, down by 1.0% from the prior closing price. This is a bold prediction, given the fact that Singtel currently holds the majority market share in the fixed broadband industry. However, StarHub has been making aggressive moves to increase their presence in the market, such as expanding their network of fibre infrastructure and offering competitive prices for their services. As such, they may be able to edge out their competitor by 2023, if they continue on their current trajectory. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Starhub Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 2.13k | 134.4 | 6.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Starhub Ltd. More…

| Operations | Investing | Financing |

| 539.9 | -359.2 | -166.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Starhub Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.25k | 2.52k | 0.34 |

Key Ratios Snapshot

Some of the financial key ratios for Starhub Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.3% | -2.1% | 10.7% |

| FCF Margin | ROE | ROA |

| 17.1% | 24.2% | 4.4% |

Analysis

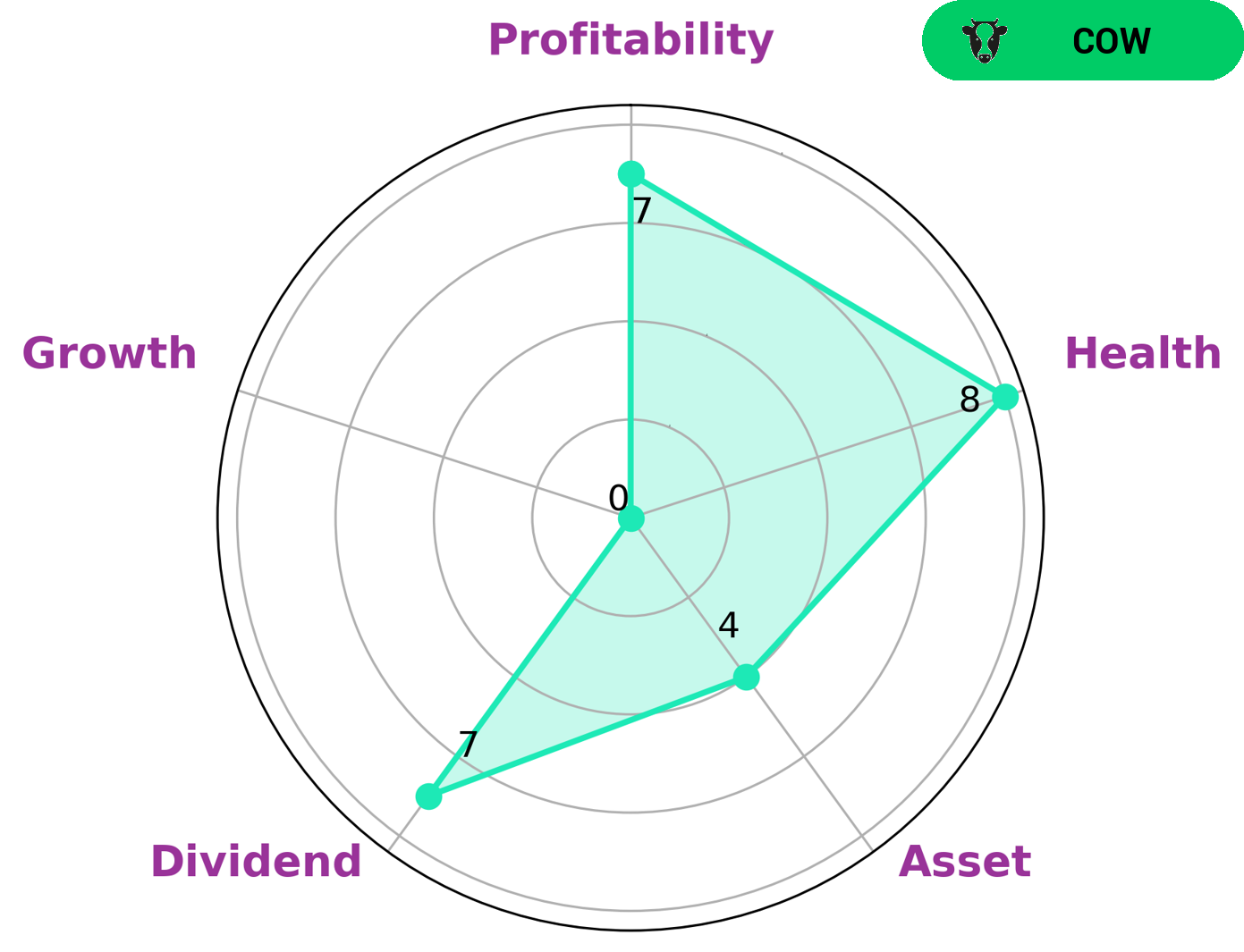

At GoodWhale, we conducted an analysis of STARHUB LTD‘s fundamentals and concluded that it is classified as a ‘cow’, a type of company with the track record of paying out consistent and sustainable dividends. With its strong dividend, profitability, and medium asset ratings, STARHUB LTD may be of particular interest to value-oriented investors looking for stocks that provide a steady income stream. Additionally, STARHUB LTD has a high health score of 8/10. This means that considering its cashflows and debt, the company is capable to safely ride out any crisis without the risk of bankruptcy. Moreover, with its weak growth rating, it may be attractive to income investors with a low-risk appetite. More…

Peers

It operates both fixed line and wireless services for businesses and consumers, and provides a wide range of television, broadband and mobile services. Its major competitors include Asia Pacific Telecom Co Ltd, Swoop Holdings Ltd, and TIM SA. All of these companies offer similar services in the telecommunications industry, with each striving to become the market leader.

– Asia Pacific Telecom Co Ltd ($TWSE:3682)

Asia Pacific Telecom Co Ltd is a telecommunications company operating in the Asia Pacific region. It has a market capitalization of 26.64B as of 2023, indicating it is a large-cap company. The company’s Return on Equity (ROE) is -10.72%, which indicates its performance has been below average compared to its industry peers. The negative ROE suggests that the company is not able to generate enough profits relative to its shareholders’ equity. The company provides telecommunication services such as mobile and fixed telephony, broadband internet, digital television, and various other services.

– Swoop Holdings Ltd ($ASX:SWP)

Swoop Holdings Ltd is a business that specializes in asset management and capital markets. It has a market capitalization of 58.38M as of 2023, making it a relatively small-cap stock compared to its peers. Its Return on Equity of -5.03% is also lower than the industry average, indicating that the company is not generating profits efficiently. Despite these figures, Swoop Holdings Ltd is still an attractive investment opportunity for investors looking for long-term growth potential and risk management.

– TIM SA ($BER:TCZ)

TIM SA is a leading global telecommunications and technology company based in Brazil. It specializes in providing services for mobile phones and internet, including voice and data, as well as offering other technologies such as Internet of Things and smart metering solutions. The company has a market cap of 5.52 billion as of 2023 and has a Return on Equity of 9.6%. This indicates that the company is making efficient use of its assets to generate good returns for its shareholders. The company also has a strong presence across South America, which provides it with a competitive edge in the market. TIM SA is well positioned to capitalize on the growth opportunities in the telecommunication sector.

Summary

StarHub Ltd is a telecommunications provider in Singapore with a strong presence in the fixed broadband market. According to current industry projections, StarHub is expected to surpass Singtel, its main competitor, in the fixed broadband market by 2023. The company has received mostly positive media coverage to date, and investing in the company could prove to be a wise decision.

StarHub’s services include mobile broadband, enterprise products, media solutions, and digital solutions. Moreover, StarHub has a dividend yield of around 4%, which could provide investors with healthy returns over the long-term.

Recent Posts