CLARUS CORPORATION Reports Revenue Beat Despite Lower Non-GAAP EPS

May 2, 2023

Trending News ☀️

Despite a lower than expected Non-GAAP EPS of $0.18, the company was able to beat revenue estimates by $2.33M, with a total of $97.4M. This was largely attributed to the company’s strategic investments in product and customer-centric initiatives, which enabled the firm to capitalize on the increasing demand for its services. CLARUS CORPORATION ($NASDAQ:CLAR) is known for its innovative solutions that help financial institutions transform their operations and improve their performance. Their products and services are used by a wide range of banks, insurers, wealth managers, and asset managers around the world.

In addition, the company’s specialized solutions are designed to meet the needs of rapidly evolving markets and help financial institutions maintain a competitive edge. Overall, CLARUS CORPORATION’s first quarter performance reflects the resilience of the company’s business model and its ability to remain competitive in an ever-changing financial landscape. The company’s strong results show that it is well-positioned to continue delivering value for its customers and shareholders.

Share Price

CLARUS CORPORATION reported revenue that beat analysts expectations on Monday, despite lower Non-GAAP Earnings Per Share (EPS). The company’s stock opened at $9.7 and closed at $9.5, dropping by 2.3% from the previous closing price of $9.7. Despite the positive revenue performance, investors were cautious regarding CLARUS CORPORATION’s financial results due to the lower Non-GAAP EPS.

The company’s lower EPS was mainly due to higher operating costs and taxes. While this was a disappointing result, CLARUS CORPORATION’s stock has shown resilience in the past and analysts are hopeful that the company will make a strong recovery in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Clarus Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 448.11 | -69.78 | 3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Clarus Corporation. More…

| Operations | Investing | Financing |

| 14.61 | -7.75 | -13.86 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Clarus Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 518.14 | 226.04 | 7.88 |

Key Ratios Snapshot

Some of the financial key ratios for Clarus Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.0% | 34.7% | -15.5% |

| FCF Margin | ROE | ROA |

| 1.4% | -13.2% | -8.4% |

Analysis

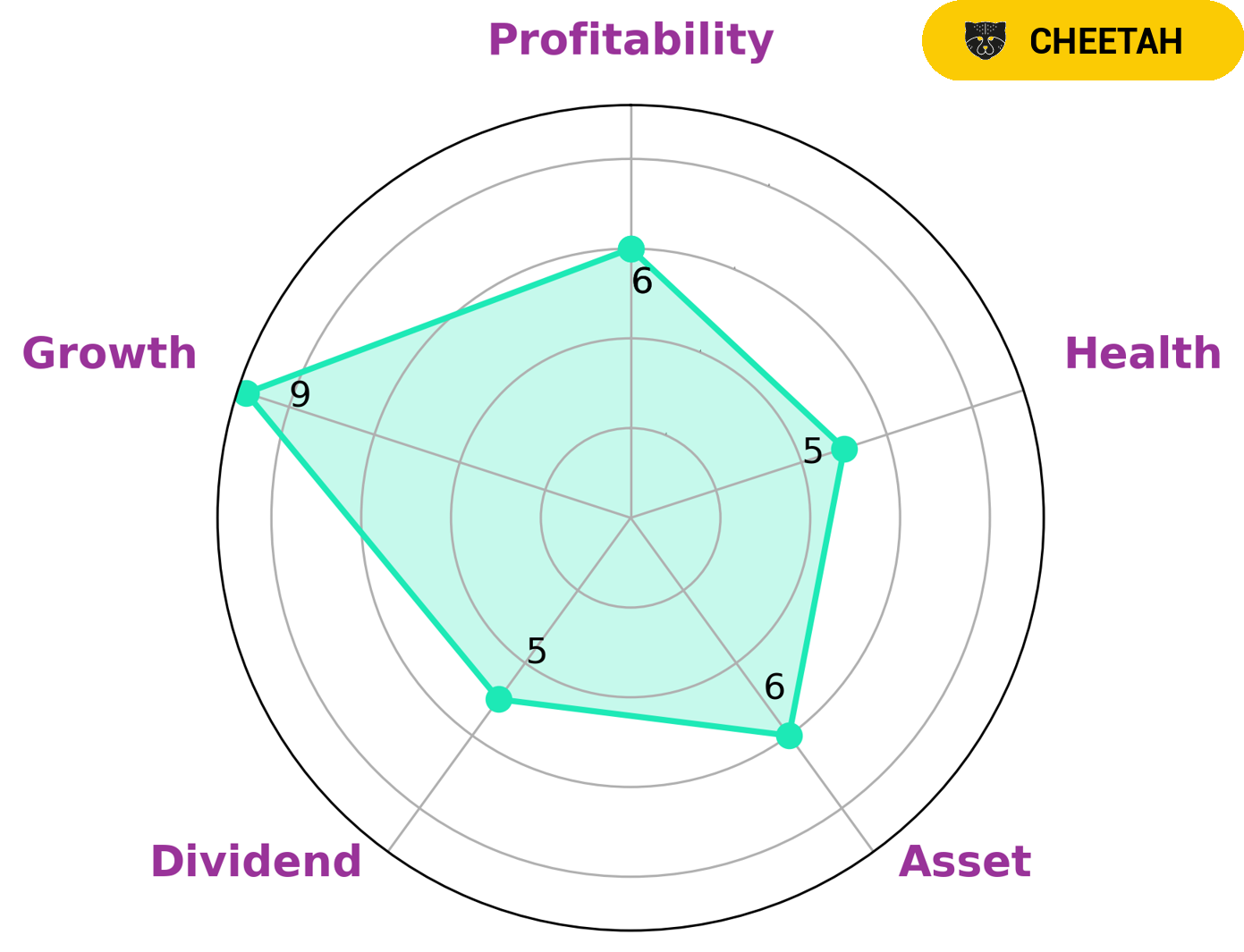

At GoodWhale, we conducted an in-depth analysis of CLARUS CORPORATION‘s fundamentals. According to our Star Chart, CLARUS CORPORATION is strong in growth, and medium in asset, dividend, and profitability. Based on this, we have classified CLARUS CORPORATION as a “cheetah”, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this classification, investors looking for higher returns with higher risk may be interested in this company. It is important to note, however, that CLARUS CORPORATION has an intermediate health score of 5/10 considering its cash flows and debt. This indicates that the company might be able to pay off debt and fund future operations. More…

Peers

The competition in the global musical instruments market is expected to intensify in the coming years as leading companies such as Yamaha Corporation, Johnson Health Tech Co. Ltd., and Rapala VMC Corporation battle for market share. The competition among these companies is likely to be driven by factors such as product innovation, marketing campaigns, and expansion into new geographic markets.

– Yamaha Corp ($TSE:7951)

Yamaha Corporation is a Japanese multinational corporation and conglomerate with a wide range of products and services, predominantly musical instruments, electronics, motorcycles, power sports equipment, and other motorized products.

The company has a market capitalization of 955.5 billion as of 2022 and a return on equity of 7.25%. Yamaha’s products are marketed under a variety of brand names, including Yamaha, Line 6, Steinberg, and Yamaha Pro Audio. The company also operates a number of subsidiaries, including Yamaha Music Education, Yamaha Motor Company, and Yamaha Golf-Car Company.

– Johnson Health Tech Co Ltd ($TWSE:1736)

Johnson Health Tech Co Ltd has a market cap of 22.03B as of 2022, a Return on Equity of -2.12%. The company is a leading manufacturer and distributor of fitness equipment and related products. Its products include treadmills, ellipticals, exercise bikes, strength training equipment, and home gyms. The company operates in over 100 countries and has a strong presence in the United States, Europe, and Asia.

– Rapala VMC Corp ($OTCPK:RPNMF)

Rapala VMC Corporation is a Finnish manufacturer of fishing lures, hooks, and other fishing tackle. The company has a market capitalization of 165.26 million as of 2022 and a return on equity of 7.98%. Rapala VMC Corporation is a leading provider of fishing products and services worldwide. The company’s products are sold in over 140 countries. Rapala VMC Corporation’s products include fishing lures, hooks, line, and other fishing tackle. The company also manufactures and sells fishing rods, reels, and other fishing equipment.

Summary

The stock price has been volatile following the release, with investors analyzing the performance of the company in order to make investment decisions.

Recent Posts