AT&T Stock Soars in 2023, Outperforming Market on Strong Trading Day.

March 26, 2023

Trending News ☀️

AT&T ($NYSE:T) Inc. experienced a surge in its stock on a strong market day. This impressive growth was a welcome sight for investors, as it was an indication of the company’s financial health and success. The impressive performance of AT&T Inc.’s stock was likely aided by its strong financials and solid business model.

Its strong brand presence and diversified portfolio of services and products also likely played a role in its stellar performance in the market. Overall, it was a strong day for AT&T Inc. and its stockholders.

Share Price

On Friday, AT&T Inc. stock soared on the market, closing at $18.6 on strong trading day, up 0.8% from the last closing price of $18.5. Media sentiment towards the stock is mostly positive at the time of writing. The company has seen a significant increase in its stock price over the past few weeks, outperforming the general market in the process. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for At&t Inc. More…

| Total Revenues | Net Income | Net Margin |

| 120.74k | -8.73k | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for At&t Inc. More…

| Operations | Investing | Financing |

| 32.02k | -25.8k | -23.74k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for At&t Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 402.85k | 296.4k | 13.68 |

Key Ratios Snapshot

Some of the financial key ratios for At&t Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -12.7% | -8.0% | 2.5% |

| FCF Margin | ROE | ROA |

| 10.3% | 1.7% | 0.5% |

Analysis

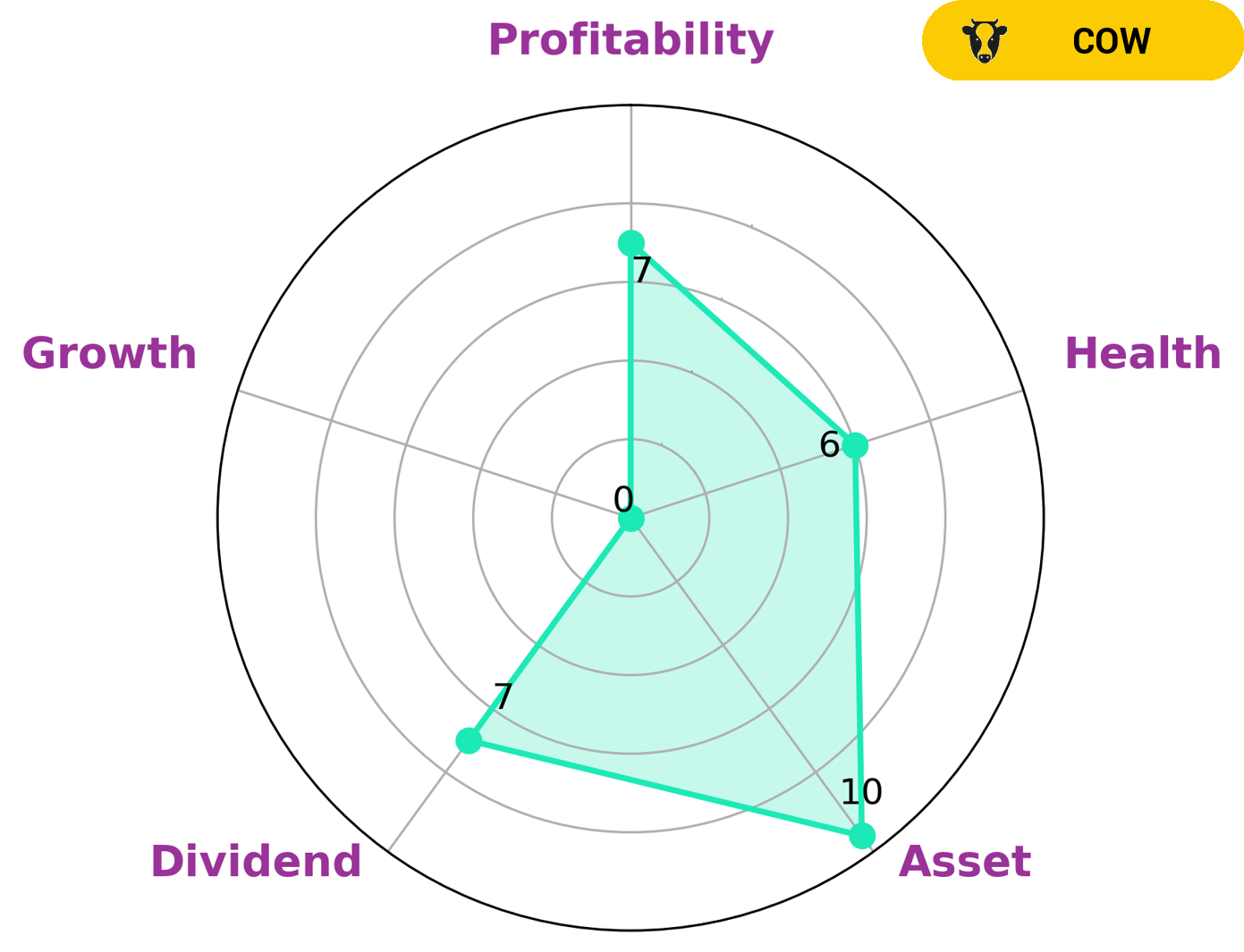

At GoodWhale, we conducted an analysis of AT&T INC‘s financials and from our Star Chart, AT&T INC was classified as a ‘cow’, a type of company with a track record of paying out consistent and sustainable dividends. We believe that conservative investors looking for steady returns may be interested in investing in AT&T INC due to its reliable dividend yields. In terms of their financials, AT&T INC is strong in assets, dividend, and profitability, but weak in growth. With regard to their health score, AT&T INC has an intermediate score of 6/10 with regard to cashflows and debt, indicating that the company should be able to ride out any financial crisis without the risk of bankruptcy. More…

Peers

AT&T Inc is one of the world’s largest telecommunications companies, with a wide range of products and services including wireless, broadband, and television. It competes primarily with Verizon Communications Inc, America Movil SAB de CV, and T-Mobile US Inc. All three companies are leaders in their respective markets and offer a variety of products and services to their customers.

– Verizon Communications Inc ($NYSE:VZ)

Verizon Communications Inc. has a market capitalization of 155.68 billion as of 2022 and a return on equity of 22.51%. The company is a provider of communications, information and entertainment products and services to consumers, businesses and governmental agencies. Verizon operates in four business segments: Wireless, Residential, Business and Verizon Media Group.

– America Movil SAB de CV ($OTCPK:AMXVF)

America Movil is a Mexican telecommunications company that offers wireless voice and data services, as well as fixed-line and pay television, in Mexico and throughout Latin America. The company has a market cap of 52.63B as of 2022 and a Return on Equity of 26.76%. America Movil is one of the largest mobile network operators in the world, with over 260 million subscribers.

– T-Mobile US Inc ($NASDAQ:TMUS)

T-Mobile US Inc is a wireless carrier operating in the United States. The company has a market cap of 170.75 billion as of 2022 and a return on equity of 4.35%. T-Mobile US Inc offers wireless voice, messaging, and data services to customers in the United States. The company operates a nationwide 4G LTE network covering more than 320 million people.

Summary

AT&T Inc. stock has been performing extremely well in the year 2023, far outdoing the market as a whole and showing strong trading on the day. According to current media sentiment, the market is generally positive on AT&T stock. Analysts suggest that investors should consider the company’s rich history, large customer base, and wide variety of services when making decisions. AT&T’s strong financials, including rising revenues and cashflow, are also a major draw.

The company’s recent strategic investments, cost cutting measures, and innovative product launches are helping to drive its success. Looking ahead, analysts see potential for further growth and continued positive returns for investors.

Recent Posts