AvidXchange Leads the Way in Middle-Market B2B Automation Solutions

June 12, 2023

☀️Trending News

AVIDXCHANGE ($NASDAQ:AVDX): AvidXchange Holdings is a fast-growing leader in the middle-market B2B automation solutions industry. It is currently one of the largest payment networks for businesses, boasting a wide range of automation services and products designed to streamline the accounts payable and receivable process. AvidXchange is continuously innovating and developing new solutions to automate document management, invoice processing and payment delivery. AvidXchange offers a comprehensive suite of solutions to simplify and improve the workflow of accounts payable and accounts receivable processes within organizations. With an end-to-end payment network, AvidXchange automates the entire payment cycle from receiving invoices to making payments and reconciling accounts.

Their solutions are designed to help businesses stay compliant, reduce operational costs, and increase efficiency by automating manual processes. AvidXchange also provides an open API platform for developers to build tailored integrations to meet their customers’ specific needs. AvidXchange has become a trusted partner among businesses across the world, providing them with the most innovative solutions to streamline their financial operations. As they continue to innovate their product offerings and create unique solutions for their customers, AvidXchange will no doubt remain a leader in the middle-market B2B automation solutions industry.

Market Price

On Friday, the company’s stock opened at $10.9 and closed at $11.0, up 1.5% from its previous closing price of $10.8. This marks the fourth consecutive trading day in which the stock has gained value, reflecting investor confidence in the company’s ability to provide reliable automation solutions for middle-market businesses. As the industry continues to focus on automating processes, AvidXchange Holdings is well-positioned to remain at the forefront of providing innovative solutions. With a strong focus on customer satisfaction, the company has become a trusted partner for middle-market businesses in need of an automation solution. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Avidxchange Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 331.97 | -92.13 | -27.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Avidxchange Holdings. More…

| Operations | Investing | Financing |

| -29.02 | 147.52 | 73.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Avidxchange Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.95k | 1.3k | 3.3 |

Key Ratios Snapshot

Some of the financial key ratios for Avidxchange Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.4% | – | -21.9% |

| FCF Margin | ROE | ROA |

| -14.4% | -6.9% | -2.3% |

Analysis

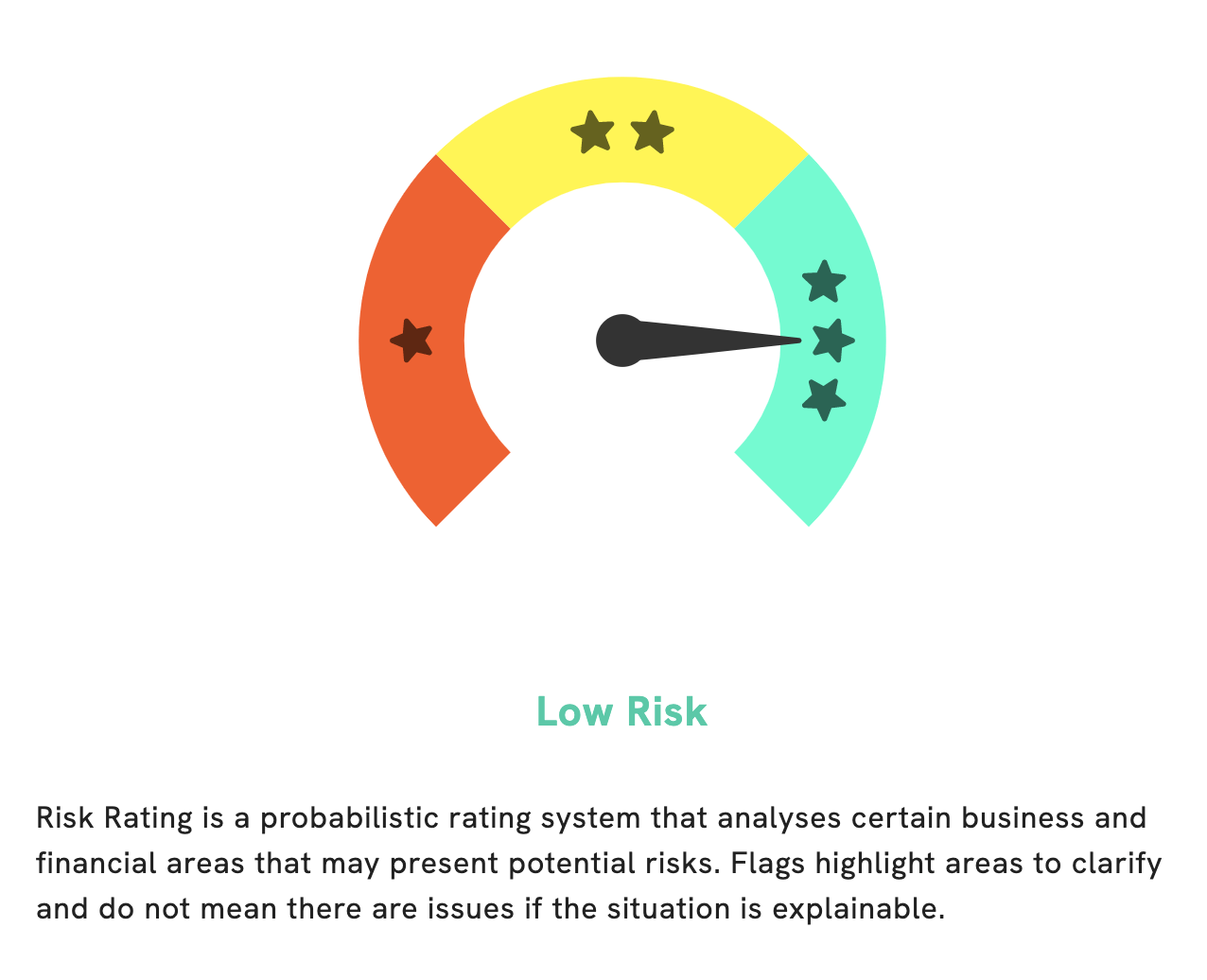

GoodWhale has thoroughly examined AVIDXCHANGE HOLDINGS‘s fundamental data to provide an accurate risk rating. After our analysis, we have determined that AVIDXCHANGE HOLDINGS presents a low risk investment from both a financial and business standpoint. Additionally, we have detected one risk warning in the cashflow statement of AVIDXCHANGE HOLDINGS. To access this risk warning and learn more about AVIDXCHANGE HOLDINGS’s overall risk rating, become a registered user on GoodWhale. More…

Peers

The company was founded in 2000 and is headquartered in Charlotte, North Carolina. AvidXchange has over 700 employees and serves over 6,000 customers in North America. AvidXchange’s main competitors are i3 Verticals Inc, GreenBox POS, and Avalara Inc. These companies are all similar to AvidXchange in that they provide software solutions for businesses.

However, each company has its own unique offerings that set it apart from the others.

– i3 Verticals Inc ($NASDAQ:IIIV)

Verticals Inc is a publicly traded company with a market capitalization of 506.04 million as of 2022. The company has a return on equity of -2.68%. Verticals Inc is a provider of cloud-based software and services for businesses. The company’s software and services enable businesses to manage their operations, customers, and employees.

Summary

AvidXchange Holdings is an attractive investment opportunity in the middle-market B2B automation space. Financial analysis reveals that AvidXchange has consistently outperformed its peers in terms of revenue and gross profit margins. Moreover, the company has a robust balance sheet with low leverage and strong cash flows. Its impressive track record of strong performance makes it a great buy for investors looking to capitalize on its potential for continued long-term success.

Recent Posts