Investors See Decreasing Returns on Capital Invested in YETI Holdings

June 12, 2023

🌥️Trending News

Investors have recently seen a decrease in returns on capital invested in YETI ($NYSE:YETI) Holdings. YETI Holdings is a publicly traded company specializing in premium outdoor lifestyle products such as coolers, drinkware, and other camping and outdoor gear. This decline has been attributed to a number of factors, including increased competition from other brands, higher costs associated with keeping up with industry trends, and an overall slowdown in consumer spending. The company has responded to these challenges by diversifying its product offerings and exploring new markets, however the effects of these changes are yet to be seen.

Despite efforts to improve the situation, the company is still facing a number of challenges that could further reduce investor returns. As such, potential investors should proceed with caution and conduct thorough due diligence before investing in YETI Holdings.

Stock Price

YETI HOLDINGS‘ stocks opened at $38.1 and then closed at $37.6, which marked a 1.2% decrease from the previous closing price of 38.0. This decrease in stock prices indicates that investors are not confident in YETI HOLDINGS’ ability to generate returns on their capital investments. The decrease in returns on investment may leave investors with little incentives to keep investing in YETI HOLDINGS, further diminishing its future growth potential. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Yeti Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.6k | 74.6 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Yeti Holdings. More…

| Operations | Investing | Financing |

| 142.76 | -54.05 | -22.39 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Yeti Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.01k | 463.95 | 6.26 |

Key Ratios Snapshot

Some of the financial key ratios for Yeti Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.8% | 3.6% | 6.3% |

| FCF Margin | ROE | ROA |

| 5.5% | 11.9% | 6.3% |

Analysis

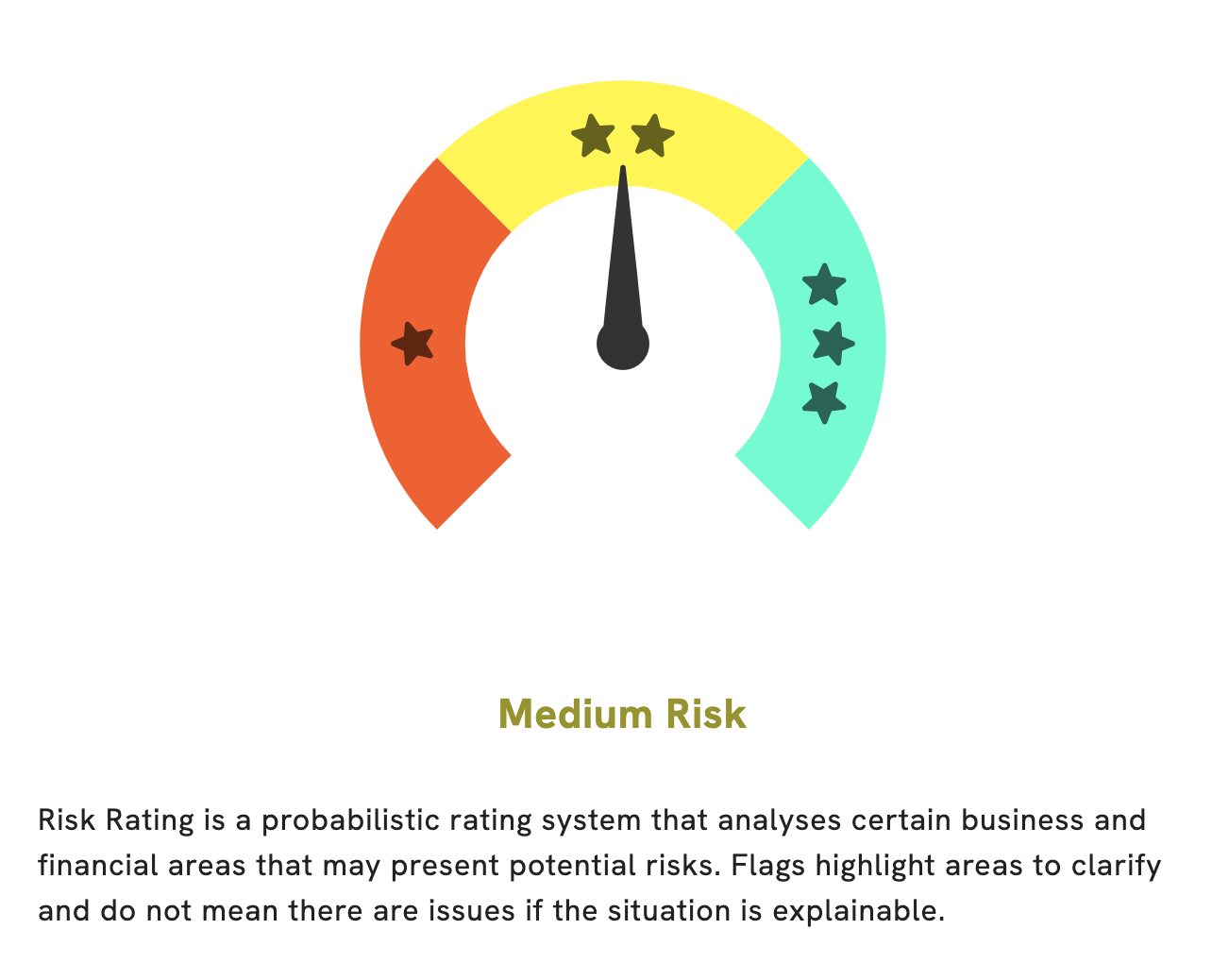

At GoodWhale, we have conducted an analysis of YETI HOLDINGS‘s fundamentals and have come to the conclusion that it is a medium risk investment in terms of financial and business aspects. Our Risk Rating system uses data such as income sheets, balance sheets, and market information to assess a company’s overall risk. However, our system has detected two risk warnings in the income sheet and balance sheet of YETI HOLDINGS. To view this information in more detail, become a registered user of our platform. We hope you find the information useful in making an informed decision about investing in YETI HOLDINGS. More…

Peers

In recent years, the competition between YETI Holdings Inc and its competitors has intensified, as each company strives to gain market share in the highly competitive cooler and drinkware industry. While YETI has long been the market leader, its competitors are quickly catching up, offering products that are comparable in quality and price. As the competition heats up, it will be interesting to see which company comes out on top.

– Tandem Group PLC ($LSE:TND)

Tandem Group PLC is a holding company that engages in the design, manufacture, and distribution of bicycles and bicycle related products. The company operates through the following segments: Bicycles, Components, and Others. The Bicycles segment designs, manufactures, and sells complete bicycles, electric bicycles, and folding bicycles. The Components segment manufactures and sells bicycle components and wheels. The Others segment includes the group’s online retailing business. Tandem Group was founded by Frank Bowden in 1885 and is headquartered in Coventry, the United Kingdom.

– Bonny Worldwide Ltd ($TWSE:8467)

Bonny Worldwide Ltd is a publicly traded company with a market capitalization of 2.57 billion as of 2022. The company has a return on equity of 16.57%. Bonny Worldwide Ltd is engaged in the business of providing offshore oil and gas services. The company has a fleet of offshore support vessels that it uses to provide services to the oil and gas industry.

– Bollinger Industries Inc ($OTCPK:BOLL)

Bollinger Industries Inc is a publicly traded company with a market capitalization of 262.12k. The company manufactures and sells a variety of products, including electric vehicles, towing products, and other related accessories. Bollinger Industries was founded in 1984 and is headquartered in New York, New York.

Summary

Investing in YETI Holdings has been met with slower returns on capital. As a result, investors need to be aware of the potential risks and rewards of investing in this company. The stock market can be volatile and unpredictable, and so investors should consider their own financial goals, risk tolerance, and time horizon when making an investing decision.

It is important to also analyze the performance of the company’s management and its competitive landscape to ensure that their investments are sound and their returns are as expected. Investing in YETI Holdings can be a risky endeavor, but if done right, the rewards can be significant.

Recent Posts