Ufp Industries Stock Fair Value – Wedbush lowers UFP Industries’ FY2024 earnings forecast in recent research note

November 15, 2024

🌧️Trending News

UFP ($NASDAQ:UFPI) Industries, Inc. (UFP) is a leading supplier of wood, wood composite, and other related products. The company offers a wide range of building materials and components, including lumber, composite decking, fencing, siding, and concrete forming products. UFP also provides industrial packaging, components for the manufactured housing market, and other wood products for the retail, construction, and industrial markets. In recent years, UFP has been experiencing steady growth in revenue and earnings.

However, according to a recent research note from Wedbush, a renowned investment firm, UFP’s projected earnings for fiscal year 2024 have been lowered. This news has caused some concern among investors and analysts. The research note from Wedbush attributed the lowered forecast to several factors, including increased competition in the building materials industry and rising raw material costs. These factors have put pressure on UFP’s margins and could potentially impact the company’s profitability in the long term. However, it is important to note that this is just one analyst’s opinion and does not necessarily reflect the overall outlook for UFP Industries. The company has a strong track record of success and has consistently delivered solid financial results.

Additionally, UFP has a diversified product portfolio and a wide geographic reach, which helps mitigate risks associated with fluctuations in specific markets. Furthermore, UFP has a strong balance sheet with low debt levels and ample cash reserves. This provides the company with financial flexibility to weather any short-term challenges that may arise. UFP also continues to invest in innovative technologies and processes to improve its efficiency and maintain its competitive edge. In conclusion, while Wedbush’s lowered forecast for FY2024 may be cause for concern, investors should not overlook UFP Industries’ overall strong performance and growth potential. With its diversified product portfolio, strong balance sheet, and focus on innovation, UFP is well-positioned to overcome any challenges and continue to deliver value to its shareholders in the long term.

Earnings

In a recent research note, Wedbush has lowered UFP Industries‘ forecast for earnings in fiscal year 2024. This comes after the company released its earnings report for the fourth quarter of fiscal year 2023, ending on December 31, 2021. According to the report, UFP Industries earned a total revenue of 2016.8 million USD and a net income of 137.91 million USD. Compared to the previous year, UFP Industries saw a 5.4% increase in total revenue and a 4.0% increase in net income. While this may seem like a positive growth trend, it has still resulted in a decrease in the company’s forecasted earnings for fiscal year 2024. This indicates that Wedbush has a less optimistic view of the company’s future performance.

Furthermore, over the past three years, UFP Industries’ total revenue has fluctuated, reaching a high of 2016.8 million USD and a low of 1524.35 million USD. This suggests that the company may be experiencing some challenges in sustaining steady growth. Wedbush’s decision to lower UFP Industries’ earnings forecast for fiscal year 2024 may be attributed to various factors such as changes in market conditions, industry trends, and potential challenges facing the company. It will be interesting to see how UFP Industries addresses these challenges and if they are able to meet Wedbush’s revised forecast in the coming years.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ufp Industries. More…

| Total Revenues | Net Income | Net Margin |

| 7.22k | 514.31 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ufp Industries. More…

| Operations | Investing | Financing |

| 959.89 | -240.16 | -162.86 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ufp Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.02k | 967.58 | 49.02 |

Key Ratios Snapshot

Some of the financial key ratios for Ufp Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.9% | 22.0% | 9.0% |

| FCF Margin | ROE | ROA |

| 10.8% | 13.6% | 10.1% |

Market Price

This news caused some concern among investors, as the company’s stock price initially dropped upon the release of the note. On Friday, the stock opened at $133.48 and slightly increased to close at $134.49, a gain of 0.94% from the previous closing price of $133.24. Wedbush’s revised earnings forecast for UFP Industries is likely due to several factors. One possible reason could be a decrease in demand for the company’s products or services. This could be due to a variety of reasons, such as changes in consumer preferences or a slowdown in the overall economy. Another factor could be an increase in competition within the industry, resulting in lower revenues and profits for UFP Industries. It is worth noting that Wedbush’s revised forecast is for the fiscal year 2024, which is still several years away. This indicates that the investment firm may have some concerns about the long-term outlook for UFP Industries.

However, it is important to consider that this is just one analyst’s opinion and may not necessarily reflect the overall sentiment of all investors. Despite the lowered forecast, UFP Industries’ stock price has remained relatively stable. This could be seen as a positive sign, as it suggests that investors have not lost confidence in the company’s future prospects. It will be interesting to see how the stock performs in the coming weeks and months, as more information becomes available about the company’s financial performance. In conclusion, Wedbush’s recent research note has caused some fluctuations in UFP Industries’ stock price and has raised questions about the company’s future earnings potential. However, it is important for investors to do their own research and consider multiple factors before making any investment decisions. It will be crucial for UFP Industries to address any concerns raised by the investment firm and demonstrate a strong performance in the coming years to regain investor confidence. Live Quote…

Analysis – Ufp Industries Stock Fair Value

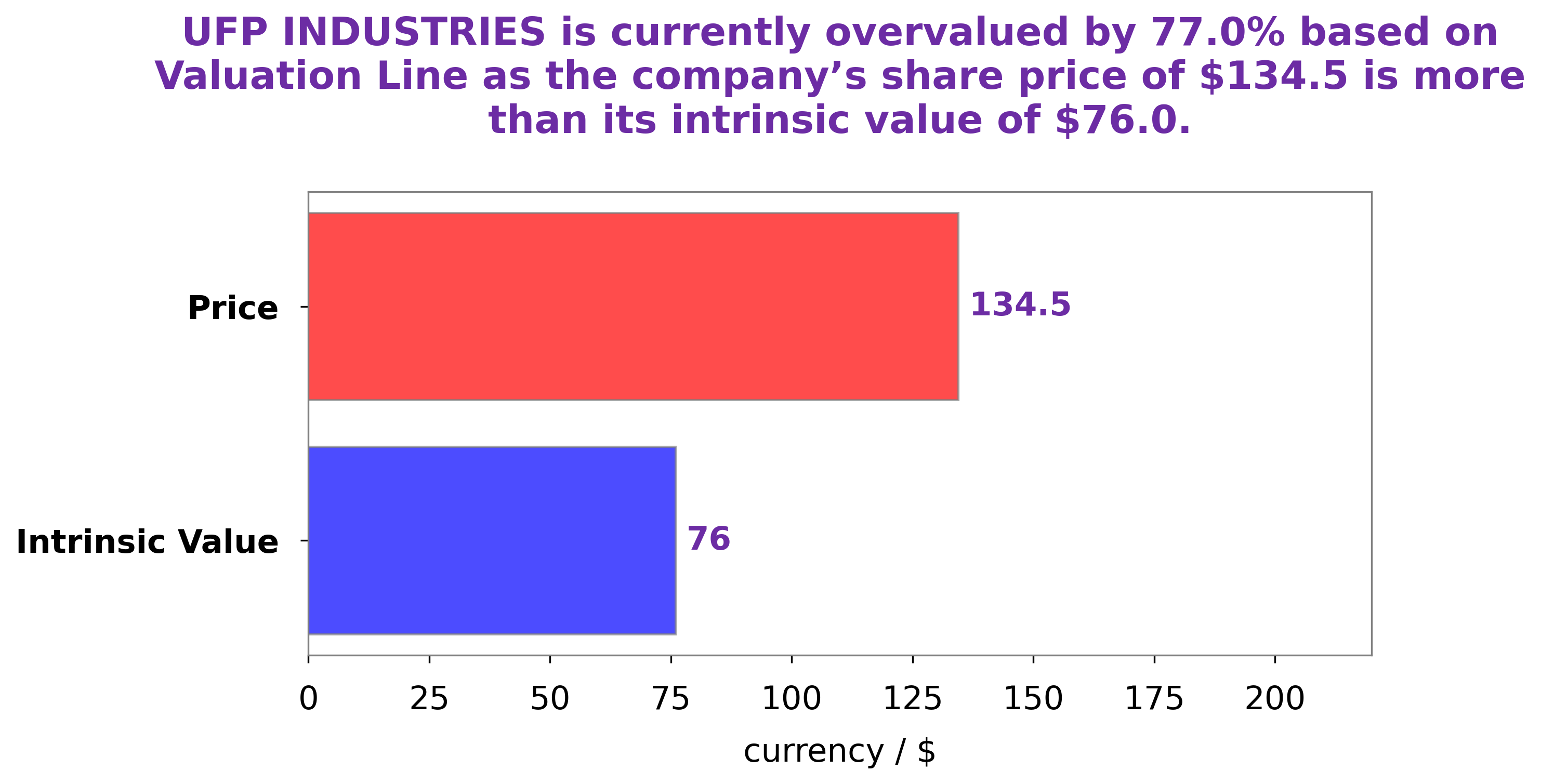

After thorough examination of UFP INDUSTRIES‘ financials, it is clear that the company is currently overvalued. Our proprietary Valuation Line, which takes into account various financial metrics and industry trends, suggests that the fair value of UFP INDUSTRIES stock is around $76.0. However, the current market price for the stock is $134.49, indicating an overvaluation of 76.9%. This overvaluation may be due to factors such as market speculation, market sentiment, and investor optimism. However, as an objective analysis based on data and analysis, we believe that the stock is currently trading at a premium that is not justified by the company’s financials. Investors should be cautious when considering investing in UFP INDUSTRIES at its current valuation. It is important to carefully evaluate the company’s financial performance and market trends before making any investment decisions. As always, we recommend conducting thorough research and seeking professional advice before investing in any stock. More…

Peers

UFP Industries Inc is one of the largest producers of wood products in North America. The company’s competitors include Blue Star Opportunities Corp, Interfor Corp, and West Fraser Timber Co. Ltd.

– Blue Star Opportunities Corp ($OTCPK:BSTO)

Interfor Corp is a Canadian forestry company with operations in British Columbia, Washington state, and Oregon. The company has a market cap of 1.23 billion Canadian dollars as of 2022. The company’s return on equity is 34.77%. Interfor Corp is engaged in the business of growing and harvesting trees, and manufacturing and selling lumber and wood products. The company’s products are used in the construction, industrial, and retail markets.

– Interfor Corp ($TSX:IFP)

As of 2022, West Fraser Timber Co. Ltd. had a market capitalization of $8.54 billion. The company had a return on equity of 26.74%. West Fraser Timber Co. Ltd. is a forest products company that produces lumber, wood chips, and other forest products. The company was founded in 1955 and is headquartered in Vancouver, Canada.

Summary

According to Wedbush, a financial services and investment firm, they have lowered their earnings estimates for UFP Industries, Inc. for the fiscal year of 2024. This means that they anticipate the company’s profitability to be lower than previously expected. This news may impact investors’ decisions on whether to buy, hold, or sell UFP Industries stocks. Other factors to consider when analyzing the company’s potential for growth include its financial performance, market trends, and industry competition.

Investors should also keep an eye on any updates or changes in UFP Industries’ business strategies and future plans. Overall, it is important to carefully evaluate all available information before making any investment decisions related to UFP Industries.

Recent Posts