Choice Hotels International Reports Impressive Non-GAAP EPS and Revenue Beats

May 10, 2023

Trending News ☀️

Choice Hotels International ($NYSE:CHH) Inc. (NYSE: CHH) reported impressive Non-GAAP earnings per share (EPS) and revenue beats on Tuesday. The company revealed Non-GAAP EPS of $1.12, surpassing estimates by $0.11, and revenue of $332.79M, exceeding expectations by $12.36M. The company has a portfolio of brands including Comfort Inn, Comfort Suites, Quality, Clarion, Sleep Inn, Econo Lodge, Rodeway Inn, MainStay Suites, Suburban Extended Stay Hotel, Cambria Hotels and many more. The impressive Non-GAAP EPS and revenue beats are likely to have a positive effect on the stock prices of Choice Hotels International Inc. as investors take note of the strong performance reported for the quarter.

Earnings

In its earning report of FY2022 Q4 ending December 31 2022, CHOICE HOTELS INTERNATIONAL reported impressive non-GAAP earnings per share (EPS) and revenue beats. The total revenue of this quarter was 361.98M USD, representing a 27.2% increase compared to the same period last year. However, net income decreased 13.4% to 55.51M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CHH. More…

| Total Revenues | Net Income | Net Margin |

| 1.4k | 330.27 | 22.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CHH. More…

| Operations | Investing | Financing |

| 367.06 | -442.43 | -394.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CHH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.1k | 1.95k | 2.96 |

Key Ratios Snapshot

Some of the financial key ratios for CHH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.9% | 11.5% | 34.3% |

| FCF Margin | ROE | ROA |

| 19.5% | 136.8% | 14.3% |

Share Price

Despite the positive news, however, CHOICE HOTELS INTERNATIONAL stock opened at $131.5 and closed at $126.0, down by 2.9% from prior closing price of 129.8. This decrease could be attributed to investors’ expectations of greater profitability and the fact that the stock has seen a steady upward trend over the past few months. Live Quote…

Analysis

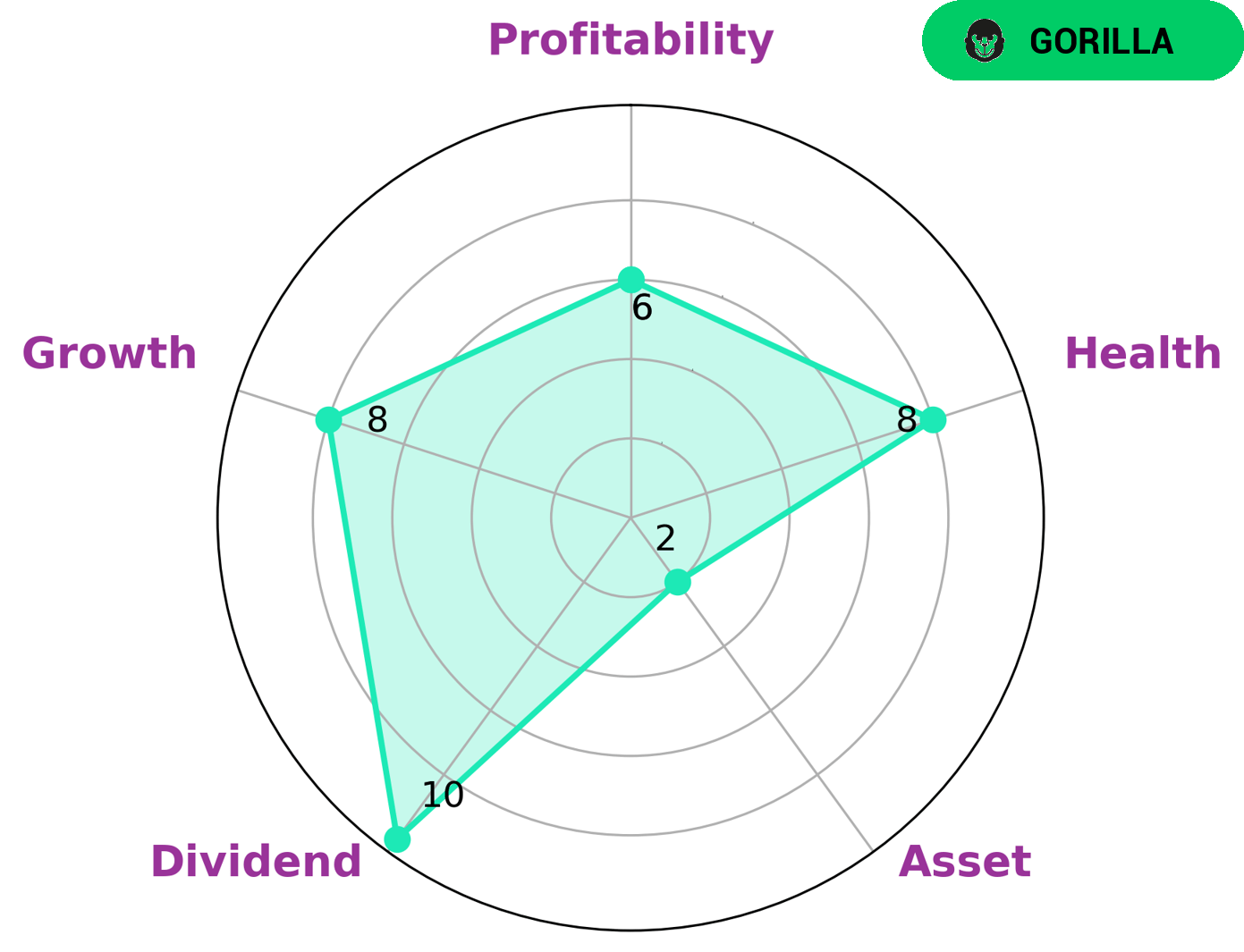

At GoodWhale, we analyzed the financials of CHOICE HOTELS INTERNATIONAL and concluded that the company is strong in dividend, growth, and medium in profitability, but weak in asset. Our Star Chart also indicates that CHOICE HOTELS INTERNATIONAL has a high health score of 8/10, making it capable to safely ride out any crisis without the risk of bankruptcy. Additionally, we classified CHOICE HOTELS INTERNATIONAL as a ‘gorilla’, which is a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given the strong financial standing of CHOICE HOTELS INTERNATIONAL, we believe that long-term investors looking for a solid dividend yield and stable growth would be interested in this company. Those who are looking for short-term gains might be less interested, however, as the company does not seem to offer large upside potential. Nonetheless, CHOICE HOTELS INTERNATIONAL is a solid option for investors who are looking for a reliable and consistent long-term investment. More…

Peers

Choice Hotels International, Inc. is one of the world’s largest hotel companies. With over 6,300 hotels across more than 35 countries and territories, Choice Hotels International offers a wide variety of lodging options to suit any need. Wyndham Hotels & Resorts, Hilton Worldwide Holdings, and Marriott International are all major competitors in the hotel industry.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts Inc is one of the largest hotel companies in the world, with over 7,500 hotels across more than 80 countries. The company offers a wide range of hotel brands, from economy to luxury, and its portfolio includes some of the most well-known hotel brands in the world, such as Wyndham, Ramada, Days Inn, and Super 8. Wyndham Hotels & Resorts is headquartered in Parsippany, New Jersey.

The company’s market cap is 6.2B as of 2022 and its ROE is 30.65%.

– Hilton Worldwide Holdings Inc ($NYSE:HLT)

Hilton Worldwide Holdings Inc. is a hospitality company that owns, leases, manages, develops, and franchises hotels and resorts. The company operates in three segments: Owned and Leased Hotels, Management and Franchise, and Timeshare. As of December 31, 2020, it owned, leased, or managed 2,084 properties with 883,944 rooms. Hilton Worldwide Holdings Inc. was founded in 1919 and is headquartered in McLean, Virginia.

– Marriott International Inc ($NASDAQ:MAR)

Marriott International is one of the world’s largest hotel companies, with more than 6,000 properties in over 120 countries and territories. Marriott operates and franchises hotels and timeshare properties under 30 brands, including Marriott, Ritz-Carlton, Sheraton, and Westin. The company also has a vacation ownership division, Marriott Vacations Worldwide. Marriott was founded in 1927 by J. Willard Marriott and Frank J. Taylor.

Summary

Choice Hotels International is a leading lodging company that offers a variety of hotel brands to suit the needs of different travelers. The stocks traded higher following the announcement reflecting investors’ positive sentiment towards the financial results. Analysts are optimistic on the stock’s future performance as the company is expected to benefit from ongoing travel demand recovery.

Recent Posts