Examining the Financial Health of China Merchants Port Holdings

May 28, 2023

Trending News 🌥️

When analyzing the financial health of China Merchants Port ($SEHK:00144) Holdings, one of the most important considerations is the balance sheet. Is the company’s balance sheet in good condition? In order to answer this question, it is necessary to examine both short-term and long-term liabilities and assets. China Merchants Port Holdings (CMPH), is a publicly traded port operator based in Hong Kong, China. It operates and manages ports, terminals, and related services in Mainland China, Taiwan, Hong Kong, Singapore, and other parts of the world. The company offers container terminals, bulk cargo terminals, oil terminals, logistics-related services, and port management services. CMPH is one of the leading port operators in the world and is listed on the Hong Kong Stock Exchange. It is necessary to analyze the company’s current assets, such as cash and accounts receivable, as well as its non-current assets, such as property, plant, and equipment. It is also important to assess the company’s liabilities, including both short-term and long-term debt.

In addition, one must consider current and non-current liabilities such as accounts payable and deferred income taxes. A thorough examination of the balance sheet can provide an indication of the financial health of CMPH and whether or not it is in good condition.

Share Price

As of Monday, China Merchants Port Holdings (CHINA MERCHANTS PORT) stock opened at HK$12.2 and closed at HK$12.4, up by 0.5% from last closing price of 12.3. This is likely due to its strong presence in the industry, its diversified portfolio of assets, and its long-term commitment to developing its core operations. Furthermore, the company’s financials are also healthy, with strong cashflow and a high return on equity.

The company also has a healthy balance sheet with significant equity and low debt levels. All of these factors suggest that China Merchants Port Holdings is in good financial standing and is well-positioned to take advantage of growth opportunities in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for China Merchants Port. More…

| Total Revenues | Net Income | Net Margin |

| 12.54k | 7.78k | 67.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for China Merchants Port. More…

| Operations | Investing | Financing |

| 8.78k | -3.82k | -4.9k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for China Merchants Port. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 172.16k | 49.58k | 25.78 |

Key Ratios Snapshot

Some of the financial key ratios for China Merchants Port are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.1% | 19.9% | 95.1% |

| FCF Margin | ROE | ROA |

| 57.9% | 7.2% | 4.3% |

Analysis

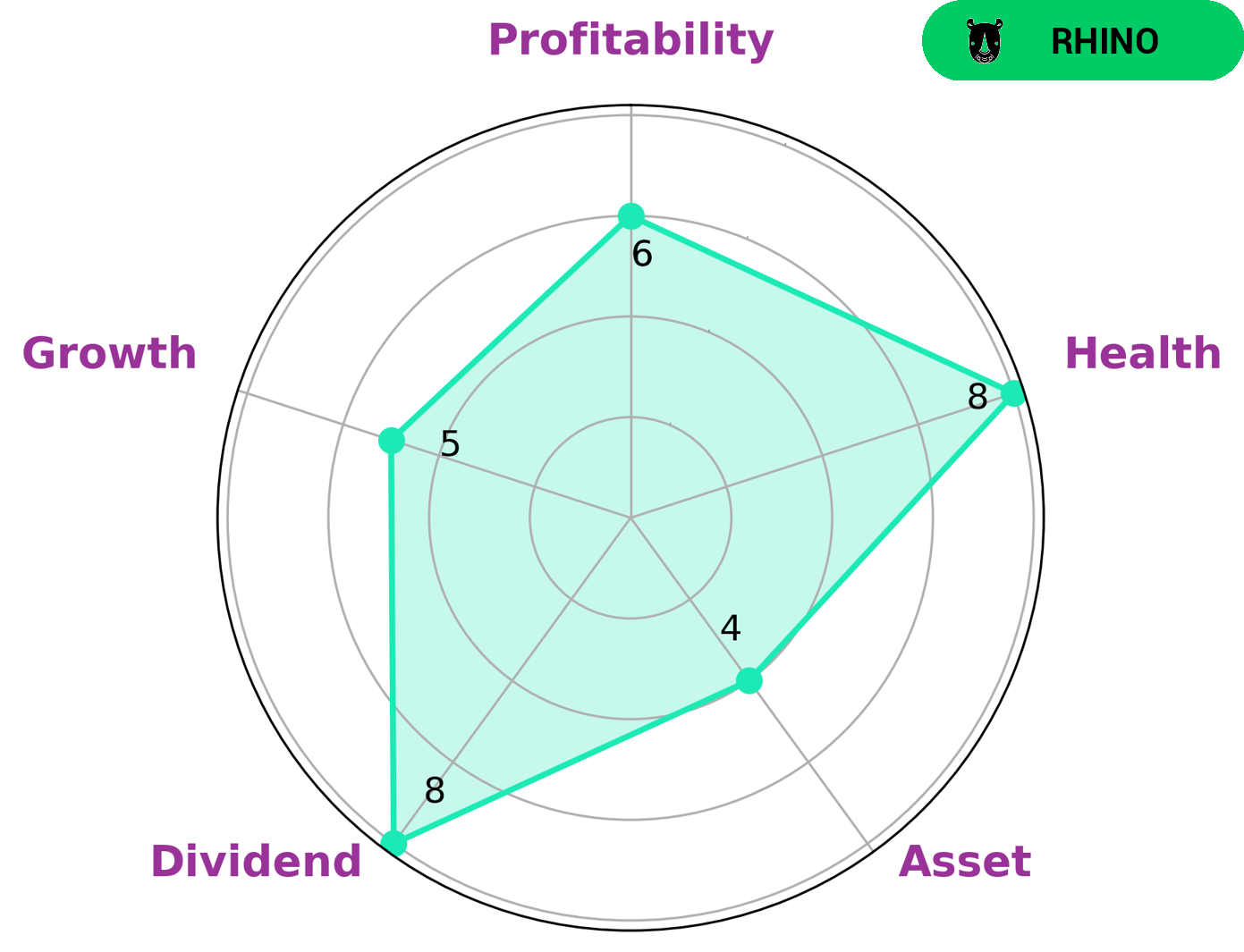

At GoodWhale, we conducted an analysis of CHINA MERCHANTS PORT’s financials and classified it as a ‘rhino’ according to our Star Chart. This designation indicates that the company has achieved moderate revenue or earnings growth. As such, investors seeking companies with steady growth may be interested in CHINA MERCHANTS PORT. We found that CHINA MERCHANTS PORT is strong in dividend, and medium in asset, growth, and profitability. Furthermore, CHINA MERCHANTS PORT has a high health score of 8/10 with regard to its cashflows and debt. This makes it well-equipped to pay off debt and fund future operations. More…

Peers

The competition between China Merchants Port Holdings Co Ltd and its competitors, Perak Transit Bhd, PT Nusantara Pelabuhan Handal Tbk, and Rizhao Port Jurong Co Ltd, is fierce in the port services industry as each company strives to provide the best services in the market. From technological advancements to strategic partnerships, each of these companies is continually looking for ways to stay ahead of the competition and gain a larger market share.

– Perak Transit Bhd ($KLSE:0186)

Perak Transit Bhd is a Malaysian public transportation company that provides bus and coach services throughout the state of Perak. With a market cap of 943.8M as of 2022, the company is well-positioned to continue its growth trajectory in the transportation industry. In addition, Perak Transit Bhd boasts a strong Return on Equity (ROE) of 9.55%, indicating the company’s ability to effectively manage its assets and generate returns for its investors. This suggests that the company is well-positioned for continued growth and success.

– PT Nusantara Pelabuhan Handal Tbk ($IDX:PORT)

PT Nusantara Pelabuhan Handal Tbk is a leading Indonesian port operator that provides port services, such as port management, operation, and maintenance. With a market cap of 2.45T as of 2022 and a Return on Equity (ROE) of 4.69%, the company has been able to generate strong returns for its shareholders. Furthermore, the company has been consistently profitable with a steady growth rate over the years. This has enabled the company to remain competitive in the port services industry and provide quality services to its customers.

– Rizhao Port Jurong Co Ltd ($SEHK:06117)

Rizhao Port Jurong Co Ltd is a Chinese port logistics company based in Rizhao, Shandong Province. With a market cap of 979.4M as of 2022, the company is a major player in the global shipping industry. In terms of profitability, the company boasts a Return on Equity of 7.14%, indicating that it is generating returns for its shareholders. Rizhao Port Jurong Co Ltd provides port-related services such as port management, cargo handling, and logistics services. The company also offers integrated transport solutions, including port services, warehousing management, shipping agency services, and other related services.

Summary

China Merchants Port Holdings (CMPort) is a leading global port operator with a strong presence in mainland China and key ports around the world. Overall, CMPort’s financial health is strong, and it has a solid position for sustainable future growth.

Recent Posts