BrightSpire Capital: Market Exiting Office Loans, But Entering Slowly

June 4, 2023

🌥️Trending News

BRIGHTSPIRE ($NYSE:BRSP): BrightSpire Capital is a firm that specializes in office loans and has recently begun entering the market.

However, their entrance has been slow, as the market is quickly exiting due to uncertainty in the economy. Despite this, BrightSpire Capital is confident in their ability to provide loan options that are secure and beneficial for both borrowers and lenders. Their team of experienced financial professionals has decades of combined experience in the industry, allowing them to develop tailored solutions that are both cost-effective and reliable. They have also put together a variety of loan products, such as traditional commercial real estate loans, bridge loans, construction loans, and more. These loan products are specifically designed to meet the needs of businesses, allowing them to take advantage of potential opportunities while safeguarding their financial future. BrightSpire Capital’s mission is to help businesses grow and succeed by providing them with the necessary financial resources to do so. They have built a network of top-tier funds and investors which allows them to provide their clients with the financial solutions needed to grow. By entering the market slowly, they are able to work closely with borrowers to ensure that they are getting the best loan product. As BrightSpire Capital continues to gain traction in the market, they will begin to slowly expand their presence and reach more businesses. With their years of experience in the industry, coupled with their innovative loan products, they are sure to become a leader in office loans.

Share Price

BrightSpire Capital, a market specialist in office loans, opened their stock on Thursday at $5.9 and closed at $6.0, up by 1.9% from the previous closing price of 5.9.

However, despite their market expertise, BrightSpire Capital is still entering the market slowly. Due to their cautious approach, BrightSpire Capital is facing some difficulties in terms of competing with other lenders in the market. Despite this, they remain committed to their slow and steady growth strategy and hope to take advantage of the rising trend in office loans. BrightSpire Capital has also been focusing on strengthening its relationships with existing customers and building new ones. They are also actively looking for ways to increase their market share in office loans. With their steady growth and commitment to quality, BrightSpire Capital is well-positioned to take advantage of the current office loan trend in the market. They are slowly but surely entering the market and expanding their product portfolio. As BrightSpire Capital continues to move forward, it will be interesting to see how they progress in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Brightspire Capital. More…

| Total Revenues | Net Income | Net Margin |

| 378.59 | 13.94 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Brightspire Capital. More…

| Operations | Investing | Financing |

| 132.59 | 377.76 | -445.81 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Brightspire Capital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.6k | 3.25k | 10.42 |

Key Ratios Snapshot

Some of the financial key ratios for Brightspire Capital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 1.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

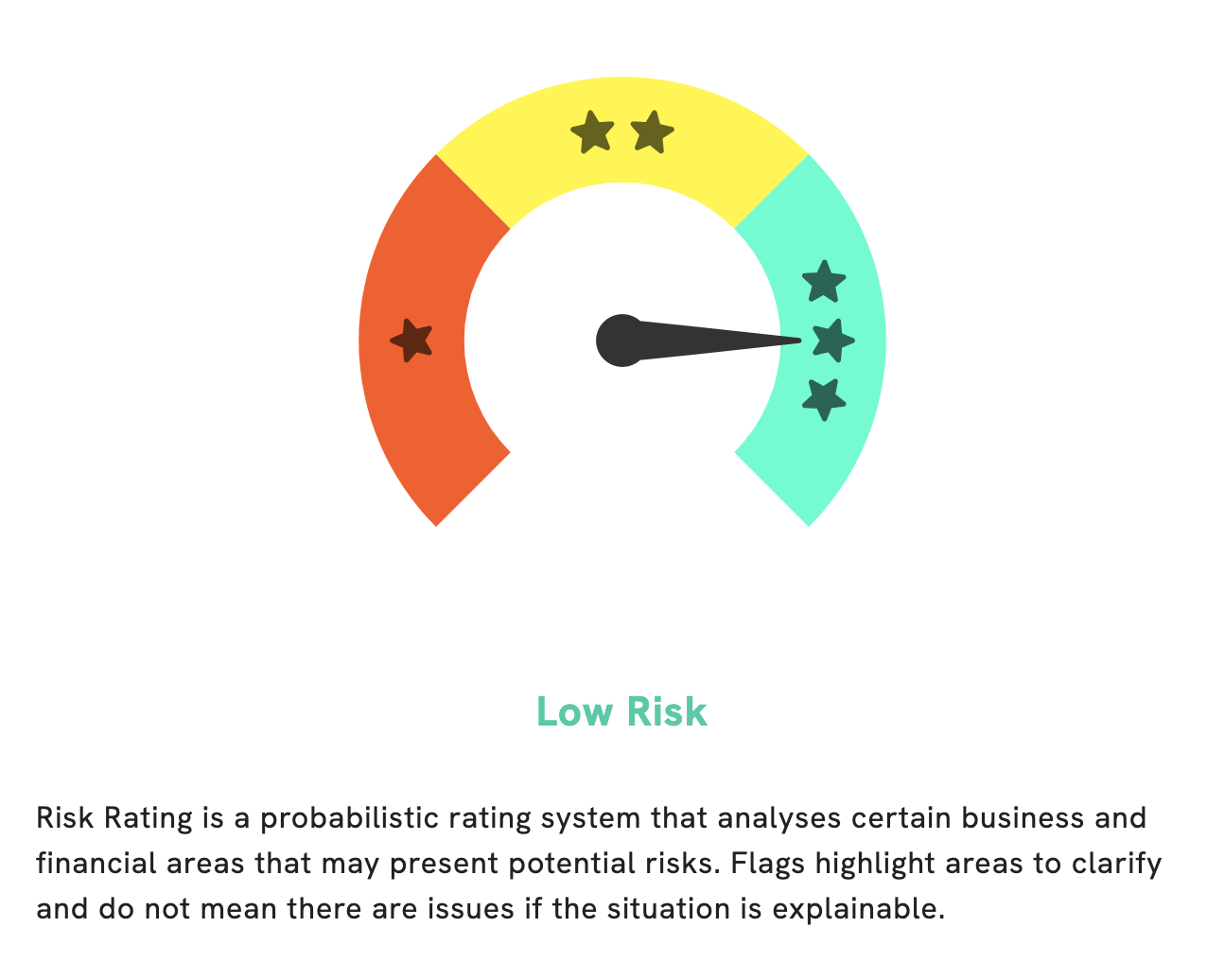

GoodWhale recently conducted an in-depth analysis of BRIGHTSPIRE CAPITAL‘s fundamentals. After careful examination, we have determined the company to be a low risk investment in terms of financial and business aspects. Upon further scrutiny, GoodWhale has detected one risk warning in BRIGHTSPIRE CAPITAL’s balance sheet. To view the exact details of this warning, we invite you to register on goodwhale.com. Here you can access our sophisticated algorithm and get a complete picture of the company’s health. You can trust that GoodWhale is dedicated to providing its users with up-to-date and accurate information about BRIGHTSPIRE CAPITAL’s financial performance. We strive to be your reliable source for essential risk ratings and data. More…

Peers

The Company offers a broad range of products and services, including equity and debt financing, advisory services, and merchant banking. BrightSpire Capital Inc is a publicly traded company on the Toronto Stock Exchange (TSX: BSC). Modiv Inc is a publicly traded company on the Toronto Stock Exchange (TSX: MDV). 360 Capital REIT is a publicly traded company on the Toronto Stock Exchange (TSX: TSXV: CUR.UN). AREIT Inc is a publicly traded company on the Toronto Stock Exchange (TSX: ARE).

– Modiv Inc ($NYSE:MDV)

Modiv Inc is a publicly traded company with a market cap of 78.07M as of 2022. The company is engaged in the business of providing technology solutions for the retail industry. Modiv Inc’s products and services include retail management software, point-of-sale systems, and mobile commerce solutions. The company serves clients in the United States, Canada, and Europe.

– 360 Capital REIT ($ASX:TOT)

Invesco Mortgage Capital Inc. is a real estate investment trust that focuses on investing in, financing and managing residential and commercial mortgage-backed securities and mortgage loans. The company has a market capitalization of $118.44 million as of 2022. It is headquartered in Atlanta, Georgia, and has offices in New York, Los Angeles, Chicago, Boston, Dallas and San Francisco.

– AREIT Inc ($PSE:AREIT)

REIT, or Real Estate Investment Trust, is a company that owns, operates, or finances income-producing real estate. The market capitalization, or market cap, of a company is the total value of its shares of stock. As of 2022, the market cap of REIT Inc is 48.13 billion dollars. The company owns and operates a variety of income-producing real estate, including office buildings, shopping centers, apartments, and warehouses. REIT Inc is one of the largest real estate investment trusts in the United States.

Summary

BrightSpire Capital is an investment firm that offers office loans and other financing services to businesses. The company’s analysis shows that the office loan market is expected to experience a surge in demand, as businesses look to take advantage of low-interest rates and better terms.

However, BrightSpire urges investors to be cautious and enter slowly, as there are still risks associated with investing in this market. It is important to understand the business plans and potential risks involved in every loan, as well as the repayment structure and other obligations. BrightSpire believes in careful research and analysis before investing in office loans to ensure that investments are secure and have the potential to generate a healthy rate of return.

Recent Posts