Signet Jewelers Reports Record-Breaking Earnings and Revenue

June 12, 2023

🌥️Trending News

Signet Jewelers ($NYSE:SIG), a leading retailer of fine jewelry in the United States, Canada and the United Kingdom, recently reported record-breaking earnings and revenue for its fiscal third quarter. Non-GAAP Earnings Per Share of $1.78 surpassed expectations by $0.29, while revenue of $1.7 Billion exceeded predictions by $50 Million. It offers a range of products, services, and customer services that include diamond rings, stud earrings, polishing and repairs, as well as custom designs. The company is headquartered in Akron, Ohio and its shares are traded on the New York Stock Exchange under the symbol SIG.

The strong financial performance indicates the resilience of Signet Jewelers amid a challenging retail environment and serves as a testament to the company’s innovative approach to customer service and product offerings. With continued growth in digital sales and stores operations, Signet Jewelers is poised for further success in the coming quarters.

Earnings

In its earning report of FY2023 Q4 as of January 31 2021, SIGNET JEWELERS reported record-breaking earned 2186.5M USD in total revenue and 254.3M USD in net income. This marked a 22.2% decrease in total revenue, and a 19.1% decrease in net income, compared to the same quarter in the previous year. Despite this decrease, SIGNET JEWELERS has seen tremendous growth over the past three years, with total revenue increasing from 2186.5M USD to 2666.2M USD. These strong earnings signals a healthy outlook for the company going forward.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Signet Jewelers. More…

| Total Revenues | Net Income | Net Margin |

| 7.67k | 523.1 | 6.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Signet Jewelers. More…

| Operations | Investing | Financing |

| 551.6 | -550.3 | -265.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Signet Jewelers. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.21k | 3.97k | 49.25 |

Key Ratios Snapshot

Some of the financial key ratios for Signet Jewelers are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.3% | 78.9% | 9.1% |

| FCF Margin | ROE | ROA |

| 5.3% | 19.6% | 7.1% |

Share Price

On Thursday, Signet Jewelers reported record-breaking earnings and revenue. Their stock opened at $61.1 and closed at $62.1, representing a plunge of 10.7% from last closing price of 69.5. These figures indicate that the company has seen a surge in both sales and profits, with the stock price reflecting the strong performance.

Furthermore, the company also announced that it is planning to increase its dividend by 3%, which will further benefit shareholders. Overall, the news from Signet Jewelers is encouraging for investors as it shows the company is in a strong position to deliver on its promises and continue to perform well. Live Quote…

Analysis

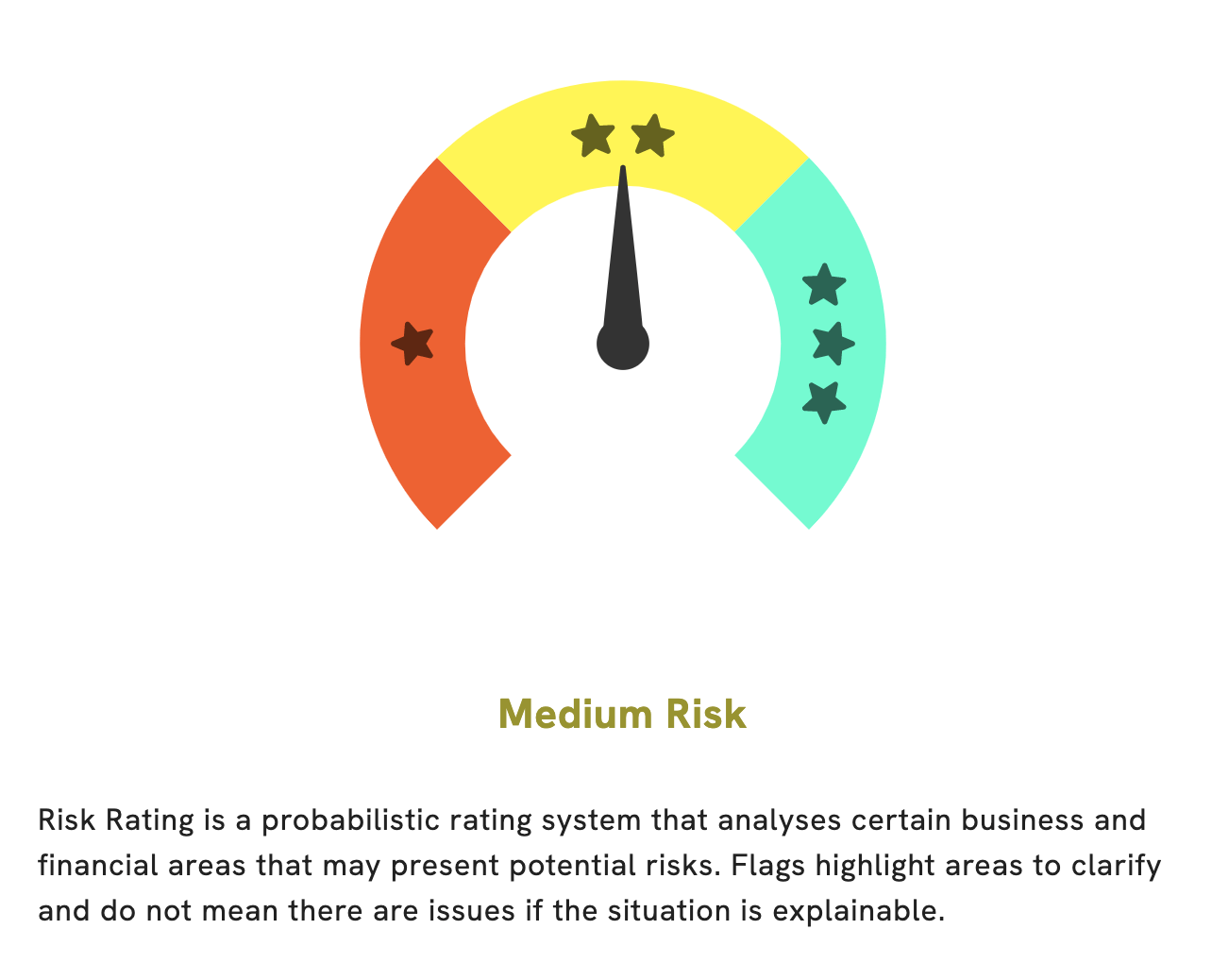

At GoodWhale, we conducted an analysis of SIGNET JEWELERS‘ fundamentals, and based on our Risk Rating, SIGNET JEWELERS is a medium risk investment in terms of financial and business aspects. However, we have detected 2 risk warnings in SIGNET JEWELERS’ income sheet and balance sheet. To access this more detailed information, become a registered user with GoodWhale and you can check it out. More…

Peers

The company is engaged in the retail sale of diamond jewelry, watches, and other related items. Signet Jewelers competes in the jewelry industry with other retailers such as Jakroo Inc, ABC Technologies Holdings Inc, and National Vision Holdings Inc.

– Jakroo Inc ($OTCPK:JKRO)

ATC Technologies Holdings Inc is a global provider of precision machining solutions. The company offers a range of services, including contract manufacturing, machining, and assembly. ATC serves a variety of industries, including aerospace, defense, medical, and semiconductor. The company has a market cap of 559.41M and a ROE of -9.23%.

– ABC Technologies Holdings Inc ($TSX:ABCT)

National Vision Holdings Inc is a holding company that operates through its subsidiaries as one of the largest optical retailers in the United States. The company offers a wide variety of vision care products and services including eyeglasses, contact lenses, eye exams, and prescription sunglasses. As of 2022, the company had a market capitalization of 2.66 billion dollars and a return on equity of 10.47%. National Vision Holdings Inc operates over 1,400 stores in 42 states across the United States.

Summary

Signet Jewelers is a leading global specialty retail jewelry company that operates in the United States, Canada, and the United Kingdom. Recently, the company reported strong second-quarter results, which beat analyst expectations. Signet’s Non-GAAP Earnings Per Share (EPS) of $1.78 was $0.29 higher than expected, while its revenue of $1.7B surpassed analyst estimates by $50M. Despite these impressive results, Signet’s stock price moved down the same day, indicating that investors were not impressed with the results.

This could be because Signet continues to face headwinds from the ongoing Covid-19 pandemic. Nevertheless, looking ahead, investors are expecting Signet to benefit from its recent acquisition of R2Net, an online retailer of diamond and fine jewelry, as well as from its digital transformation efforts.

Recent Posts