Evaluating the Market Performance of National Storage Affiliates Trust Stock.

March 7, 2023

Trending News ☀️

National Storage Affiliates ($NYSE:NSA) Trust (NSA) is a self-administered and self-managed real estate investment trust (REIT) that specializes in the ownership, operation, and acquisition of self-storage facilities. As with other REITs, their goal is to provide investors with stable income and long-term growth. Investors must assess the market performance of NSA stock to determine if it is worth investing in. When evaluating the market performance of NSA stock, investors must look at several factors, including the current market price, the company’s overall financial performance, its competitive advantage in the industry, and its management team. Analyzing the stock price and its trading volume gives an indication of how the market perceives the company’s performance, while analyzing its financial performance helps investors understand the company’s risk profile and its potential for future growth.

Additionally, investors should assess the competitive advantage that NSA offers compared to its peers in the industry, such as its geographic diversification, acquisition strategy, and customer service standards. Finally, investors should examine NSA’s management team and determine whether they have sufficient experience and knowledge to continue to drive the company’s success. By thoroughly assessing the market performance of National Storage Affiliates Trust stock, investors can make more informed decisions about whether to invest in the company or not.

Price History

The market performance of National Storage Affiliates Trust stock has been mostly positive in recent days. On Friday, the stock opened at $44.1 and closed at $44.6, a 1.9% increase from its previous closing price of $43.8. This is the latest in a string of successful days for NATIONAL STORAGE AFFILIATES TRUST stock, which has seen the value of the stock increase steadily in recent weeks. As such, it appears that the market is optimistic about the future of this company, and investors are taking notice. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NSA. More…

| Total Revenues | Net Income | Net Margin |

| 801.57 | 90.25 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NSA. More…

| Operations | Investing | Financing |

| 443.85 | -584.16 | 154.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NSA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.07k | 3.68k | 17.07 |

Key Ratios Snapshot

Some of the financial key ratios for NSA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 36.1% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

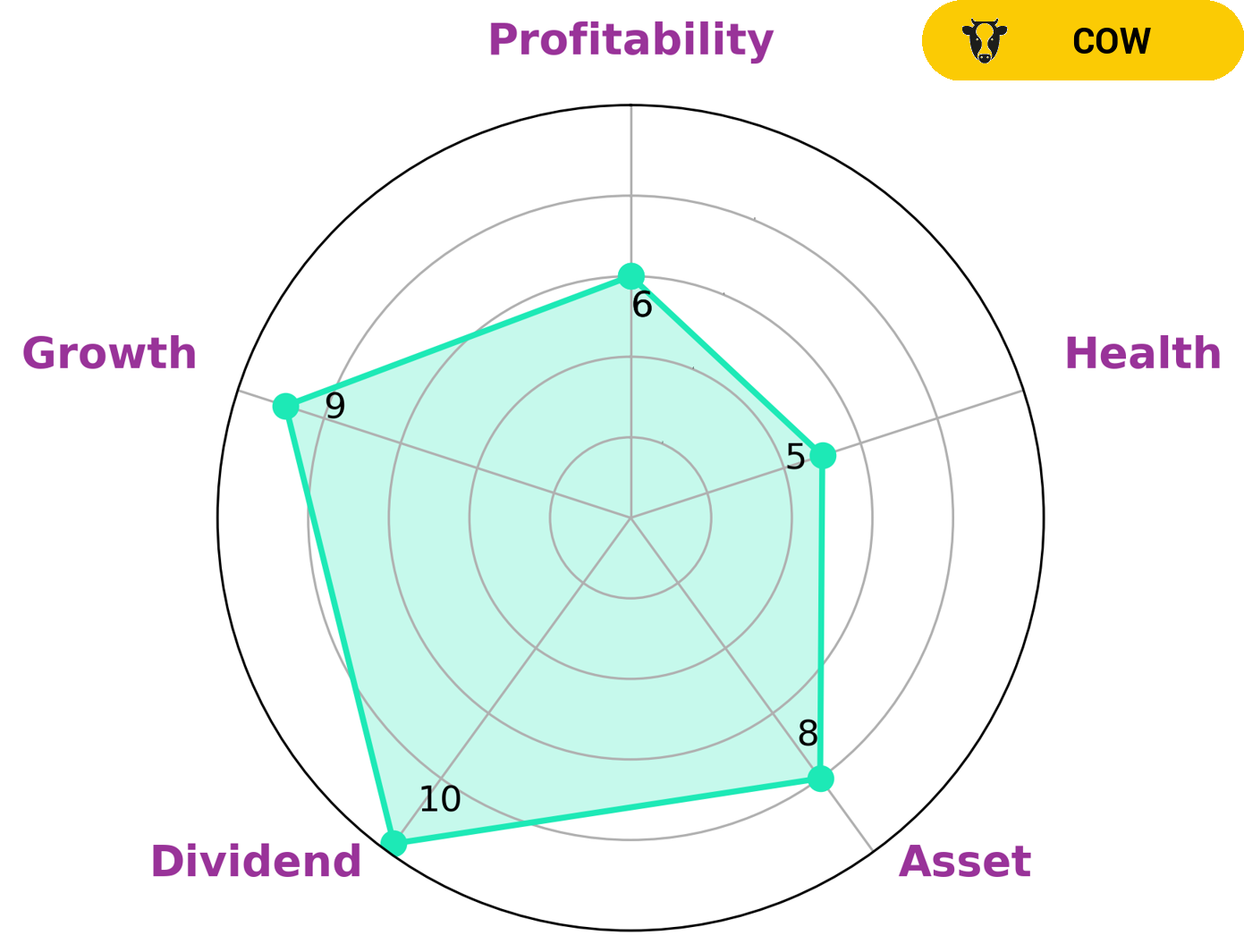

GoodWhale has conducted an analysis of NATIONAL STORAGE AFFILIATES TRUST’s financials, which reveals that the company is strong in assets, dividends, and growth, and has an intermediate health score of 5/10. This suggests that NATIONAL STORAGE AFFILIATES TRUST has the ability to safely ride out any crisis without the risk of bankruptcy. Furthermore, we classify NATIONAL STORAGE AFFILIATES TRUST as a ‘cow’ – a type of company that has a track record of paying out consistent and sustainable dividends. This type of company will most likely attractive to dividend-seeking investors, as well as growth investors who seek a reliable and sustainable way to generate passive income. Furthermore, more conservative investors may be drawn to such a stable company, as it is likely to manage a crisis better than companies with more volatile finances. More…

Peers

All four companies are publicly traded real estate investment trusts (REITs) and are among the largest self-storage providers in the United States. National Storage Affiliates Trust is the second-largest self-storage REIT by market capitalization, behind Extra Space Storage Inc.

– Extra Space Storage Inc ($NYSE:EXR)

Extra Space Storage Inc is a real estate investment trust that owns and operates self-storage properties. As of December 31, 2020, the company owned and operated 1,891 self-storage properties in 42 states; Washington, D.C.; and Puerto Rico. It has a market cap of 22.22B as of 2022.

– Public Storage ($NYSE:PSA)

Public Storage is a self-storage company that has a market cap of 51.38B as of 2022. The company has over 2,200 locations in the United States and Europe.

– CubeSmart ($NYSE:CUBE)

CubeSmart is a self-storage real estate investment trust. The company invests in self-storage properties and operates them under the CubeSmart brand. As of December 31, 2020, the company owned 1,444 self-storage properties in 38 states, Washington, D.C., and Puerto Rico.

Summary

National Storage Affiliates Trust (NSA) has had a positive performance in the stock market so far. Analysts believe this to be due to the company’s strong management, robust financial position, and positive outlook for future growth. NSA has a strong balance sheet, with over $1 billion in assets and little to no debt, as well as a steady cash flow. Furthermore, its dividend yield is attractive, making it attractive to investors seeking income stability.

Moreover, the company’s portfolio of well-located storage properties continues to generate steady revenue and yield growth. With NSA’s experienced leadership team and driven value-creation strategy, many investors believe the company is on track to deliver long-term results.

Recent Posts