Icahn Enterprises LP Common Stock Shares Experience Significant 9.87% Drop in Trading to $29.04 on May 24, 2023.

May 26, 2023

Trending News ☀️

EXPERIENCE ($ASX:EXP): On May 24th, 2023, Icahn Enterprises LP Common Stock shares experienced a significant drop in trading, decreasing by 9.87% to $29.04. Icahn Enterprises LP is a publicly traded investment firm founded and chaired by one of the world’s most successful investors, Carl Icahn. The company specializes in a wide range of investments such as private equity, venture capital, real estate, energy, and more. This significant decline in trading comes as a surprise to many investors considering the company’s positive track record over the past several years. Additionally, the company’s portfolio also saw significant returns with strategic investments in businesses such as Herbalife Nutrition, CVR Energy, and Dell Technologies. Despite the decline in trading on May 24th, many investors believe that Icahn Enterprises LP’s strong financials and well-crafted portfolio will be able to help them rebound from this minor setback.

In addition, the company’s ability to adapt to market conditions has been one of its most admirable qualities throughout its investing history. As such, many investors are optimistic for a strong recovery in the coming weeks and months.

Analysis

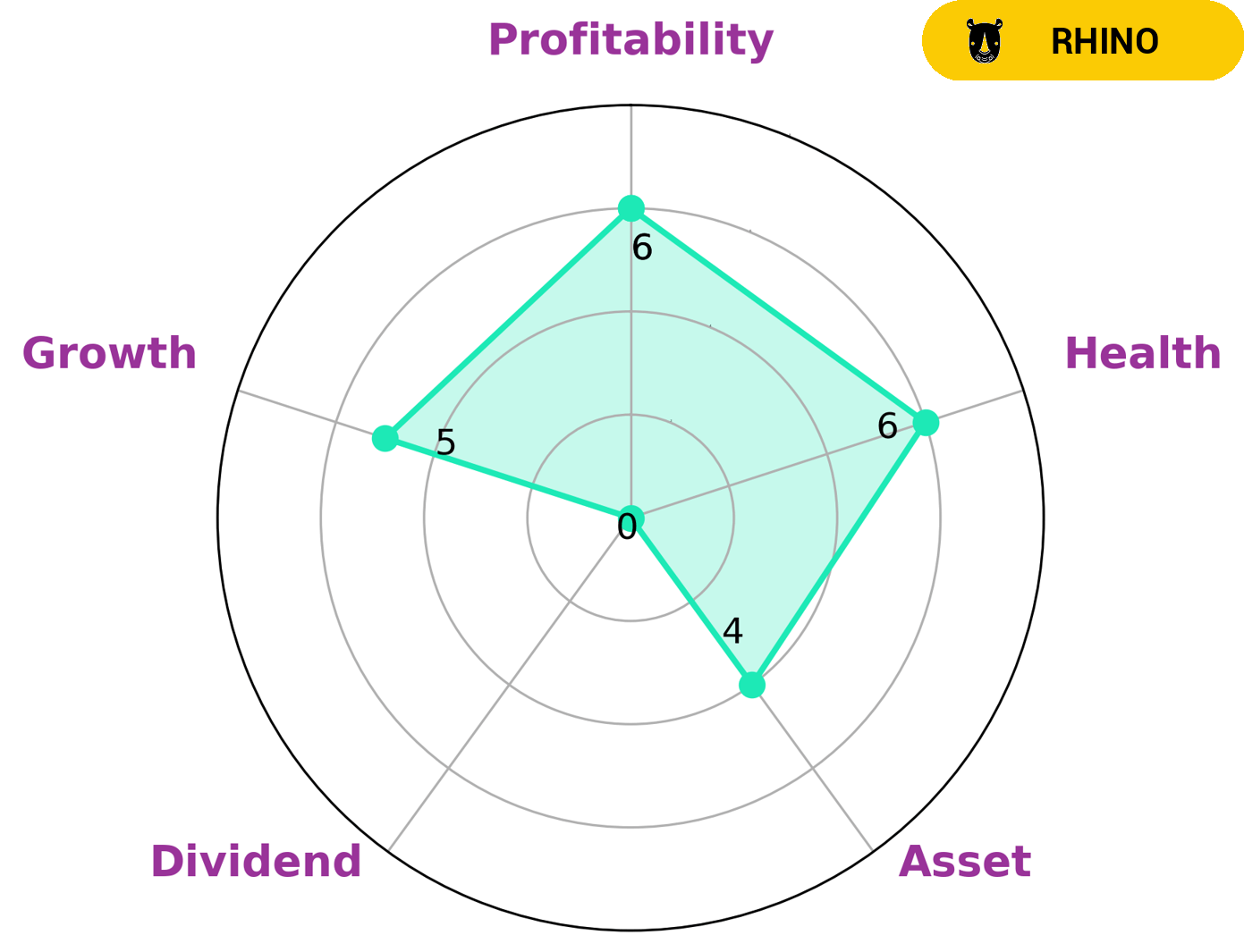

At GoodWhale, we analyzed the financials of EXPERIENCE and based on our Star Chart, it has an intermediate health score of 6/10. This score takes into account cashflows and debt, and suggests that EXPERIENCE is likely to be able to sustain future operations in times of crisis. Our analysis also revealed that EXPERIENCE is strong in asset, growth, profitability and weak in dividend. As a result, we classified EXPERIENCE as a ‘rhino’, a company that has achieved moderate revenue or earnings growth. Investors who are interested in EXPERIENCE could look into the company’s asset and profitability metrics. As a ‘rhino’ company, it may be suitable for investors who are looking towards steady but not explosive growth. Investors should also keep in mind the company’s weak dividend performance and take the necessary steps to ensure their investments are well-protected. Experience_Significant_9.87_Drop_in_Trading_to_29.04_on_May_24_2023.”>More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Experience. More…

| Total Revenues | Net Income | Net Margin |

| 88.66 | -11.14 | -10.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Experience. More…

| Operations | Investing | Financing |

| 8.27 | -16.15 | -5.21 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Experience. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 187.15 | 64.47 | 0.16 |

Key Ratios Snapshot

Some of the financial key ratios for Experience are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -13.6% | -22.5% | -11.3% |

| FCF Margin | ROE | ROA |

| -4.9% | -5.1% | -3.3% |

Peers

Experience Co Ltd is a leading provider of adventure experiences in Australia and New Zealand. The company offers a range of services including skydiving, hot air ballooning, bungee jumping, and white water rafting. The company has a strong market presence in both countries and is the market leader in terms of market share. However, the company faces stiff competition from SkyCity Entertainment Group Ltd, Hotel Grand Central Ltd, and InvoCare Ltd.

– SkyCity Entertainment Group Ltd ($NZSE:SKC)

SkyCity Entertainment Group Ltd is a gaming and entertainment company based in New Zealand. The company operates casinos, restaurants, bars, and hotels. It also has a convention centre and an online gaming platform. The company’s market cap is 2.05B as of 2022 and its ROE is 3.48%.

– Hotel Grand Central Ltd ($SGX:H18)

Hotel Grand Central Ltd is a hotel operator based in Hong Kong. The company operates a portfolio of hotels in major cities across Asia Pacific, including Hong Kong, Singapore, Beijing, Shanghai and Tokyo. The company is listed on the Hong Kong Stock Exchange and has a market capitalisation of HK$6.7 billion as of July 2020. The company’s shares have been trading at around HK$4.00 per share over the past year. The company’s return on equity for the year ended 31 December 2019 was 7.4%.

– InvoCare Ltd ($ASX:IVC)

InvoCare Ltd is a provider of funeral and cemetery services with operations in Australia, New Zealand, and Singapore. The company has a market capitalization of $1.45 billion as of 2022 and a return on equity of 3.32%. InvoCare Ltd is a publicly traded company listed on the Australian Securities Exchange. The company was founded in 1979 and has its headquarters in Sydney, Australia.

Summary

Investing in Icahn Enterprises LP Common Stock can be a risky venture, as evidenced by the 9.87% drop in the stock price on May 24, 2023. This drop indicates that investors must be aware of the potential for further losses when investing in the company. The stock price could move down further, so it is important for any investor to take time to research the company and its performance before making a decision to invest.

It is also important to consider what other investments are available and what potential rewards they offer. Investing in any company can be a risky endeavor, but by doing proper research and taking all relevant factors into account, an investor can attempt to minimize losses and maximize returns.

Recent Posts