Retail Investors Take Major Hit as American Superconductor Corporation’s Market Cap Drops US$22m Last Week

March 25, 2023

Trending News 🌥️

The recent US$22m drop in American Superconductor ($NASDAQ:AMSC) Corporation’s market cap has had a significant impact on individual investors, who currently hold 46% of the company’s shares. For these retail investors, this means a sharp decrease in their investment returns, which understandably has caused concern and a great deal of uncertainty. The massive drop in market cap is indicative of the importance of retail investors for the success of American Superconductor Corporation. This means that any changes in stock prices could have a major impact on the public, and this is why it is essential for these investors to remain informed about the company’s performance and the stock market as a whole.

Ultimately, the US$22m decrease in market cap highlights how volatile the stock market can be and how quickly fortunes can be made or lost. For American Superconductor Corporation, this has meant hefty losses for both individual and institutional investors, making it clear that everyone has a stake and strong motivation to ensure that the company succeeds.

Price History

The stock opened at $4.6 on Friday, but closed at $4.3, a drop of 8.0% from the last closing price of $4.6. This decrease in share price represents a loss of a significant amount of money for retail investors who had purchased the stock. The decrease in market cap is an indication of retail investor sentiment towards the company and its prospects of success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Superconductor. More…

| Total Revenues | Net Income | Net Margin |

| 102.55 | -33.2 | -32.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Superconductor. More…

| Operations | Investing | Financing |

| -20.12 | -1.27 | 0.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Superconductor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 165.07 | 77.86 | 2.95 |

Key Ratios Snapshot

Some of the financial key ratios for American Superconductor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.4% | – | -32.0% |

| FCF Margin | ROE | ROA |

| -20.8% | -22.5% | -12.4% |

Analysis

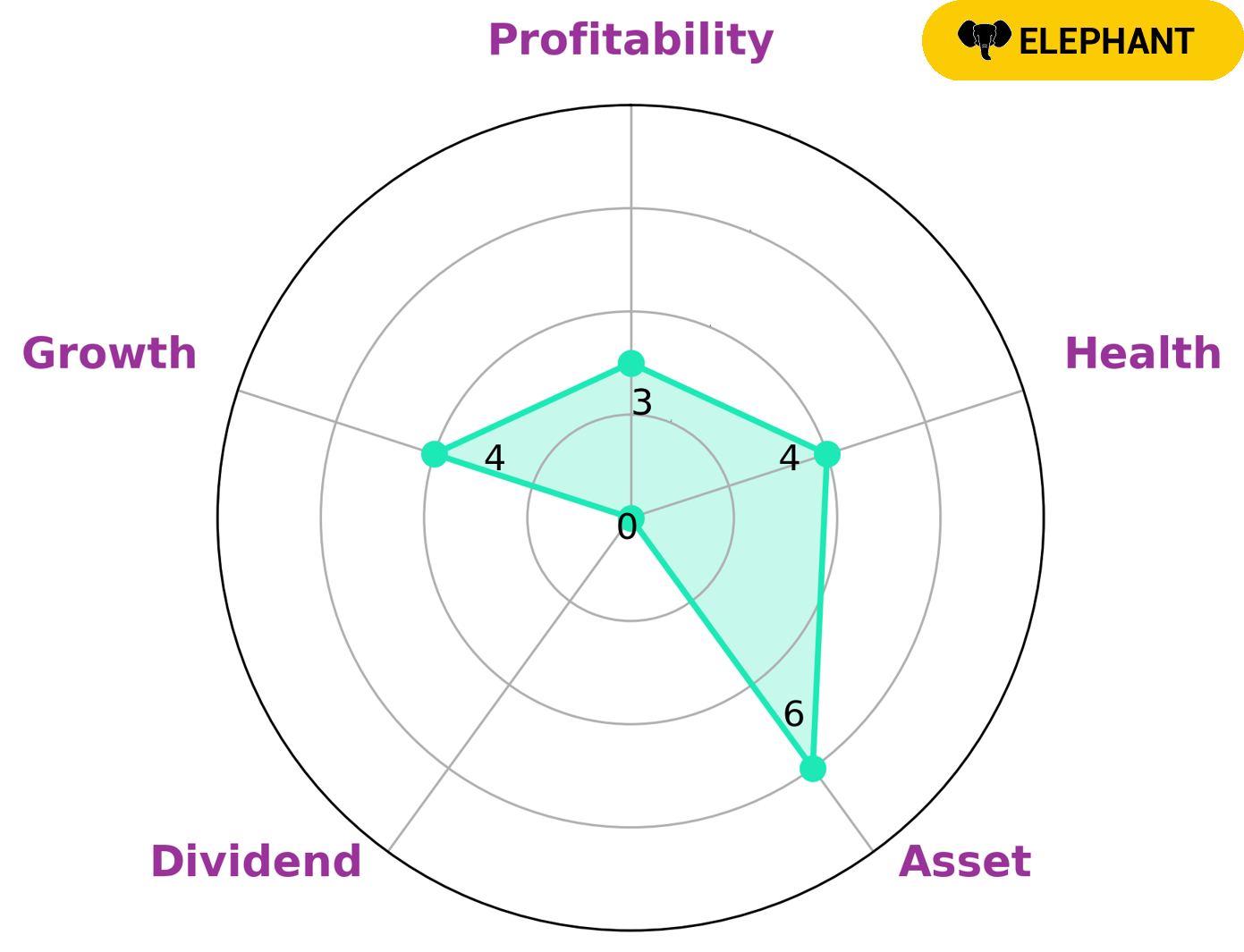

At GoodWhale, we analyzed the financials of AMERICAN SUPERCONDUCTOR to understand the company’s long-term sustainability. After examining the Star Chart, we classified the company as an ‘elephant’, which suggests significant assets after liabilities are deducted. This type of company is likely to attract investors who are seeking a secure and stable income stream. When looking into AMERICAN SUPERCONDUCTOR’s financial health, we found that it had an intermediate health score of 4 out of 10, indicating that the company is able to stay afloat in the event of a crisis without the risk of bankruptcy. AMERICAN SUPERCONDUCTOR is strong in asset, medium in growth and weak in dividend and profitability. Overall, AMERICAN SUPERCONDUCTOR presents investors with a secure and stable option for their investments. More…

Peers

The competition between American Superconductor Corp and its competitors is fierce. EnSync Inc, Siemens Energy AG, and Suzlon Energy Ltd are all competing for the same market share. Each company is trying to develop the best technology and products to win customers.

– EnSync Inc ($OTCPK:ESNC)

EnSync, Inc., together with its subsidiaries, develops, manufactures, and sells commercial and industrial distributed energy resources (DER) systems that provide energy management solutions to electric utilities, commercial, industrial, and institutional customers worldwide. The company offers DER products, including photovoltaic (PV) inverters, energy storage systems, and controls that enable its customers to manage energy, including demand charges, and maximize their return on investment.

– Siemens Energy AG ($OTCPK:SMNEY)

Siemens Energy AG is a German multinational conglomerate company headquartered in Munich and the largest industrial manufacturing company in Europe with branch offices abroad. The company was founded in 1847 as a maker of telegraph equipment and now serves as a parent company for the majority of Siemens’ businesses. Siemens Energy AG focuses on the energy sector and provides products and services for oil and gas production, power generation and transmission, renewable energy, and more. As of 2022, Siemens Energy AG has a market cap of 7.82B and a return on equity of -4.82%.

– Suzlon Energy Ltd ($BSE:532667)

Suzlon Energy Ltd is a renewable energy company headquartered in Pune, India. The company is engaged in the development, construction, and operation of wind power projects. As of March 31, 2021, the company had an installed capacity of 2,278 MW in India and 3,871 MW globally.

The company has a market cap of 81.86B as of 2022 and a Return on Equity of -56.31%. The company’s market cap has been on a decline in recent years due to a number of factors including the global economic slowdown, the Indian government’s policy change on renewable energy targets, and the company’s own financial troubles. The company has been struggling to meet its debt obligations and has been selling off assets to raise cash. In spite of these challenges, the company remains one of the leading players in the global wind energy market.

Summary

American Superconductor (AMSC) experienced a dramatic decline in market cap last week, with their stock price dropping significantly. This is a major hit to retail investors, as the company had previously been performing well. Analysts attribute the decline to a combination of lack of investor confidence and weak earnings performance, as well as overall market volatility.

Recent Posts