MCKESSON CORPORATION Outperforms Market on Strong Trading Day

January 30, 2023

Trending News ☀️

MCKESSON ($NYSE:MCK): McKesson Corporation outperformed the market on a strong trading day, displaying the potential of the company and its stock in a volatile market. McKesson has become a leader in the healthcare industry, offering a wide range of products, services and solutions to help customers manage the cost and quality of care more effectively. Its integrated portfolio of technology, services and products includes medical-surgical supplies, pharmaceuticals, home health care, durable medical equipment and software solutions. The company has also been investing heavily in new technologies to improve the quality of care and improve patient outcomes. McKesson has also been enhancing its product offerings by partnering with leading technology companies such as Amazon and Microsoft. This has helped the company stay ahead of the competition and remain a key player in the healthcare industry.

McKesson’s stock has been performing well in recent months, outperforming the market on a strong trading day. The stock has been buoyed by strong earnings reports and upbeat guidance from management, as well as continued investments in new technologies. In sum, McKesson Corporation has demonstrated its ability to outperform the market on a strong trading day. With a strong financial performance, positive guidance from management and continued investments in new technologies, the company is well-positioned to continue to be a leader in the healthcare industry.

Price History

Despite having mostly positive media exposure right now, the stock opened at $380.2 and closed at $378.0, down by 0.2% from its previous closing price of 378.7. Overall, MCKESSON CORPORATION‘s stock performance was strong on Friday, considering the fact that the market was going through a volatile period. Even though the stock closed lower than its opening price, it was still able to remain above its previous closing price. The stock’s performance was also helped by news of a potential merger between MCKESSON CORPORATION and another company. The news of the potential merger has caused investors to take a closer look at MCKESSON CORPORATION, which has led to an increase in trading activity.

This is likely to continue in the future, as investors remain confident in the company’s future prospects. In conclusion, MCKESSON CORPORATION was able to post a strong performance on Friday despite the market’s volatility. The potential merger news has also helped boost investor confidence in the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mckesson Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 272.03k | 2.06k | 0.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mckesson Corporation. More…

| Operations | Investing | Financing |

| 4.43k | 184 | -4.18k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mckesson Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 63.08k | 64.33k | -12.46 |

Key Ratios Snapshot

Some of the financial key ratios for Mckesson Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.0% | 2.4% | 1.2% |

| FCF Margin | ROE | ROA |

| 1.5% | -111.3% | 3.3% |

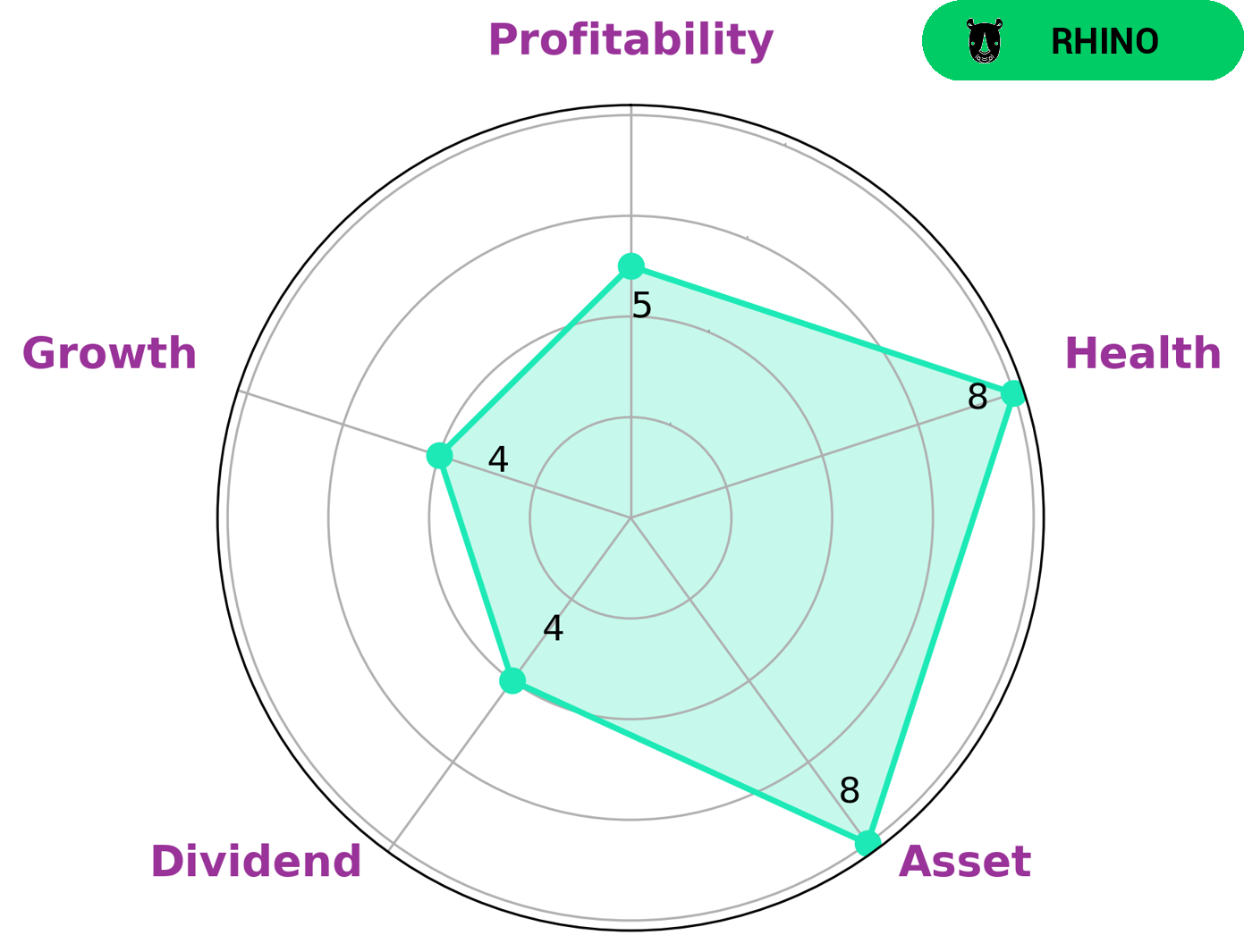

VI Analysis

MCKESSON CORPORATION is classified as a “rhino” based on its fundamentals and long term potential according to the VI Star Chart. This type of company has achieved moderate revenue or earnings growth and is attractive to investors who prioritize stability and value over aggressive growth. The company has a high health score of 8/10 considering its cashflows and debt, indicating that it is capable of sustaining future operations in times of crisis. Additionally, MCKESSON CORPORATION is strong in assets and medium in dividend, growth, and profitability. All of these factors make MCKESSON CORPORATION an attractive investment opportunity for both long-term and short-term investors. The company’s cash flow and debt position are strong indicators of the company’s ability to weather market downturns and potential risks. Furthermore, its medium scores in dividend, growth, and profitability suggest that the company is able to generate positive returns for investors without taking on excessive risk. All of these considerations make MCKESSON CORPORATION an attractive investment for those looking for moderate returns with low risk. In conclusion, MCKESSON CORPORATION is an attractive investment opportunity for those seeking moderate returns with low risk. The company’s strong fundamentals and high health score are indicative of its ability to sustain operations during difficult times. Additionally, its medium scores in dividend, growth, and profitability provide investors with the opportunity to generate positive returns while minimizing risk. As such, MCKESSON CORPORATION is an attractive option for investors seeking long-term stability and value. More…

VI Peers

In the healthcare sector, McKesson Corp competes against Cardinal Health Inc, AmerisourceBergen Corp, and Sigma Healthcare Ltd. These companies are all major players in the healthcare industry, and each one brings something unique to the table. However, McKesson Corp is the largest of these companies, and its size gives it a significant competitive advantage.

– Cardinal Health Inc ($NYSE:CAH)

Cardinal Health Inc is a healthcare services and products company that operates in two segments: Pharmaceutical and Medical. The company’s Pharmaceutical segment includes sales of branded, generic and over-the-counter pharmaceutical products, as well as nuclear pharmacy services. The Medical segment provides a range of medical products and services, including surgical and medical products, medical devices and laboratory products and services. Cardinal Health Inc has a market cap of 18.55B as of 2022. The company’s Return on Equity for the same period is 55.12%.

– AmerisourceBergen Corp ($NYSE:ABC)

AmerisourceBergen is one of the world’s largest pharmaceutical services companies. It offers a range of services and products to healthcare providers and pharmaceutical companies. The company has a market cap of 29.64B as of 2022 and a return on equity of 417.0%. AmerisourceBergen is a publicly traded company listed on the New York Stock Exchange.

– Sigma Healthcare Ltd ($ASX:SIG)

Sigma Healthcare is a leading full-line wholesale and distribution company that services pharmacies across Australia. The company has a market capitalisation of $693.83 million as of March 2022 and a return on equity of 0.46%. Sigma Healthcare is a diversified healthcare company with operations in both pharmacy and hospital sectors. The company’s primary activities include the wholesale distribution of pharmaceuticals, medical and surgical supplies. Sigma Healthcare also owns and operates a number of community pharmacies across Australia.

Summary

McKesson Corporation has seen a strong day of trading on the stock market, with its stock outperforming the market. Currently, the company is receiving mostly positive media exposure. Investors are advised to consider this company as a potential investment opportunity due to its strong performance in the stock market and its favorable media attention. McKesson Corporation has a long history of stability and reliability, making it a safe investment choice for those looking to diversify their portfolio.

Additionally, the company is well-positioned to capitalize on any potential new opportunities that arise in the future.

Recent Posts