Barclays Downgrades Target Price for Wyndham Hotels & Resorts to $85.00

January 30, 2023

Trending News 🌥️

Barclays recently downgraded its target price for Wyndham Hotels & Resorts ($NYSE:WH) to $85.00. Wyndham Hotels & Resorts is an international hotel and resort chain that is headquartered in Parsippany, New Jersey. The company operates under multiple brands, including Wyndham Hotels & Resorts, Ramada, Super 8, La Quinta, and Days Inn. Wyndham also owns several vacation rental companies, including Vacasa, Hoseasons, and Novasol. Despite the recent downgrade, Wyndham Hotels & Resorts remains a strong company with a bright future. The company has been able to increase its revenue and occupancy rates year over year and has made a series of strategic acquisitions in recent years that have allowed it to expand into new markets and strengthen its competitive position.

Wyndham also offers a variety of loyalty programs to reward its customers and incentivize repeat business. Overall, Wyndham Hotels & Resorts has a solid business model and attractive growth prospects. While the recent downgrade from Barclays is noteworthy, investors may still want to consider Wyndham as a potential long-term investment. With its strong portfolio of brands and loyalty programs, Wyndham is well positioned to continue to be successful in the hospitality industry for years to come.

Stock Price

At the time of writing, the news sentiment has been mostly positive. On Monday, Wyndham Hotels & Resorts’ stock opened at $75.4 and closed at $76.3, which was a 1.3% increase from its prior closing price of 75.3. The downgrade by Barclays was due to their belief that the stock is overvalued and that the company’s outlook is not as strong as expected. Despite this downgrade, investors still seem to be optimistic about Wyndham Hotels & Resorts and its future performance. The company has reported strong earnings and revenue growth in the past few quarters, and many analysts are confident that this trend will continue. Wyndham Hotels & Resorts has also made several strategic investments to expand its reach and strengthen its market presence.

They have acquired some smaller hotel companies in the past year, and have been actively expanding their portfolio of properties worldwide. They are also focusing on developing new technologies to improve customer experience and enhance operational efficiency. Overall, investors have remained confident in Wyndham Hotels & Resorts despite the recent downgrade from Barclays. They are optimistic about the company’s future prospects and believe that its strategic investments will pay off in the long run. The stock has seen a steady increase in value over the past few months, and investors are hopeful that this trend will continue. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WH. More…

| Total Revenues | Net Income | Net Margin |

| 1.56k | 348 | 21.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WH. More…

| Operations | Investing | Financing |

| 448 | 177 | -527 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.21k | 3.15k | 11.96 |

Key Ratios Snapshot

Some of the financial key ratios for WH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.3% | 6.0% | 35.5% |

| FCF Margin | ROE | ROA |

| 26.1% | 32.1% | 8.2% |

VI Analysis

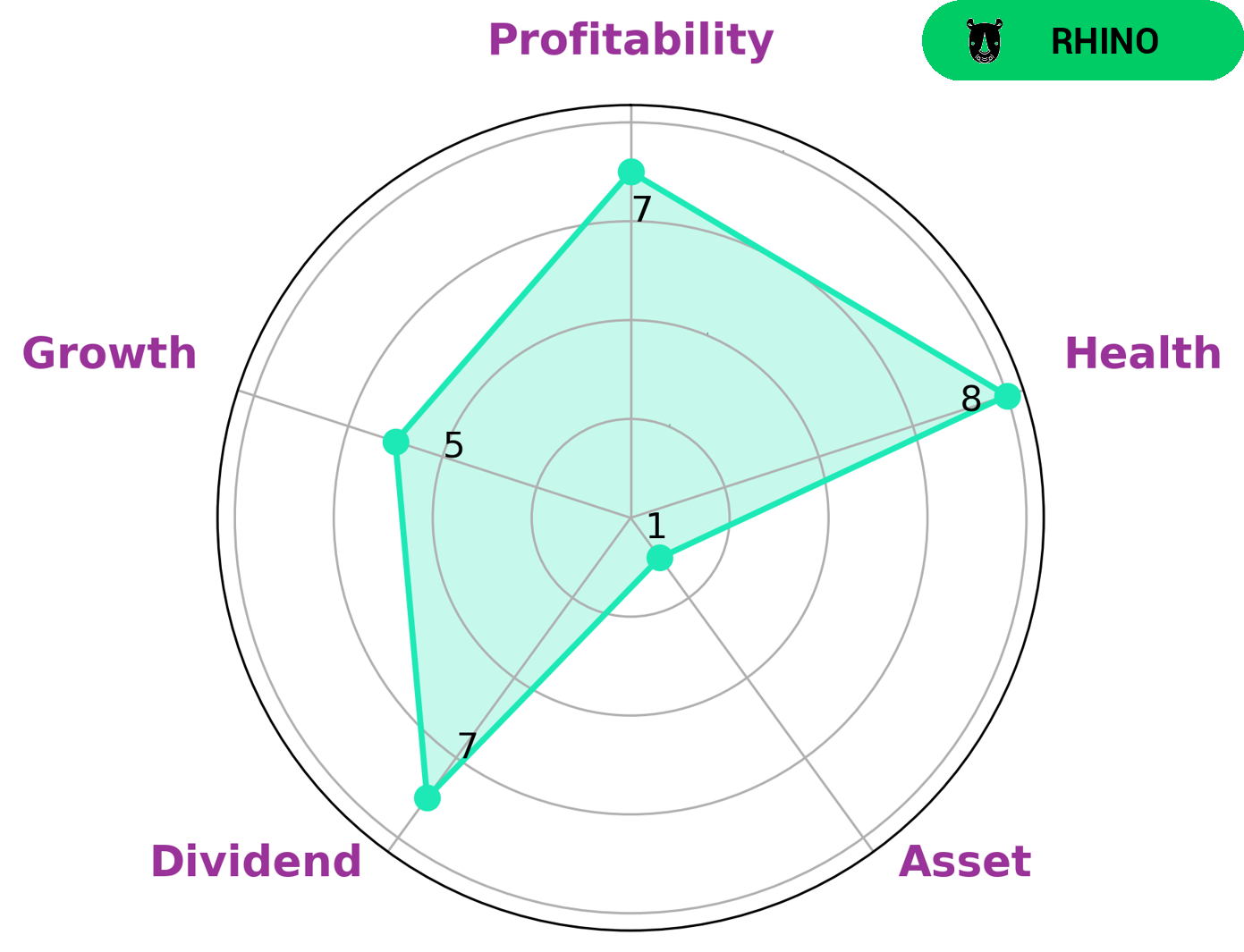

Investors looking for a steady yet solid return may be interested in WYNDHAM HOTELS & RESORTS. The company’s fundamentals reflect its long-term potential, and its health score of 8/10 according to the VI Star Chart indicates that it is capable of paying off its debts and funding future operations. It is classified as a ‘rhino’ company, which means it has achieved moderate revenue or earnings growth. WYNDHAM HOTELS & RESORTS is strong in terms of dividend and profitability, medium in terms of growth, and weak in terms of asset. Investors can expect a steady return in the form of dividend payments, as well as a reasonable level of profitability. Growth may not be as high as some other companies, but it is still feasible and may increase in the future. The weak asset may indicate that the company is not able to invest as much in the future, but the strong dividend and profitability should more than make up for it in the short term. Overall, WYNDHAM HOTELS & RESORTS is a solid choice for investors looking for a steady return with reasonable returns on their investment. The company’s fundamentals show that it is capable of handling its debt and funding future operations, and its moderate growth indicates that there may be further potential for growth in the future. More…

VI Peers

The hotel industry is a fiercely competitive marketplace. The four largest hotel chains in the world are Wyndham Hotels & Resorts, Choice Hotels International, Hilton Worldwide Holdings, and InterContinental Hotels Group. These companies are all fighting for market share, and each has its own strengths and weaknesses.

– Choice Hotels International Inc ($NYSE:CHH)

Hotels International Inc is one of the world’s largest hotel companies, with more than 6,500 hotels across more than 30 countries. The company operates under a variety of brand names, including Choice Hotels, Comfort Inn, Quality Inn, Sleep Inn, Clarion, Cambria Hotel & Suites, MainStay Suites, Suburban Extended Stay Hotel, Econo Lodge, and Rodeway Inn. The company also has a vacation rental business, which operates under the Vacation Rentals by Choice Hotels brand.

– Hilton Worldwide Holdings Inc ($NYSE:HLT)

Hilton Worldwide Holdings Inc is a hospitality company that owns, leases, manages, develops, and franchises hotels and resorts. The company has a market cap of 37.86B as of 2022 and a return on equity of -143.8%. Hilton Worldwide Holdings is headquartered in Virginia.

– InterContinental Hotels Group PLC ($LSE:IHG)

InterContinental Hotels Group PLC is a hotel company that owns, manages, and franchises hotels and resorts. The company has a market cap of 8.36 billion as of 2022 and a return on equity of -34.42%. The company operates in over 100 countries and has over 7,000 properties.

Summary

Recently, Barclays has downgraded the target price for the company to $85.00. Despite this, the sentiment among investors remains mostly positive. Wyndham has been creating value for investors by expanding its portfolio and leveraging economies of scale to save costs. Its strategic focus on technology and digital enhancements has helped attract customers and drive revenue growth.

The company has also been investing in its loyalty program, which provides members with exclusive benefits. Wyndham continues to be a strong player in the hospitality industry, providing investors with a favorable long-term outlook.

Recent Posts