Tapestry Impresses Analysts, Demonstrates Solid Pricing & Diversified Global Reach

May 13, 2023

Trending News ☀️

Tapestry ($NYSE:TPR), formerly known as Coach, is a leading American multinational luxury fashion company based in New York City. The company has earned much praise from analysts for their strong pricing and diversified global reach. Tapestry has demonstrated a solid track record in product innovation, operational execution, and financial discipline which has helped them become a leader in the luxury fashion market. This makes them one of the most influential players in the global luxury fashion industry. Furthermore, Tapestry’s recent acquisition of Kate Spade New York and Stuart Weitzman has further strengthened their presence in the market and provided them with a larger customer base. Analysts have been particularly impressed with Tapestry’s ability to maintain their prices in a highly competitive market.

Despite the presence of numerous competitors, Tapestry has been able to remain competitive by consistently offering quality products at competitive prices. This allows them to remain competitive and attract more customers. Overall, Tapestry’s strong pricing and diversified global reach have made them a leader in the luxury fashion industry. Analysts have been impressed with their ability to remain competitive and maintain solid pricing in a highly competitive market. Tapestry’s strategy has allowed them to gain a strong foothold in the industry and continue to grow their customer base.

Market Price

On Friday, analysts were impressed with TAPESTRY‘s stock performance as it opened at $40.4 and closed at $41.2, up by 2.4% from last closing price of 40.2. It showcased the company’s solid pricing strategy and its diversified global reach. The strong performance in this quarter demonstrated the company’s ability to create and sustain value for investors. Furthermore, the stability of its stock prices and the fact that it was able to achieve a 2.4% increase in the closing price indicate good prospects for the company’s future performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tapestry. More…

| Total Revenues | Net Income | Net Margin |

| 6.59k | 836.7 | 12.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tapestry. More…

| Operations | Investing | Financing |

| 647.5 | 282.7 | -1.33k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tapestry. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.26k | 4.94k | 9.8 |

Key Ratios Snapshot

Some of the financial key ratios for Tapestry are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.1% | 16.5% | 16.3% |

| FCF Margin | ROE | ROA |

| 7.8% | 29.4% | 9.3% |

Analysis

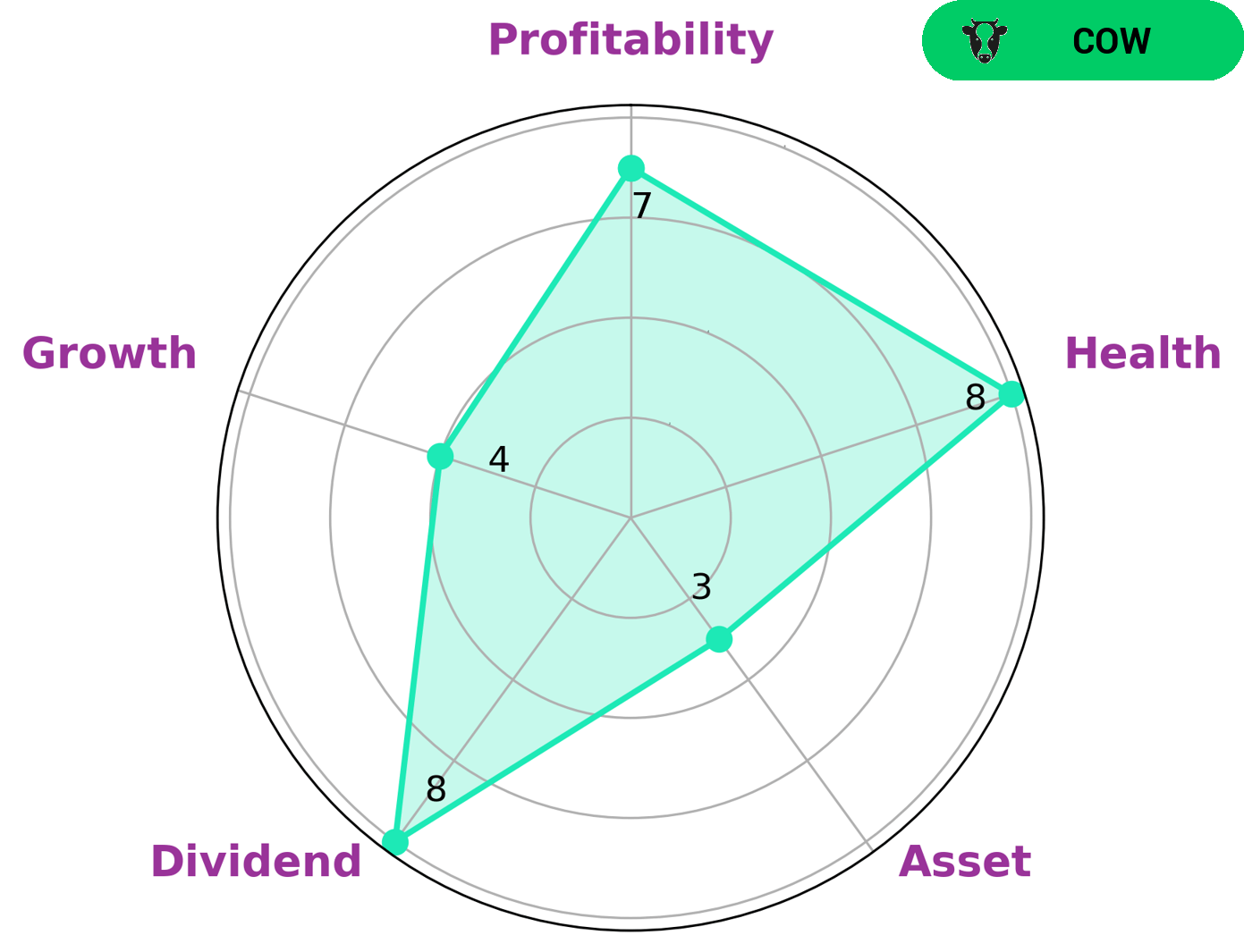

At GoodWhale, we recently analyzed the fundamentals of TAPESTRY. According to our Star Chart, TAPESTRY is strong in dividend, profitability, and medium in growth and weak in asset. This makes TAPESTRY an attractive investment for investors who are looking for a steady return from their investments, such as retirees or those with a low appetite for risk. TAPESTRY also has a high health score of 8/10 with regard to its cashflows and debt, making it capable of riding out any crisis without the risk of bankruptcy. More…

Peers

In the luxury goods industry, Tapestry Inc. competes against companies like CCC SA, Prada SpA, and Nordstrom Inc. While each company has its own unique strengths, Tapestry Inc. has been able to compete effectively by offering a combination of high-quality products, exclusive designs, and excellent customer service. As a result, Tapestry Inc. has been able to maintain a loyal customer base and grow its business.

– CCC SA ($LTS:0LS5)

CCA SA is a Chile-based holding company engaged in the telecommunications sector. The Company’s main shareholder is América Móvil, S.A.B. de C.V. (AMX), through its subsidiary Telmex Internacional, S.A.B. de C.V. (Telmex). CCA SA’s subsidiaries include VTR Chile S.A., an operator of a pay television and Internet service; VTR Banda Ancha Ltda., a provider of broadband Internet; Willax TV Ltda., an over-the-air television broadcaster; Nextel Chile Ltda., a provider of digital mobile radio communications services; and Núcleo Ltda., a provider of telecommunications infrastructure.

– Prada SpA ($SEHK:01913)

Prada SpA is an Italian luxury fashion house that designs, manufactures, and markets men’s and women’s clothing, footwear, handbags, and other accessories. The company has a market cap of 96.72B as of 2022 and a Return on Equity of 11.91%. Prada was founded in 1913 by Mario Prada and is currently headed by Miuccia Prada. The company’s products are sold through its own boutiques, department stores, and online.

– Nordstrom Inc ($NYSE:JWN)

Nordstrom, Inc. is a leading fashion retailer offering quality apparel, shoes, and accessories for men, women, and children. Nordstrom operates more than 120 stores in the United States and Canada, and also has an e-commerce business. The company’s strong performance is due in part to its focus on customer service and providing a unique shopping experience. Nordstrom’s market cap is 3.15B as of 2022, and its ROE is 70.09%. Nordstrom is a publicly traded company on the Nasdaq stock exchange.

Summary

Tapestry, Inc. has generated positive investor sentiment, with analysts praising its solid pricing strategy and global presence. The company’s broad geographic footprint, with operations in Asia, Europe, and North America, has enabled it to optimize its portfolio and capture more customers across different markets. Its product offerings are well received by customers, and its strong financial performance has earned it the trust of investors. As such, Tapestry is an attractive option for those considering investing in the retail goods industry.

Recent Posts