Bowlero Corp Intrinsic Value – Bowlero Corp Director’s Insider Purchase Signals Potential Growth for Company Shares

September 20, 2024

☀️Trending News

The company’s mission is to provide a fun and unique experience for customers of all ages through its modern and innovative approach to bowling. Recently, the company’s stock has caught the attention of investors due to the insider purchasing activity of one of its directors, Robert J Bass. On September 09, 2024, Bass purchased shares of Bowlero Corp ($NYSE:BOWL) for $1703.0. This significant insider purchase has sparked speculation among investors about the potential growth and future prospects of the company. Insider purchasing is often seen as a positive sign for a company’s stock, as it indicates that those within the company have confidence in its future success. This is especially true when it comes to high-level executives, such as directors, who typically have a deep understanding of the company’s operations and financials. This sentiment is shared by investors, as the stock price has already seen a considerable increase following the announcement of his purchase.

In addition to insider purchasing, Bowlero Corp has also been making strategic moves to expand its business and diversify its offerings. This move positions Bowlero Corp as the largest operator of bowling centers in the world. Furthermore, the company has been investing in technology and partnerships to enhance the customer experience at its venues. This includes virtual reality experiences, laser tag, and other interactive activities, attracting a broader audience and increasing revenue opportunities. As the company continues to innovate and expand its reach, investors can be confident in its long-term prospects.

Price History

On Thursday, BOWLERO CORP (symbol: BWL) saw a slight dip in their stock price, opening at $11.99 and closing at $11.66. This was a decrease of 1.1% from the previous closing price of $11.79.

However, this dip may not necessarily be cause for concern, as recent insider trading activity suggests potential growth for the company’s shares. This insider purchase is significant because it indicates confidence in the company’s future performance and potential growth. Insider buying is typically seen as a positive sign for a company’s stock, as it shows that those within the company have faith in its future success. This can be especially reassuring for investors, as insiders are typically more knowledgeable about the company’s operations and financials than the general public.

In addition, this insider purchase comes at a time when BOWLERO CORP has been experiencing steady growth. This growth can be attributed to the company’s expansion efforts, with the opening of several new bowling centers and acquisitions of other bowling alleys. Furthermore, BOWLERO CORP has also been making efforts to improve their customer experience and attract a younger demographic. The company has implemented virtual reality games and revamped their food and beverage offerings to modernize the traditional bowling experience. Overall, while BOWLERO CORP’s stock may have seen a slight decrease on Thursday, the recent insider purchase by one of the company’s directors suggests potential growth for its shares. With a strong track record of growth and efforts to revamp its offerings, BOWLERO CORP may continue to see positive performance in the future. Investors should keep an eye on the company’s stock as it may present a potential opportunity for growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bowlero Corp. More…

| Total Revenues | Net Income | Net Margin |

| 1.09k | 41.86 | 9.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bowlero Corp. More…

| Operations | Investing | Financing |

| 173.11 | -336.88 | 263.57 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bowlero Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.19k | 3.15k | 0.26 |

Key Ratios Snapshot

Some of the financial key ratios for Bowlero Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 26.7% | – | 11.0% |

| FCF Margin | ROE | ROA |

| -1.1% | 66.1% | 2.3% |

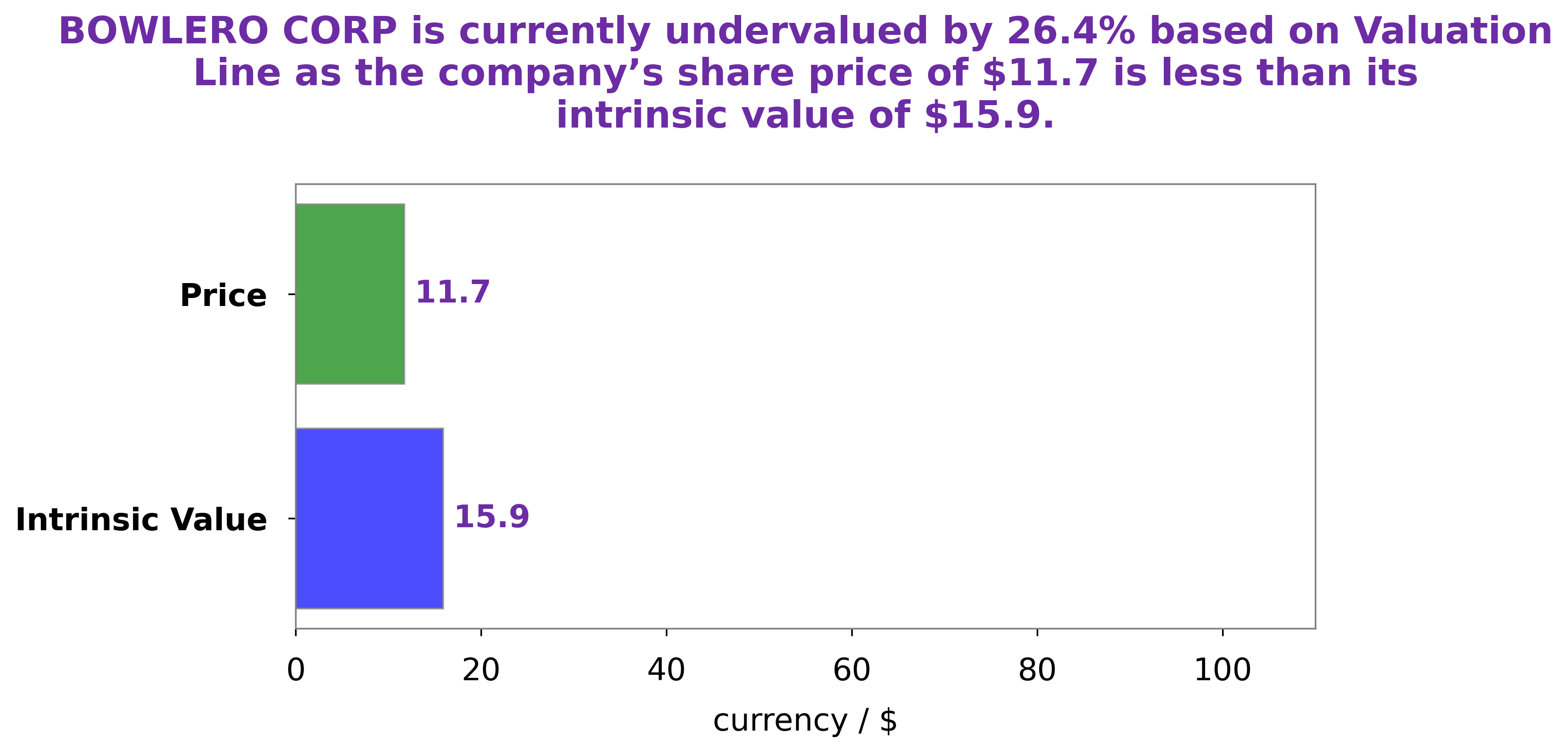

Analysis – Bowlero Corp Intrinsic Value

After conducting a thorough analysis of BOWLERO CORP‘s fundamentals, I have determined that the fair value of its stock is approximately $15.9. This calculation was made using our proprietary Valuation Line, which takes into account various financial metrics such as revenue, earnings, and cash flow. Currently, BOWLERO CORP’s stock is trading at $11.66, which means it is undervalued by 26.6%. This presents an opportunity for investors to purchase the stock at a discounted price and potentially see a significant return on their investment when the stock reaches its fair value. One of the key factors contributing to BOWLERO CORP’s undervaluation is its strong financial performance. The company has consistently reported solid revenue and earnings growth, indicating a healthy and stable business. In addition, its strong cash flow allows for potential investments in growth opportunities, further strengthening its position in the market. Furthermore, BOWLERO CORP operates in a growing industry, as recreational activities and experiences continue to gain popularity. This presents potential for the company to continue its upward trajectory and potentially exceed its fair value in the future. In conclusion, based on our analysis, I believe that BOWLERO CORP’s stock is currently undervalued and presents a strong investment opportunity for those looking to diversify their portfolio and potentially see significant returns in the long run. More…

Peers

In the world of professional bowling, there are few companies that can compete with Bowlero Corp. Founded in 2013, Bowlero has quickly become the largest operator of bowling centers in the United States. With over 300 locations across the country, Bowlero offers bowlers of all skill levels a place to enjoy their favorite pastime. While Bowlero is the clear leader in the industry, there are a few other companies that are worth mentioning. PSYC Corp, Huayi Brothers Media Corp, and Thumzup Media Corp are all major players in the world of professional bowling. Each of these companies has its own unique strengths and weaknesses, but all three are worth keeping an eye on in the years to come.

– PSYC Corp ($OTCPK:PSYC)

PSYC Corp is a provider of mental health services. The company has a market capitalization of $364,120,000 as of 2022 and a return on equity of -178.11%. PSYC Corp offers a variety of services including psychiatric evaluations, medication management, individual and group therapy, and case management. The company serves patients of all ages, from children to adults.

– Huayi Brothers Media Corp ($SZSE:300027)

Huayi Brothers Media Corp is a Chinese entertainment company with a market cap of 6.41B as of 2022. The company has a Return on Equity of -26.65%. The company produces and distributes films and television programs, and also operates theaters.

– Thumzup Media Corp ($OTCPK:TZUP)

Thumzup Media Corp is a media company that focuses on creating and distributing content across multiple platforms. The company has a market cap of 44.84M as of 2022 and a Return on Equity of -286.45%. The company’s primary operations are in the United States, Canada, and the United Kingdom.

Summary

Recent insider activity at Bowlero Corp, a company that operates bowling alleys, suggests potential gains for investors. This indicates confidence in the company’s future performance and may be seen as a positive sign by investors. While it is important to conduct a thorough analysis of a company’s financials and market trends before making any investment decisions, this recent insider activity could be seen as a favorable indicator for Bowlero Corp’s stock. Investors may want to keep an eye on the company as it moves forward.

Recent Posts