Signet Jewelers Exec Sells $740k in Company Stock in Strategic Move

September 19, 2024

🌥️Trending News

Signet Jewelers ($NYSE:SIG) Ltd is a well-known company in the jewelry industry, operating under various brand names such as Kay Jewelers, Zales, and Jared. This move, while not uncommon for executives in the corporate world, has caught the attention of investors and industry observers. The sale of such a significant amount of company stock by an executive is often interpreted as a strategic move. It is an indication that the executive believes in the financial performance of the company and is confident in its future prospects. In this case, Joan Hilson’s move has sparked speculations about the company’s financial health and potential growth in the coming years. Signet Jewelers has been working on a turnaround plan to improve its financial performance, which has seen a decline in recent years due to various factors such as changing consumer preferences and increased competition.

However, with a new management team in place and initiatives to streamline operations and invest in e-commerce capabilities, the company has shown signs of improvement. And with Hilson’s recent stock sale, it seems that the company’s executives are optimistic about its future. Furthermore, this move also reflects positively on the overall market sentiment towards Signet Jewelers. As an insider selling a large amount of stock usually indicates potential risks or challenges ahead for a company, this sale by one of its top executives shows confidence and stability within the organization. It could also be perceived as a vote of confidence for the company’s current leadership and their strategic plans. In conclusion, Joan M. Hilson’s recent stock sale in Signet Jewelers Ltd has garnered attention and sparked discussions among investors and industry observers. This strategic move not only showcases the executive’s confidence in the company’s financial performance but also reflects positively on the overall market sentiment towards Signet Jewelers. As the company continues to implement its turnaround plan and adapt to the changing retail landscape, the future looks promising for this iconic jewelry retailer.

Price History

This sale was seen as a strategic move by the company, as the stock opened at $93.66 and closed at $93.12, down by 0.47% from the previous closing price of $93.56. The timing of this sale is significant, as it comes just weeks after Signet Jewelers announced its fourth quarter and full year financial results. While the company reported strong earnings and revenue growth, it also revealed a decline in same-store sales for its major brands. This news caused a drop in the company’s stock price, making it an opportune time for the executive to sell. This move by the executive not only provides a financial benefit for them, but it also sends a message to investors that they have confidence in the company’s long-term success. By selling now, the executive is able to lock in profits and potentially reinvest in other opportunities, while still maintaining a significant stake in the company. It should also be noted that this sale was pre-scheduled, meaning it was planned in advance and not done in response to any specific event or news. This further emphasizes the strategic nature of the move and shows a calculated approach by both the executive and the company. It will be interesting to see how this sale impacts Signet Jewelers and its stock performance in the coming weeks and months. As with any major insider transaction, it is sure to draw attention and speculation from investors and industry analysts.

However, with strong financial results and a solid reputation in the jewelry industry, it is likely that Signet Jewelers will continue to thrive despite this insider selling. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Signet Jewelers. More…

| Total Revenues | Net Income | Net Margin |

| 7.34k | 427 | 5.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Signet Jewelers. More…

| Operations | Investing | Financing |

| 748.1 | -130.9 | -302.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Signet Jewelers. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.06k | 3.84k | 50.16 |

Key Ratios Snapshot

Some of the financial key ratios for Signet Jewelers are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.2% | 75.0% | 3.5% |

| FCF Margin | ROE | ROA |

| 8.4% | 7.1% | 2.6% |

Analysis

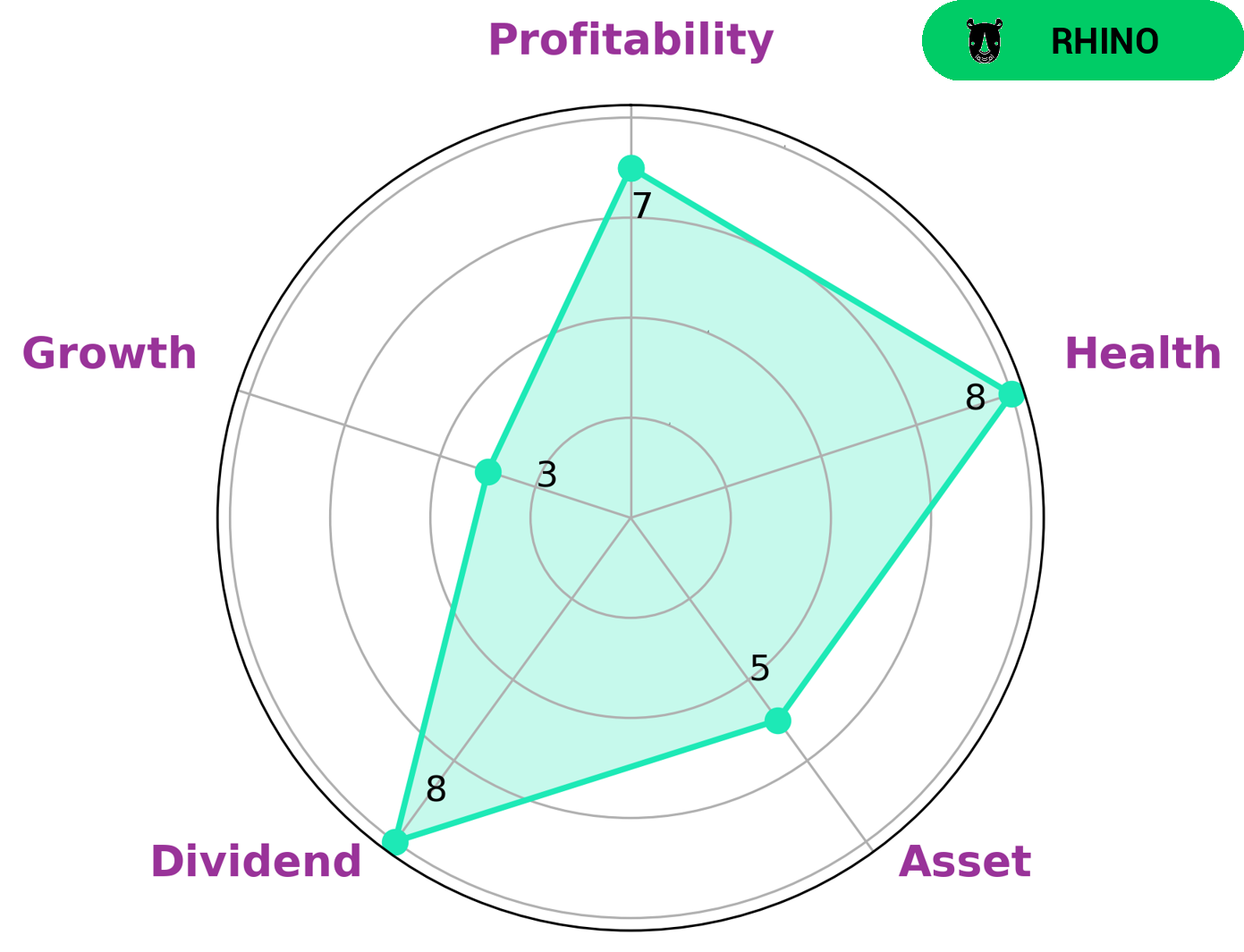

In my analysis of SIGNET JEWELERS, I first looked at the company’s basic principles to understand its overall operations. SIGNET JEWELERS is a jewelry retailer with a strong focus on customer satisfaction, ethical sourcing, and responsible business practices. These principles not only align with societal expectations and values, but also contribute to the company’s success in the market. When examining SIGNET JEWELERS’s financials, it is evident that the company excels in dividend payouts to shareholders and maintains a strong profitability. However, its asset growth has been moderate and its growth potential may be limited. This suggests that while SIGNET JEWELERS may not be experiencing significant growth, it has a solid foundation and established presence in the market. In terms of overall health, SIGNET JEWELERS receives a high score of 8 out of 10. This indicates that the company has strong cash flows and manageable debt levels, making it capable of sustaining future operations even in times of crisis. This is a positive indicator for potential investors as it signals stability and resilience in the face of economic challenges. Based on my analysis, SIGNET JEWELERS can be classified as a “rhino” type of company. This means that it has achieved moderate revenue or earnings growth, rather than being a high-growth or low-growth company. For investors looking for steady returns rather than high-risk/high-reward opportunities, SIGNET JEWELERS may be an appealing option. Overall, SIGNET JEWELERS appears to be a solid investment choice for those seeking a stable and ethical company with a history of dividend payouts and profitability. Its moderate growth potential and strong financial health make it a suitable choice for investors with a more conservative risk tolerance. More…

Peers

The company is engaged in the retail sale of diamond jewelry, watches, and other related items. Signet Jewelers competes in the jewelry industry with other retailers such as Jakroo Inc, ABC Technologies Holdings Inc, and National Vision Holdings Inc.

– Jakroo Inc ($OTCPK:JKRO)

ATC Technologies Holdings Inc is a global provider of precision machining solutions. The company offers a range of services, including contract manufacturing, machining, and assembly. ATC serves a variety of industries, including aerospace, defense, medical, and semiconductor. The company has a market cap of 559.41M and a ROE of -9.23%.

– ABC Technologies Holdings Inc ($TSX:ABCT)

National Vision Holdings Inc is a holding company that operates through its subsidiaries as one of the largest optical retailers in the United States. The company offers a wide variety of vision care products and services including eyeglasses, contact lenses, eye exams, and prescription sunglasses. As of 2022, the company had a market capitalization of 2.66 billion dollars and a return on equity of 10.47%. National Vision Holdings Inc operates over 1,400 stores in 42 states across the United States.

Summary

This transaction has caught the attention of investors and analysts, as it indicates a potential lack of confidence in the company’s future performance. It could also suggest that the executive is looking to diversify their investment portfolio. This sale comes amidst a challenging time for Signet Jewelers, with the company facing declining sales and negative news coverage. This move by a top executive may be seen as a red flag for investors considering investing in Signet Jewelers.

Recent Posts