Johnson Outdoors’ GAAP EPS and Revenue Beat Estimates by $0.61 and $12.46M Respectively.

May 6, 2023

Trending News ☀️

Johnson Outdoors ($NASDAQ:JOUT) Inc (Nasdaq: JOUT), a global leader in outdoor recreation equipment and technology, reported fourth quarter results that beat analysts’ expectations both in terms of GAAP earnings per share and revenue. For the quarter, the company reported GAAP earnings per share of $1.45, surpassing estimates by $0.61, and revenue of $202.11M, exceeding expectations by $12.46M. Johnson Outdoors is a company that designs, manufactures, and distributes outdoor gear and related accessories for a host of recreation activities, including fishing, paddling, camping, watercrafts, marine electronics, diving and outdoor apparel.

The company operates through four segments: Marine Electronics, Outdoor Equipment, Watercraft, and Diving—all of which are focused on providing innovative products to enhance the outdoor experience. This quarter’s results demonstrate the company’s ability to capitalize on its strong brand recognition and dedication to quality and innovation.

Share Price

The results surprised investors with its GAAP EPS and revenue beating estimates by $0.61 and $12.46M respectively. This positive reaction to the earnings report is indicative of the market’s optimism for Johnson Outdoors’ growth potentials in the upcoming quarters. Overall, Johnson Outdoor’s strong quarterly performance has reaffirmed investors’ confidence in the company’s growth prospects and outlook moving forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Johnson Outdoors. More…

| Total Revenues | Net Income | Net Margin |

| 768.17 | 39.51 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Johnson Outdoors. More…

| Operations | Investing | Financing |

| -16.94 | -32.08 | -12.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Johnson Outdoors. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 689.1 | 194.88 | 48.26 |

Key Ratios Snapshot

Some of the financial key ratios for Johnson Outdoors are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.4% | -3.5% | 6.8% |

| FCF Margin | ROE | ROA |

| -6.4% | 6.7% | 4.8% |

Analysis

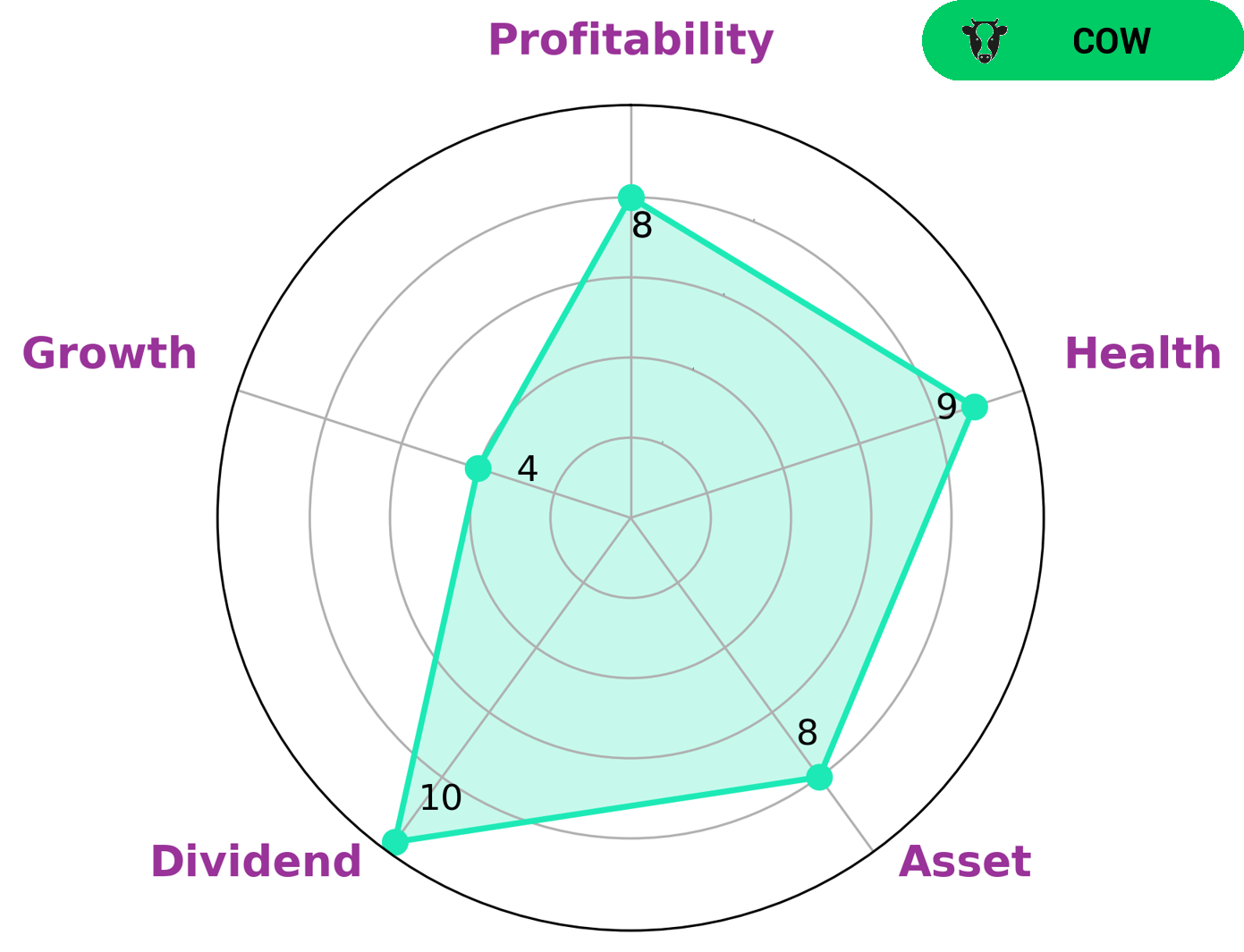

GoodWhale has conducted an in-depth analysis of JOHNSON OUTDOORS‘s fundamentals and have determined that the company has a high overall health score of 9/10 in terms of its cashflows and debt. This means that JOHNSON OUTDOORS is capable of paying off its debt and funding future operations. JOHNSON OUTDOORS is classified as a ‘cow’ company, which GoodWhale concludes has a track record of paying out consistent and sustainable dividends. Therefore, we believe that this type of company may be attractive to investors looking for a steady stream of income. Further analysis reveals that JOHNSON OUTDOORS is strong in terms of assets, dividends and profitability, but medium in growth. This may be appealing for investors seeking for stability and consistent returns. More…

Peers

Johnson Outdoors Inc is one of the leading outdoor recreation companies in the world, known for its cutting-edge products and innovative designs. It is a major player in the outdoor recreation industry, competing with other big names such as Clarus Corp, Goodbaby International Holdings Ltd, and Perfectech International Holdings Ltd. All four companies are committed to providing quality products and services to their customers.

– Clarus Corp ($NASDAQ:CLAR)

Clarus Corporation is a provider of outdoor equipment and apparel products. Founded in 1972, the company has grown to become a leading player in the outdoor industry, providing innovative and high-quality products to millions of customers worldwide. The company has a current market capitalization of 290.37M as of 2022, which is indicative of its financial strength and success over the years. Additionally, Clarus Corporation has a Return on Equity of 4.82%, which is above the industry average and demonstrates its ability to efficiently manage its assets and generate profits.

– Goodbaby International Holdings Ltd ($SEHK:01086)

Goodbaby International Holdings Ltd is a leading manufacturer and distributor of juvenile products in the Asia-Pacific region. The company has a market capitalization of 1.05 billion dollars as of 2022. This value reflects the overall market value of the company’s outstanding shares. Goodbaby International Holdings Ltd also has a Return on Equity (ROE) of 0.8%. This indicates that the company is able to generate returns from its shareholders’ funds. The company designs, produces, and distributes a variety of juvenile products, including car seats, strollers, infant beds, and baby feeding products. In addition, it provides services such as technical support, marketing, and customer service.

– Perfectech International Holdings Ltd ($SEHK:00765)

Perfectech International Holdings Ltd is a Hong Kong-based company that primarily manufactures and sells precision industrial machinery and equipment. As of 2022, the company had a market capitalization of 209.23M, indicating the total value of its outstanding shares. Furthermore, its Return on Equity (ROE) was -0.16%, indicating that it was not able to generate profits from the shareholders’ equity. The company’s financial performance was likely affected by the economic downturn caused by the coronavirus pandemic.

Summary

Johnson Outdoors Inc. (JOHNS) recently reported their GAAP earnings per share of $1.45, which beat the analysts’ estimates by a significant $0.61. Revenue for the quarter also exceeded expectations at $202.11 million, representing a $12.46 million beat. Following this news, the stock price rose substantially on the same day.

Investors should consider JOHNS in their portfolios due to its strong financial performance and positive market response. Its consistent expansion and cost-cutting strategies have resulted in steady growth and profits, making it an attractive option for long-term investors.

Recent Posts