ManpowerGroup: Investors Brace for Volatile Stock Market in the Short-Term

April 26, 2023

Trending News 🌥️

MANPOWERGROUP ($NYSE:MAN): ManpowerGroup Inc. is a global leader in providing workforce solutions to employers, staffing agencies, and governments around the world. Despite its popularity and successful track record in the market, investors are bracing for a volatile stock market for the short-term when it comes to the company’s stock price. Though ManpowerGroup continues to expand its operations and provide quality services to its clients, the short-term stock market is still unpredictable. The company’s stock price can fluctuate based on any number of factors, such as economic news, competitor news, or even changes in investor sentiment. All these factors can affect the stock price in the near term and make it difficult for investors to predict the future of the company’s stock with any sort of accuracy. ManpowerGroup is well-positioned in the industry and its long-term prospects remain strong.

However, investors should remain cognizant of the volatile nature of the stock market in the short-term, especially when it comes to ManpowerGroup’s stock price. It is important to take into account all the possible risks and rewards before investing in the company’s stock, as there is always a chance that the stock could experience a sharp decline in value in the near-term.

Market Price

On Tuesday, MANPOWERGROUP INC stock opened at $73.6 and closed at $74.9, up by 0.6% from previous closing price of 74.5. The ManpowerGroup, one of the largest global staffing companies, has seen its share prices fluctuate significantly over the past few weeks. Despite the current market volatility, analysts remain hopeful that the company’s future performance will be strong and that the stock price will continue to rise. Investors have yet to decide whether they should stay invested in MANPOWERGROUP INC or move their money elsewhere. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Manpowergroup Inc. More…

| Total Revenues | Net Income | Net Margin |

| 19.44k | 360 | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Manpowergroup Inc. More…

| Operations | Investing | Financing |

| 477.3 | -79.9 | -435.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Manpowergroup Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.89k | 6.38k | 48.4 |

Key Ratios Snapshot

Some of the financial key ratios for Manpowergroup Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.7% | -1.6% | 3.0% |

| FCF Margin | ROE | ROA |

| 2.1% | 14.8% | 4.1% |

Analysis

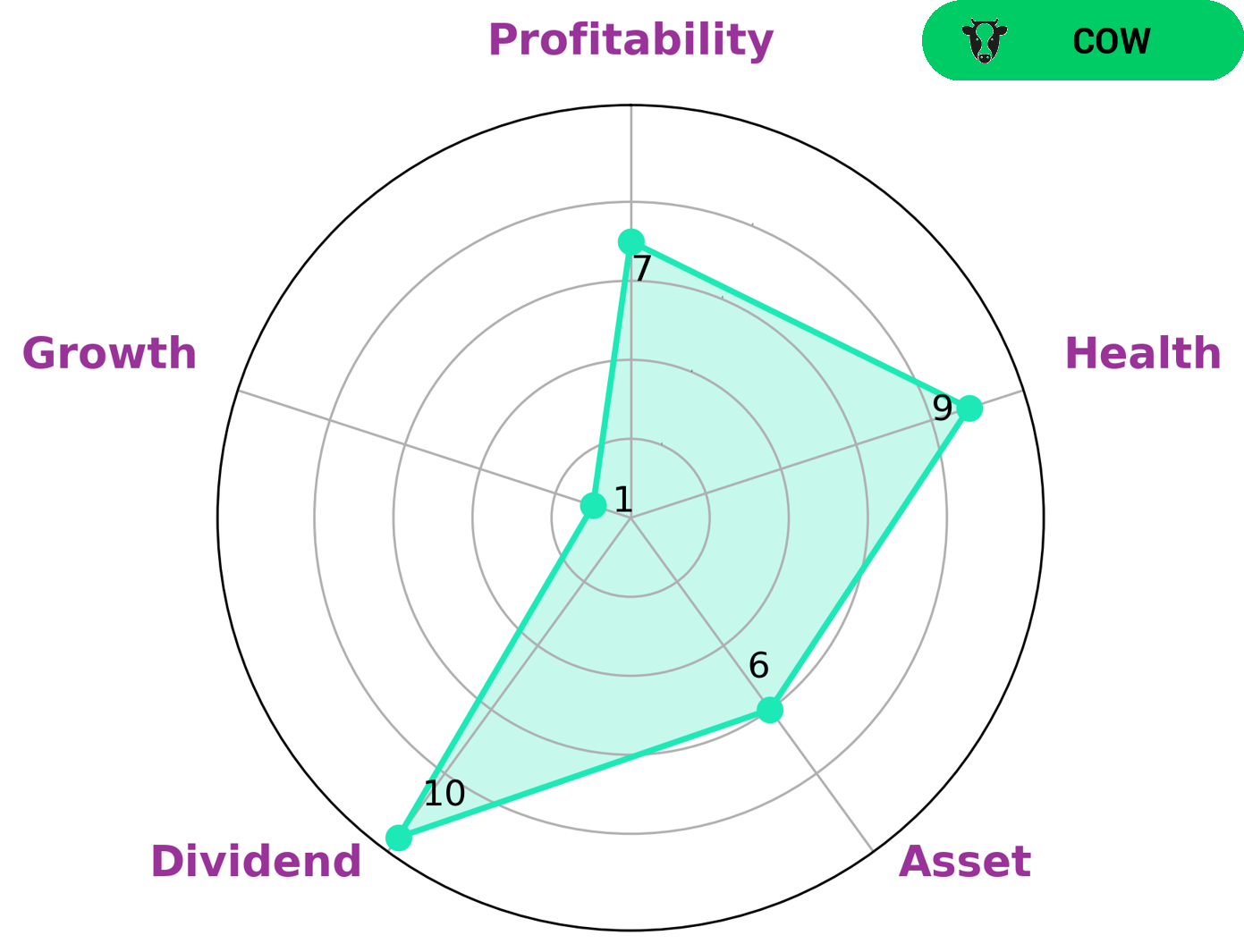

At GoodWhale, we have undertaken an analysis of the fundamentals of MANPOWERGROUP INC. Our Star Chart shows that the company is strong in dividend and profitability, and medium in asset. Its weakest point is growth. We have classified MANPOWERGROUP INC as a ‘cow’, which is a company that has the track record of paying out consistent and sustainable dividends. Investors who are interested in receiving steady returns through dividend payments may find MANPOWERGROUP INC an attractive option. We also note that MANPOWERGROUP INC has a high health score of 9/10 with regard to its cashflows and debt. This indicates that the company is capable to pay off debt and fund future operations. More…

Peers

Its competitors include Robert Half International Inc, Randstad NV, and Kelly Services Inc.

– Robert Half International Inc ($NYSE:RHI)

Robert Half International Inc. is a provider of professional staffing and consulting services. The company operates through three segments: Accountemps, Robert Half Finance & Accounting, and Robert Half Management Resources. The Accountemps segment provides temporary professional accounting and finance personnel. The Robert Half Finance & Accounting segment provides permanent placement professional accounting and finance personnel. The Robert Half Management Resources segment provides temporary and project professional management personnel. The company was founded in 1948 and is headquartered in Menlo Park, California.

– Randstad NV ($LTS:0NW2)

Randstad is a provider of human resources services. It is headquartered in the Netherlands and has over 4,800 offices in 40 countries. The company offers temporary and permanent staffing, outsourcing, and consulting services. It also provides a range of HR solutions, including payroll, benefits, and training.

– Kelly Services Inc ($NASDAQ:KELYA)

Kelly Services, Inc. is a provider of workforce solutions. The Company offers a range of services, including permanent, temporary and contract placement; outsourcing and consulting; and talent management solutions. It serves customers in a range of industries, including automotive, finance and accounting, healthcare, information technology, life sciences, manufacturing and office. The Company operates through three segments: Americas Staffing, International Staffing and Talent Solutions. The Company’s Americas Staffing segment provides staffing and human resource solutions to a range of customers throughout the United States, Canada and Puerto Rico. The International Staffing segment provides staffing solutions to a range of customers in approximately 30 countries. The Talent Solutions segment provides contract-based professional placement, managed service programs and outplacement services.

Summary

ManpowerGroup Inc. is a leading global workforce solutions provider, and it currently has a stock price that is expected to be very uncertain in the near term. Analysts are divided on the direction the stock price could take; some suggest that due to the current macroeconomic climate, the stock could potentially experience some short-term volatility.

However, with their long-term outlook they remain confident that the company is still positioned to continue its long-term growth. The company’s future depends heavily on the macroeconomic conditions, as well as their ability to innovate and capitalize on new opportunities. Investors should closely monitor the macroeconomic conditions and the company’s performance to get a better understanding of the direction of the stock price.

Recent Posts