Eventbrite Plummets 86.48%, Forecasting Uncertainty in the Coming Months.

February 14, 2023

Trending News 🌧️

Eventbrite ($NYSE:EB) Inc. is a leading provider of web-based ticketing and event management services. It offers a platform for events of all sizes, ranging from small gatherings to large conferences. Recently, the company experienced a significant drop in its stock prices, falling by 86.48%. This has caused uncertainty among investors, as it is difficult to predict what to expect in the near future. These external factors have had an adverse effect on Eventbrite’s stock prices, and there is no guarantee that its fortunes will improve in the coming months. The impact of this massive decline in stock prices has been felt across the company’s business operations, with some analysts predicting a gloomy outlook for the company. This has further clouded the prospects of Eventbrite Inc. as it faces an unclear future.

For example, its client base has been shrinking and its revenues have been significantly reduced. Furthermore, its cash reserves have also been depleted, which may hamper its ability to weather any further financial storms. In conclusion, Eventbrite Inc. has experienced an alarming drop in its stock prices, indicating that it may be facing an uncertain future ahead. The company’s management will need to devise effective strategies to stabilize its stock prices and ensure that it remains competitive in the market. With the right measures in place, Eventbrite Inc. can still rebuild its investor confidence and remain a leader in the online ticketing industry.

Price History

On Monday, Eventbrite Inc. experienced a staggering decline of 86.48%, tumbling down to $8.5 from a previous closing price of $8.6. This sudden and massive hit to the company’s stock opened up a period of uncertainty in the coming months. The news of the decline has been widely covered in the media, with mostly positive coverage. Some reports have speculated that the decline may have been influenced by external events, such as market volatility and global financial instability.

However, it remains unclear at this time whether the decline is simply a result of the market conditions or something more significant. Along with the decline in stock price comes an uncertainty in the company’s future. The sudden drop has put investors on edge and has caused concern over what may happen in the coming months. With a weakened share price, it is possible that the company may struggle to make ends meet and find itself in a difficult financial situation in the near future. At this point, it is difficult to predict how Eventbrite Inc. will fare in the coming months. It is important for investors to stay informed and watch the news to get an accurate picture of the situation.

In addition, they should consider making smart investments and diversifying their portfolios to protect their assets if the situation worsens. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eventbrite. More…

| Total Revenues | Net Income | Net Margin |

| 249.03 | -76.23 | -30.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eventbrite. More…

| Operations | Investing | Financing |

| 10.11 | -5.56 | 2.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eventbrite. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 931.64 | 781.52 | 1.52 |

Key Ratios Snapshot

Some of the financial key ratios for Eventbrite are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.0% | – | -25.8% |

| FCF Margin | ROE | ROA |

| 2.3% | -26.0% | -4.3% |

Analysis

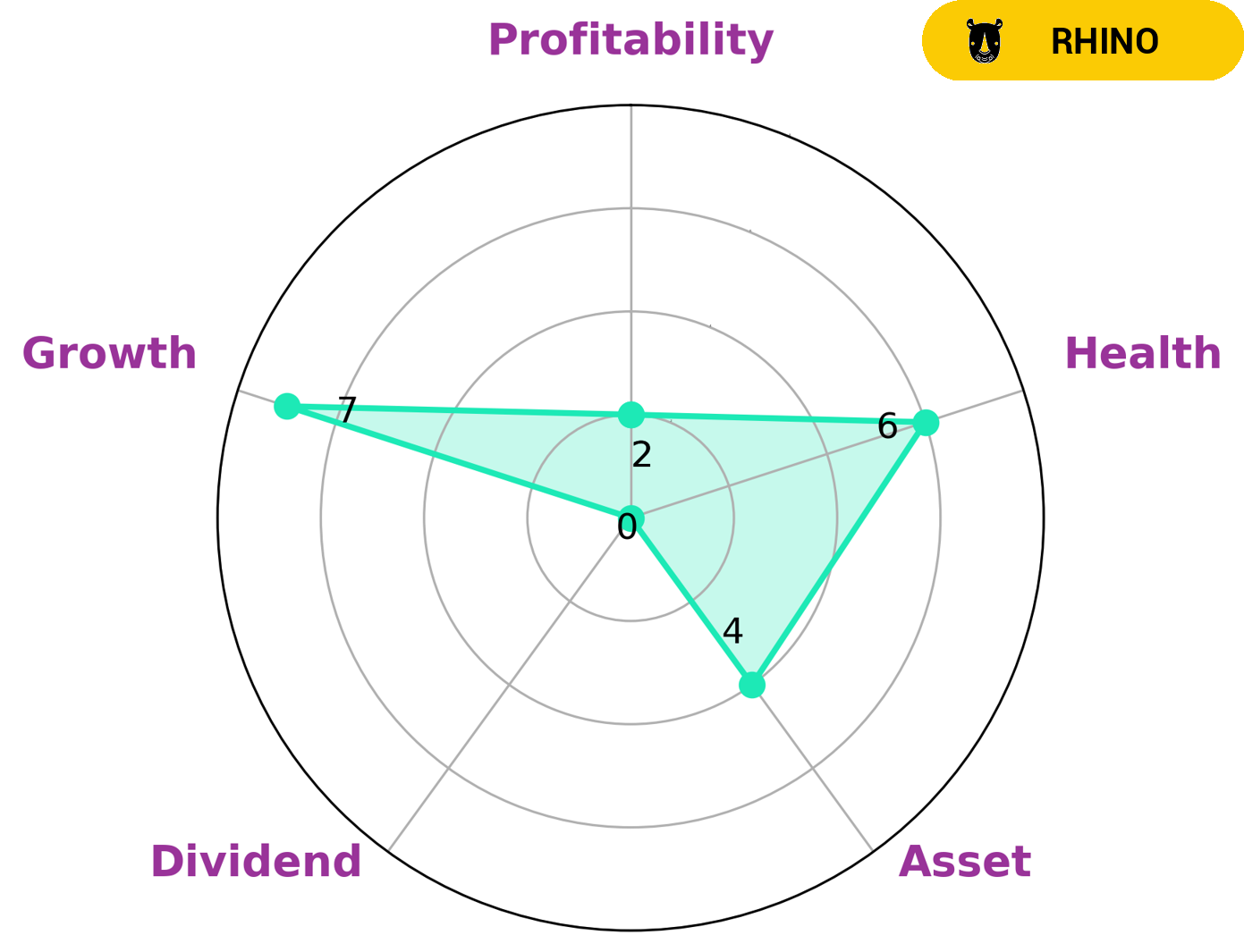

GoodWhale’s analysis of EVENTBRITE‘s wellbeing has revealed some interesting insights. According to the Star Chart, EVENTBRITE ranks highly in terms of growth but is only medium in terms of asset and weak in terms of dividend and profitability. Furthermore, EVENTBRITE has an intermediate health score of 6/10, meaning that it is likely to be able to pay off debt and fund future operations. EVENTBRITE is classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. As such, investors interested in investing in companies with moderate growth may find EVENTBRITE an attractive option. Meanwhile, investors looking for companies with high growth potential may want to look elsewhere. In addition, investors may also want to consider EVENTBRITE’s operating margins, as well as its current and past debt levels. Eventbrite’s ability to pay off its debt and fund future operations will also be important factors for potential investors to consider. Finally, investors should also take into account the company’s track record and performance in the past, as this can give an indication of the company’s potential for the future. More…

Peers

Its main competitors are Lightspeed Commerce Inc, Tymlez Group Ltd, Smartsheet Inc.

– Lightspeed Commerce Inc ($TSX:LSPD)

Lightspeed Commerce Inc is a provider of eCommerce solutions. The company offers a suite of tools to help businesses create and manage their online stores. These tools include a website builder, shopping cart software, order management system, and payments processing. Lightspeed also offers a range of services to help businesses with their online marketing and SEO.

The company has a market cap of 3.69B as of 2022 and a Return on Equity of -6.76%. Lightspeed Commerce is headquartered in Montreal, Canada.

– Tymlez Group Ltd ($ASX:TYM)

Tymlez Group Ltd is a provider of enterprise software solutions. Its solutions are used by organizations to develop and deploy blockchain applications. The company has a market cap of 21.77M as of 2022 and a Return on Equity of -82.23%.

The company’s solutions are used by organizations to develop and deploy blockchain applications. The company’s products are used by enterprises to build decentralized applications, smart contracts, and to manage digital assets.

– Smartsheet Inc ($NYSE:SMAR)

Smartsheet Inc is a publicly traded company with a market capitalization of 4.29 billion as of 2022. The company has a negative return on equity of 29.14%. Smartsheet is a provider of enterprise software solutions. The company’s products and services include a cloud-based platform that enables organizations to plan, track, automate, and report on work.

Summary

Investors have been hit hard by the recent decline of Eventbrite Inc., with the stock plummeting 86.48% in the past few months. Despite this, news coverage of the company has been largely positive, with analysts predicting the company is well-positioned to weather the current market turbulence. However, the long-term outlook for Eventbrite remains uncertain, as investors and analysts continue to monitor how the company will respond to the changing economic landscape in the coming months. Investment analysts suggest that investors should approach Eventbrite with a degree of caution and be aware of the risks associated with investing in the stock.

Recent Posts