Pearson PLC Shares Rise 0.04%, Underperforming Market on Thursday

February 10, 2023

Trending News ☀️

Pearson ($LSE:PSON) PLC is a British multinational publishing and education company, based in London and listed on the London Stock Exchange. They are one of the world’s leading learning companies and are renowned for their commitment to providing quality education to learners across the globe. On Thursday, Pearson PLC shares rose by 0.04% to £9.08, despite the FTSE 100 index climbing 0.9% to 7,735 for an all-round positive trading session. This demonstrates the steady but underwhelming growth performance of Pearson PLC over the past few days, which has not kept in line with the overall market performance. The sluggish performance of Pearson PLC’s shares can be attributed to a variety of factors. Firstly, the company’s ongoing struggles with shifting its business model to become more digitally orientated has had an impact on share prices, as they have been unable to keep pace with rapidly growing technology-based companies.

Additionally, the company’s recent decision to restructure their business model has been met with mixed reviews from investors. Moreover, the recent US-China trade war has had a detrimental impact on Pearson PLC, as their education services have been hit hard by the tariffs imposed by both countries. This has led to a decrease in consumer demand and a reduction in revenue for Pearson PLC. In conclusion, whilst Pearson PLC’s shares have risen by 0.04% on Thursday, they still remain underperforming the overall market index, which has increased by 0.9%. This highlights the ongoing struggles faced by the company as it attempts to shift its business model in order to remain competitive in an increasingly digitalised world.

Price History

Thursday was a relatively uneventful day for Pearson PLC in terms of its stock value, as the company’s shares increased by only 0.04%. This was underperforming compared to the market as a whole, which saw a slight uptick overall. At the time of writing, news reports concerning Pearson PLC have been mostly positive; however, this did not translate into any notable market growth on Thursday. The company’s stock opened at £9.1 in the morning and closed at £9.1 in the evening, indicating a minimal change in its total market value. Overall, Pearson PLC has had a generally successful year, with its share value climbing steadily since the beginning of the year.

The company has made several strategic partnerships and acquisitions that have contributed to its growth, and investors have generally been pleased with the company’s performance. While Pearson PLC may not have seen much of a bump in its stock value on Thursday, it is still well-positioned for future success. The company is continuing to make strategic investments and partnerships to ensure that it remains competitive, and investors have continued to recognize this. With its strong fundamentals and solid market position, Pearson PLC looks poised to continue its success into the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pearson Plc. More…

| Total Revenues | Net Income | Net Margin |

| 3.62k | 273 | 10.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pearson Plc. More…

| Operations | Investing | Financing |

| 368 | -152 | -518 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pearson Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.47k | 2.98k | 6.06 |

Key Ratios Snapshot

Some of the financial key ratios for Pearson Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.0% | 6.9% | 10.5% |

| FCF Margin | ROE | ROA |

| 5.4% | 5.4% | 3.2% |

Analysis

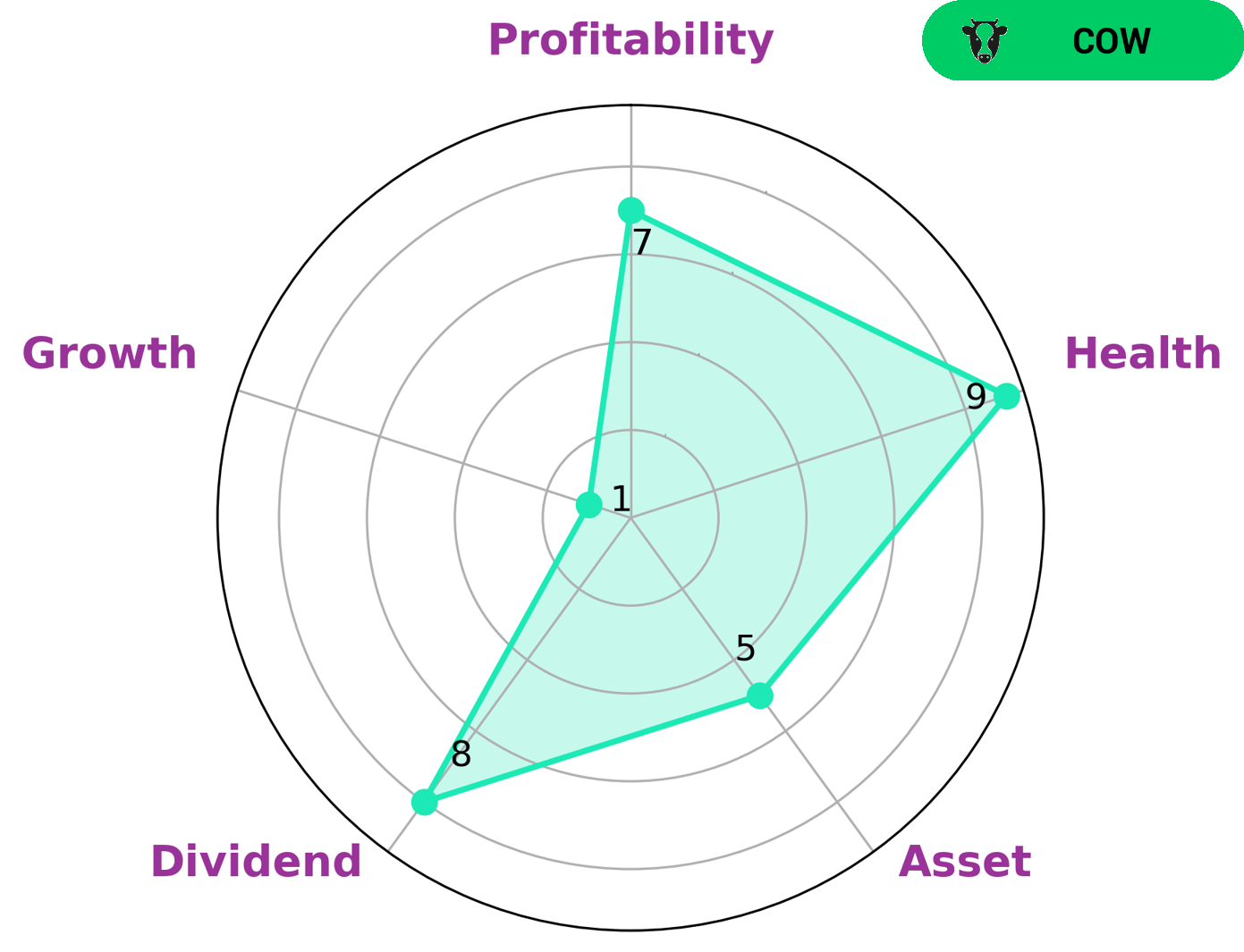

GoodWhale’s analysis of PEARSON PLC‘s fundamentals indicates that the company is classified as a “cow”, a type of company that provides consistent and sustainable dividends for its investors. Investors interested in this type of firm would likely be those who prioritize dividend income and stability, rather than high growth potential. Additionally, PEARSON PLC has a high health score of 9/10, indicating strong cashflows and low debt levels, giving the firm the capacity to pay off its debt and fund future operations. Moreover, PEARSON PLC is strong in dividend and profitability, but only medium in asset and weak in growth. This could make it an attractive prospect to investors who prioritize safe returns over larger potential returns. Furthermore, as a company that pays out regular dividends, PEARSON PLC might be a good option for an investor who is looking for an income-generating investment. In conclusion, PEARSON PLC is well-suited to those seeking consistent dividend payments, along with stable and healthy cashflows. The firm’s weak growth potential might not appeal to investors who are looking for higher returns, but it does offer a safe and reliable investment option for those seeking lower risk investments. More…

Peers

It is the largest education company in the world and was founded in 1844. The company is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. Its competitors include John Wiley & Sons Inc, Visang Education Inc, Sasbadi Holdings Bhd.

– John Wiley & Sons Inc ($NYSE:WLY)

Wiley is a global provider of knowledge and knowledge-enabled services that improve outcomes in areas of research, professional practice, and education. Through the Research segment, the company provides digital and print scientific, technical, medical, and scholarly journals, reference works, books, database services, and advertising. The Professional Development segment offers digital and print books, online assessment and training services, and education solutions in areas including accounting, finance, architecture, engineering, computing, nursing, and education. Wiley also serves the needs of individuals and institutions through the Education segment, which provides online program management services for higher education institutions and courses, as well as print and digital content and learning solutions for students and educators worldwide.

– Visang Education Inc ($KOSE:100220)

Visang Education Inc has a market cap of 72.28B as of 2022, a Return on Equity of 22.75%. The company is a provider of online education services in China. It offers a range of services, including online tutoring, test preparation, and consulting services. The company was founded in 2003 and is headquartered in Beijing, China.

– Sasbadi Holdings Bhd ($KLSE:5252)

Sasbadi Holdings Bhd is a Malaysia-based company engaged in the business of investment holding and the provision of management services. The Company’s segments include Publishing, which is engaged in the publication of educational books and marketing of learning aids; Property, which is engaged in property development and investment, and Others, which includes provision of ICT products and services, and manufacturing and trading of stationery.

Summary

Investing in Pearson PLC can be a worthwhile venture, as the company saw its shares rise 0.04% on Thursday, outperforming the overall market. This demonstrates the potential of the stock, as most of the news surrounding the company is positive. Pearson PLC has a strong presence in the education and media sectors, providing an array of digital and print services and products. The company has long been a major player in the publishing industry and is continuing to adapt to changing technologies to stay profitable.

The company also offers a variety of assessment and professional services, further diversifying its revenue sources. Despite some short term dips in their stock value, Pearson PLC remains a solid long term investment opportunity.

Recent Posts