MACOM Technology Solutions to Lead RF/Microwave Power Transistor Market in 5G Era

June 28, 2023

☀️Trending News

MACOM ($NASDAQ:MTSI) Technology Solutions is a leading provider of RF/Microwave Power Transistor solutions in the 5G era. The company has a strategic business plan in place to make sure they remain at the forefront of the market over the next six years. Their focus will be on building relationships with key stakeholders, developing innovative technologies, and creating customer-centric solutions that meet the needs of the 5G market. This will include a range of RF/Microwave Power Transistor solutions that are designed to support new antenna systems, higher frequency bands, and faster data rates. Ampleon is another key player in the RF/Microwave Power Transistor market, and they too have a strategic plan in place for the next six years. They are focusing on developing low-cost solutions that address customer requirements for speed, reliability, and efficiency.

The company also plans to increase its research and development to ensure their products meet the stringent quality and performance standards set by the 5G market. It has a strong portfolio of RF/Microwave Power Transistor solutions that have been used in various applications including wireless communications, automotive, and military applications. The company also offers product customization services to meet specific customer requirements. The company is well-positioned to capitalize on these opportunities in the coming years and is expected to remain a leader in the RF/Microwave Power Transistor market throughout the period 2023-2029.

Share Price

Its stock opened at $61.4 and closed at $60.3, down by 2.6% from previous closing price of 62.0. This dip in stock price was largely attributed to the increasing competition from other players in the sector. MACOM’s commitment to quality and innovation has enabled them to develop a comprehensive portfolio of advanced RF/Microwave products and solutions for the 5G network infrastructure. The company has worked closely with mobile operators to ensure that their products are designed to meet the needs of the latest 5G networks and technologies, as well as providing long-term reliability and performance.

Further, MACOM is well-positioned to benefit from the expected increase in demand for RF/Microwave components, due to the increasing roll out of 5G networks across the world. The company is also well-positioned to provide cutting-edge products and solutions that will enable mobile operators to deliver reliable and fast connections. The company’s commitment to quality and innovation will ensure that it remains a leader in the sector for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MTSI. More…

| Total Revenues | Net Income | Net Margin |

| 699.91 | 326.84 | 46.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MTSI. More…

| Operations | Investing | Financing |

| 171.13 | -132.62 | -28.31 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MTSI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.62k | 723.46 | 12.19 |

Key Ratios Snapshot

Some of the financial key ratios for MTSI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.5% | -16.4% | 21.1% |

| FCF Margin | ROE | ROA |

| 20.2% | 10.7% | 5.7% |

Analysis

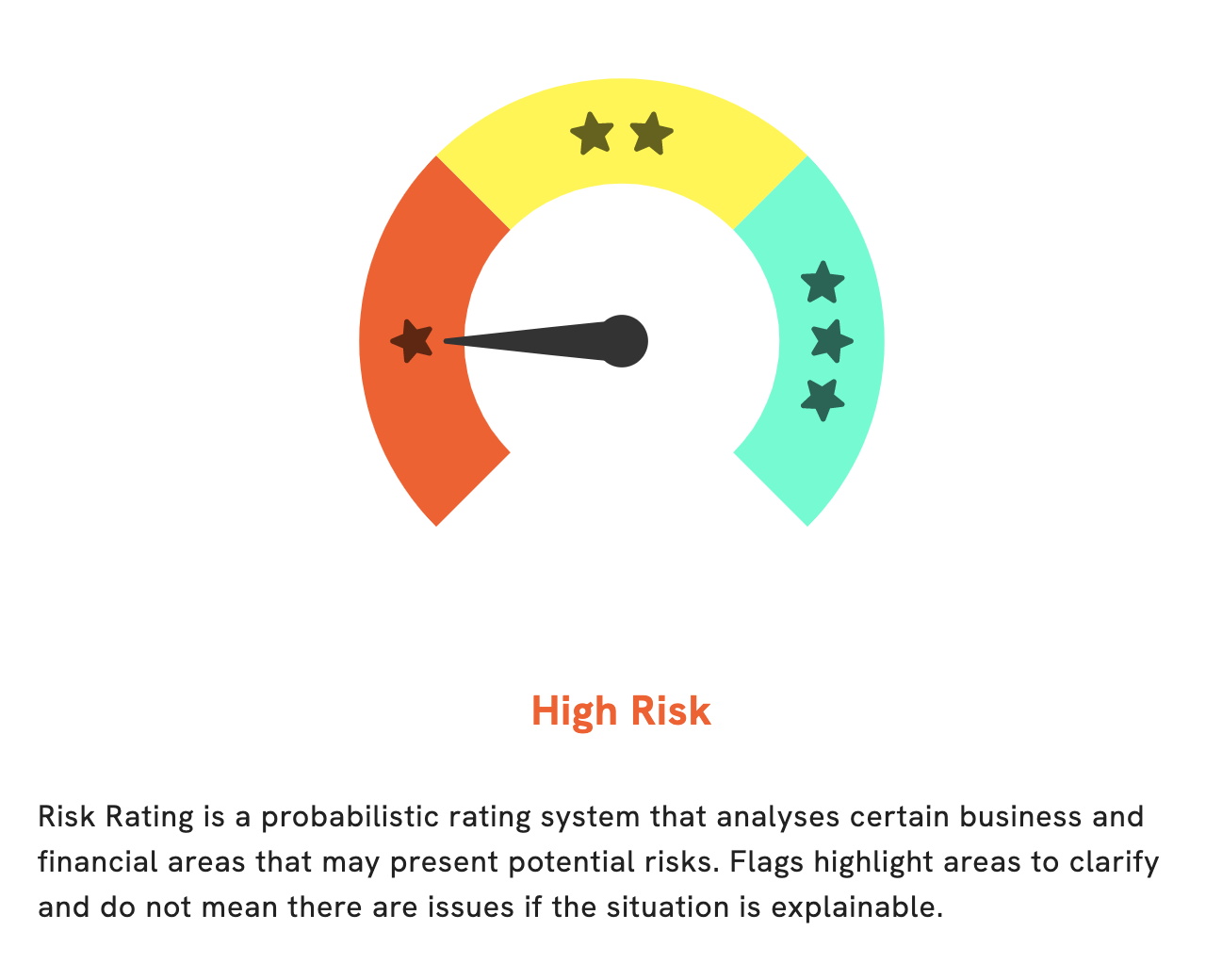

GoodWhale has conducted an in-depth analysis of MACOM TECHNOLOGY SOLUTIONS to understand the state of their wellbeing. Our Risk Rating of this company reveals that it is a high risk investment in terms of both its financial and business aspects. Upon further investigation, we have detected 4 risk warnings in the income sheet, balance sheet, non-financial and financial journal. The risk warnings that we have detected include irregularities in the transactions, incorrect financial statements, discrepancies in the cash flow and insufficient information. If you are interested in learning more about our findings, please become a registered user to access our secure platform and check out our findings. We are here to provide you with the most accurate and up-to-date information so that you can make informed decisions on your investments. More…

Peers

The semiconductor industry is intensely competitive, with companies vying for market share in a number of key areas. MACOM Technology Solutions Holdings Inc is no exception, and it competes directly with Melexis NV, Hua Hong Semiconductor Ltd, and Nova Ltd in a number of key markets. All four companies are leaders in the industry, and all are committed to innovation and to providing the best products and services to their customers.

– Melexis NV ($BER:MEX)

Melexis NV is a publicly traded semiconductor company with a market capitalization of 3.34 billion as of 2022. The company’s return on equity, a measure of profitability, was 28.95% in that same year. Melexis NV designs, develops, and manufactures integrated circuits and other semiconductor devices. Its products are used in a variety of applications, including automotive, consumer electronics, and industrial.

– Hua Hong Semiconductor Ltd ($SEHK:01347)

Hua Hong Semiconductor Ltd is a world-leading semiconductor foundry that offers advanced technologies and services for a wide range of applications. The company’s market cap as of 2022 is $34 billion, and its ROE is 9.22%. Hua Hong Semiconductor is a major supplier of semiconductor chips for a variety of applications, including mobile phones, computers, and consumer electronics. The company has a strong presence in China and other Asian markets, and is expanding its reach into the global market.

– Nova Ltd ($NASDAQ:NVMI)

Nova Ltd is a leading provider of integrated engineering solutions in the Asia-Pacific region. The company has a market cap of 2.48B as of 2022 and a ROE of 19.83%. Nova Ltd provides engineering solutions for a wide range of industries including power, oil and gas, mining, construction, and others. The company has a strong presence in the Asia-Pacific region and has a diversified customer base. Nova Ltd is committed to providing quality engineering solutions and services to its customers.

Summary

Investing in MACOM TECHNOLOGY SOLUTIONS is a great opportunity for those looking to capitalize on the potential growth of 5G technology. MACOM is well-positioned to benefit from this trend, through their range of products such as high power amplifiers, integrated circuits, and monolithic microwave integrated circuits. MACOM has the engineering expertise and manufacturing capability to develop highly efficient and reliable products.

Recent Posts