Goldman Sachs Initiates Coverage on Hasbro with Neutral Rating & Cautions on Execution Risk & Need for Deleveraging.

February 2, 2023

Trending News 🌧️

Hasbro ($NASDAQ:HAS) Inc. is a global leader in toy and game manufacturing, as well as a provider of entertainment products. Goldman Sachs has initiated coverage on Hasbro with a Neutral rating, citing both growth opportunities and execution risks, as well as the need to reduce debt. The Goldman Sachs team, led by Michael Ng, noted that their EPS expectations are in line with the consensus, with successful execution of a strong content plan and a cycle of product innovation.

However, they warned of the company’s ability to implement the Wizards of the Coast Digital Gaming plan, as well as potential pressure from foreign exchange. This could be done through a combination of organic growth, cost savings and free cash flows. The team also noted the potential for Hasbro to benefit from strong consumer demand for toys, particularly in the US and China, as well as its strategic position in the industry.

In addition, they believe that the company’s diverse portfolio of brands and products, its presence in both traditional and digital channels and its international reach provide it with a range of advantages. They have also highlighted the potential for Hasbro to benefit from strong consumer demand for toys, particularly in the US and China, as well as its strategic position in the industry.

Stock Price

The stock opened at $58.6 and closed at $60.2, up by 1.8% from its previous closing price of 59.2. Overall, the media sentiment has been mostly negative towards Hasbro. The company faces a number of challenges such as reviving its gaming business, managing its debt, and developing innovative new products. Furthermore, the ongoing pandemic has further exacerbated the situation. Despite these issues, analysts at Goldman Sachs are positive about Hasbro’s potential for growth in the long term. They believe that the company’s portfolio of iconic and beloved brands can provide a competitive edge in a challenging market. Furthermore, Goldman Sachs believes that Hasbro’s expertise in consumer insights and analytics will help it better understand consumer needs and preferences in the future. It believes that the company must continue to invest in new product innovation and digital transformation in order to remain competitive.

In addition, they state that Hasbro must continue to focus on reducing its debt in order to improve profitability. Investors should take these considerations into account when making their investment decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hasbro. More…

| Total Revenues | Net Income | Net Margin |

| 6.19k | 414.6 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hasbro. More…

| Operations | Investing | Financing |

| 394.5 | -301.3 | -679.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hasbro. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.63k | 6.63k | 21.55 |

Key Ratios Snapshot

Some of the financial key ratios for Hasbro are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.8% | 15.9% | 11.0% |

| FCF Margin | ROE | ROA |

| 3.7% | 14.3% | 4.4% |

Analysis

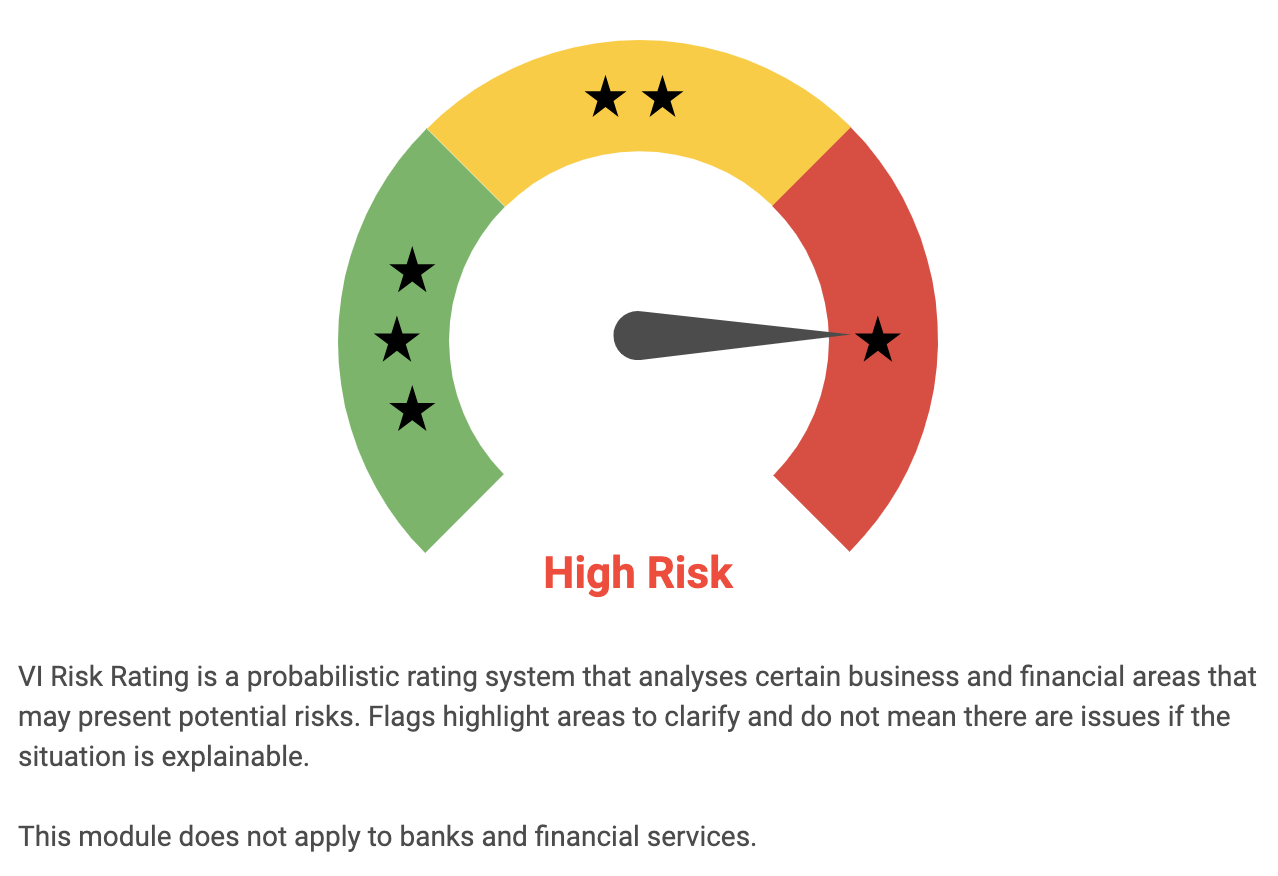

GoodWhale has conducted a comprehensive analysis of HASBRO‘s wellbeing, finding that the company is a high-risk investment in terms of its financial and business aspects. In particular, two risk warnings were detected in the balance sheet. The first warning is related to the company’s liquidity, which is defined as the ability of the company to meet its short-term financial obligations. The second warning involves non-financial aspects, like operational risk or strategic risk. In terms of liquidity, GoodWhale’s analysis suggests that HASBRO may not be able to meet its short-term financial obligations due to inadequate cash flow or a lack of resources. Furthermore, the analysis also indicates that the company may be exposed to operational risks, such as a disruption in the supply chain, or strategic risks, such as a misalignment of objectives between the company and its stakeholders. Overall, GoodWhale’s analysis suggests that HASBRO is a high-risk investment, and investors should be aware of the associated risks before making any decisions regarding the company. GoodWhale invites investors to visit goodwhale.com for further information about the potential risks associated with HASBRO’s investments. More…

Peers

Hasbro Inc is a publicly traded company that designs, manufactures, and markets games and toys. The company operates in three segments: US and Canada, International, and Entertainment and Licensing. Hasbro has a portfolio of brands that includes NERF, MONOPOLY, MAGIC: THE GATHERING, MY LITTLE PONY, TRANSFORMERS, PLAY-DOH, and SESAME STREET. The company’s competitors include Spin Master Corp, Huayi Tencent Entertainment Co Ltd, and BANDAI NAMCO Holdings Inc.

– Spin Master Corp ($TSX:TOY)

Spin Master Corp is a global leader in children’s toys, entertainment and lifestyle products. The company has a market cap of 4.57B as of 2022 and a Return on Equity of 21.64%. Spin Master Corp’s products include some of the world’s most popular toy brands, such as Paw Patrol, Hatchimals and Zoomer. The company’s products are available in over 100 countries and its mission is to inspire the next generation of play.

– Huayi Tencent Entertainment Co Ltd ($SEHK:00419)

Huayi Tencent Entertainment Co Ltd is a Chinese entertainment company with a market cap of 2.05 billion as of 2022. The company has a return on equity of -28.77%. The company is involved in the production, distribution, and exhibition of films and television programs in China. The company also operates an online game platform and a social networking website.

– BANDAI NAMCO Holdings Inc ($TSE:7832)

BANDAI NAMCO Holdings Inc is a Japanese holding company that operates in the entertainment industry. It has a market cap of 2.16T as of 2022 and a return on equity of 16.4%. The company was founded in 1955 and is headquartered in Tokyo, Japan. BANDAI NAMCO Holdings is engaged in the development, production, and marketing of toys, games, and other entertainment products. The company’s products are sold in over 40 countries worldwide.

Summary

Investing in Hasbro is a risky venture. Goldman Sachs has initiated coverage of the company with a neutral rating, citing execution risk and the need for deleveraging as reasons for caution. The overall media sentiment surrounding Hasbro has been predominantly negative. Should investors choose to invest in Hasbro, they should be aware that there are potential risks involved and to research the company thoroughly before making any decisions.

Hasbro has seen a decrease in sales, but there are still areas of potential growth such as online sales and innovative products. Investors should assess the company’s financials and management team carefully before investing.

Recent Posts