AMETEK’s AC Power for Testing Market Projected to Grow at 9.40% CAGR

May 27, 2023

Trending News 🌥️

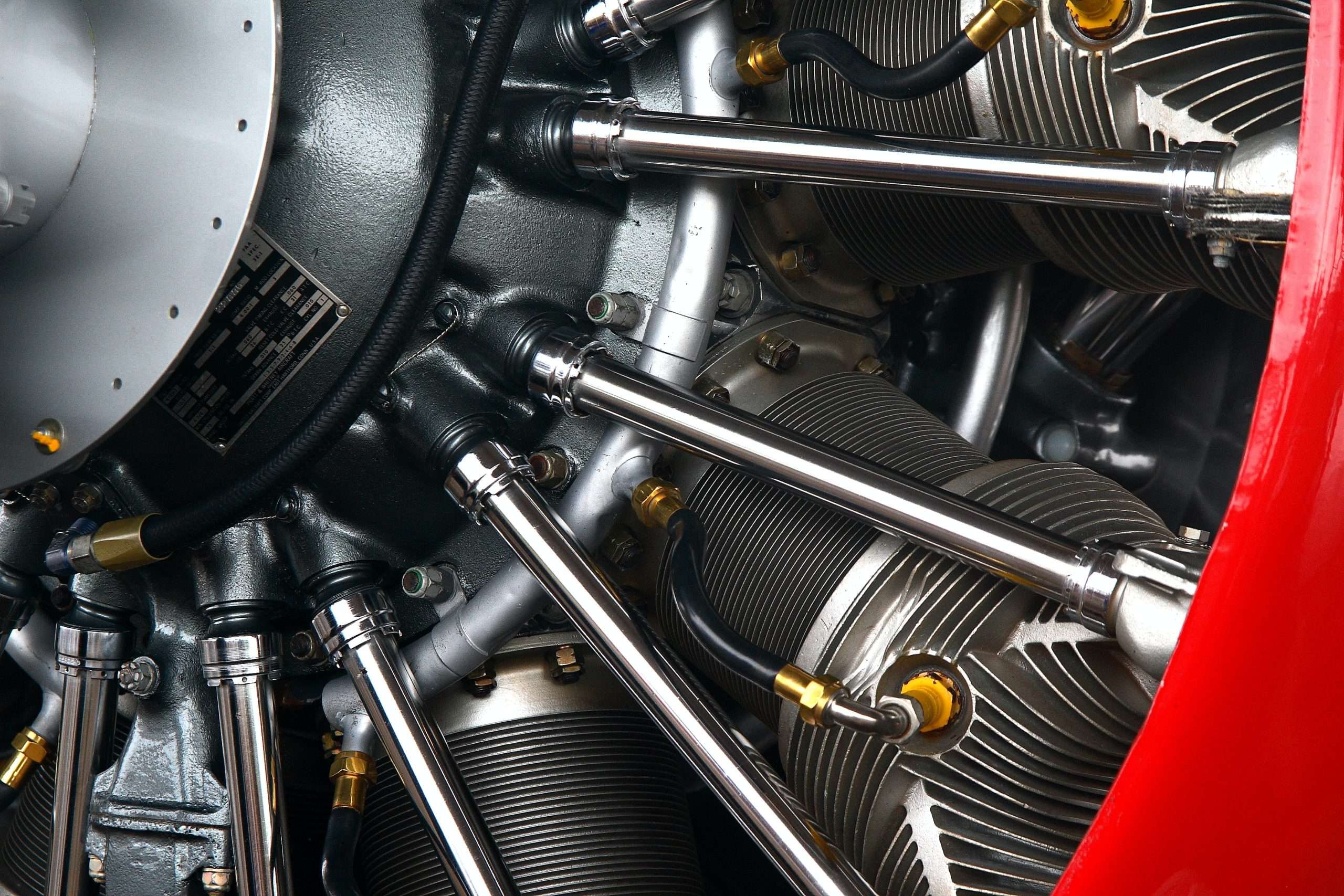

The company’s stock trades on the New York Stock Exchange under the ticker symbol AME. Recently, a study was conducted projecting that the AC Power for Testing Market is projected to grow at a compound annual rate of 9.40%. This anticipated growth is attributed to the increasing demand for AC testing due to its cost-effectiveness, accuracy, and safety.

Additionally, new technologies in AC power testing are expected to accelerate the growth of the market. AMETEK ($NYSE:AME) has been at the forefront of this growth and offers several solutions for AC power testing, such as test cells, frequency converters, and automatic test systems. These products are designed for use in aerospace, medical, and industrial applications and can be used for a variety of tests, including electrical safety tests and thermal tests. With their expertise in this field, AMETEK is well-positioned to take advantage of the projected market growth.

Analysis

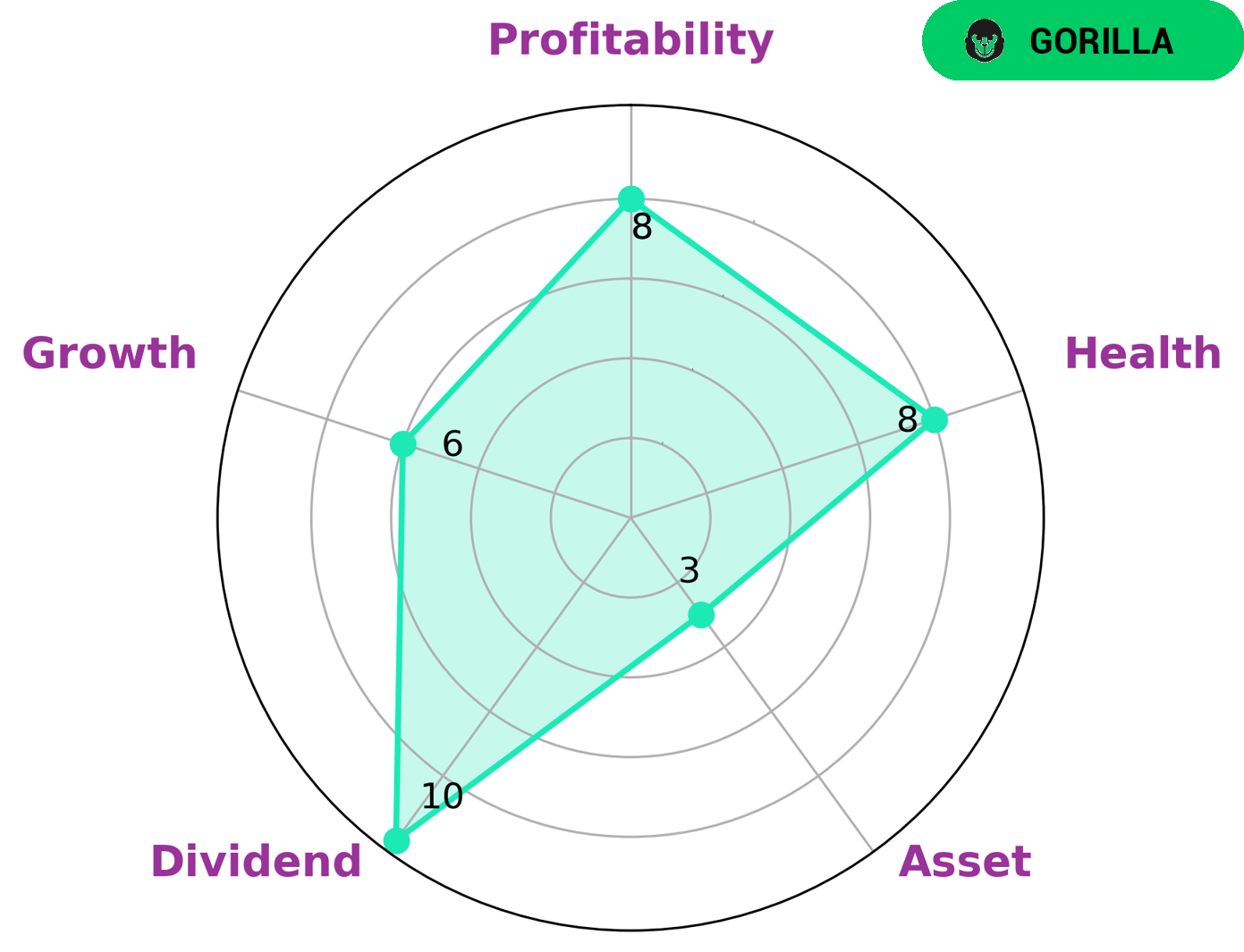

GoodWhale has conducted an analysis of AMETEK‘s wellbeing and classified it as a ‘gorilla’ type of company. This means that AMETEK has achieved stable and high revenue or earning growth due to its strong competitive advantage. This type of company may be of interest to a range of investors, from those seeking dividends to those looking for strong profitability. Growth is medium for this type of company, and asset health is slightly weak. However, when it comes to sustainability AMETEK scores highly with a health score of 8/10 with regard to its cashflows and debt. This indicates that it is capable to sustain future operations in times of crisis, making it a potentially attractive investment for more risk-averse investors. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ametek. More…

| Total Revenues | Net Income | Net Margin |

| 6.29k | 1.19k | 19.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ametek. More…

| Operations | Investing | Financing |

| 1.33k | -660.04 | -603.22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ametek. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.62k | 4.86k | 33.69 |

Key Ratios Snapshot

Some of the financial key ratios for Ametek are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.4% | 11.3% | 24.7% |

| FCF Margin | ROE | ROA |

| 19.1% | 12.8% | 7.7% |

Peers

The company’s products are used in a variety of industries, including aerospace, automotive, communications, computing, defense, and medical. AMETEK has a diversified product portfolio that includes sensor signal conditioning, data acquisition and display, power conversion and management, and motion control. The company’s competitors include Curtiss-Wright Corp, Circor International Inc, Emerson Electric Co.

– Curtiss-Wright Corp ($NYSE:CW)

Curtiss-Wright Corp is a diversified industrial manufacturer with a market cap of 6.21B as of 2022. The company has a return on equity of 12.64%. Curtiss-Wright Corp is engaged in the design, manufacture, and service of highly engineered, technologically advanced products and services. The company operates in three segments: Commercial/Industrial, Defense, and Power.

– Circor International Inc ($NYSE:CIR)

Circor International is a leading provider of highly engineered valves, controls and systems for the oil, gas and power generation industries. The company’s products are used in a wide range of applications, from the transport of natural gas and crude oil to the generation of electricity. Circor International has a market cap of 356.56M as of 2022 and a Return on Equity of -4.49%. The company’s products are used in a wide range of applications, from the transport of natural gas and crude oil to the generation of electricity.

– Emerson Electric Co ($NYSE:EMR)

Emerson Electric Co is a large publicly traded company with a market capitalization of 48.01B as of 2022. The company has a strong return on equity of 25.13%. Emerson Electric is a diversified technology and engineering company that provides innovative solutions to customers in industrial, commercial, and consumer markets worldwide. The company operates in four business segments: Process Management, Industrial Automation, Climate Technologies, and Commercial & Residential Solutions. Emerson’s products and services include process control systems, valves, actuators, pumps, motors, compressors, drives, sensors, instrumentation, power generation equipment, and analytical tools. The company has a long history of providing quality products and services to its customers.

Summary

AMETEK is a global leader in the electrical, electronic and electromechanical markets with a portfolio of leading brands. The company provides investors with a strong dividend yield, a robust balance sheet, and an impressive track record of delivering consistent returns.

In addition, AMETEK has a strong financial position, with significant cash and marketable securities on its balance sheet. The company has an impressive history of operating profitability, with strong organic growth and margin expansion. Analysts have also noted that AMETEK’s current valuation is attractive to long-term investors who are looking for a quality stock with a fair price-to-earnings ratio. Furthermore, the company is well-positioned to capitalize on growth opportunities in areas such as new product development and acquisitions. As a result, AMETEK is widely seen as an attractive long-term investment with a solid upside potential.

Recent Posts