2023: Tips for Investing in Sunstone Hotel Investors Stock

March 28, 2023

Trending News 🌥️

In the ever-changing world of investing, it is important to stay informed about the most successful investments of the year. Sunstone is one of the largest lodging real estate investment trusts in the United States, and its stock has seen tremendous growth in the past year. Here are some tips for investing in Sunstone Hotel Investors ($NYSE:SHO) Inc. stock in 2023:

First, do your research. Make sure you understand Sunstone’s business model, its current financials, and its potential for future growth. It is also important to be aware of current events and industry trends that could affect Sunstone’s performance. Doing your due diligence will ensure that you make an educated decision when it comes to investing in SHO. Second, consider your risk tolerance. Investing in Sunstone is an inherently risky endeavor, but with careful analysis and diligent research, investors can minimize their risk by understanding the company’s business model, financial standing, and potential for growth. Third, diversify your investments. Even if you believe that Sunstone is a great investment, it is important to spread out your funds into other investments as well. Diversifying your portfolio will help protect you against market fluctuations, allowing you to take advantage of growth opportunities and manage risk more effectively. Finally, be sure to monitor the stock on a regular basis. Keep an eye out for any news or events that could affect SHO’s performance and make sure you adjust your portfolio accordingly. Follow these tips to ensure a successful experience in 2023.

Share Price

On Monday, the stock opened at $9.1 and closed at $9.0, up by 1.0% from its last closing price of 9.0. This is an indicator that the stock is in a positive trend and investors should consider investing in it if they want to earn a substantial return.

However, before investing in any stock it is important to do some research and thoroughly analyze the company’s fundamentals as well as its performance in the market. Investors should also keep an eye on the company’s balance sheet, income statement, and other financial statements, as well as its dividend payout and capital structure to ensure that their investments are safe and will generate returns. Additionally, investors should also consider their risk tolerance, financial goals, and timeline when evaluating the stock market.

In addition, investors should consider following the latest news and analysis related to Sunstone Hotel Investors Inc., as this can provide them with an insight into the company’s future performance. It is also important to keep track of the company’s share price movements and other market indicators to make sure they are making the right investment decisions. However, it is essential to do some research and make informed decisions before investing in any stock. With the right strategies and knowledge, investors can maximize their returns and make profitable investments for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SHO. More…

| Total Revenues | Net Income | Net Margin |

| 912.05 | 72.59 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SHO. More…

| Operations | Investing | Financing |

| 209.38 | -165.72 | -49.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SHO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.08k | 997.86 | 8.62 |

Key Ratios Snapshot

Some of the financial key ratios for SHO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 10.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

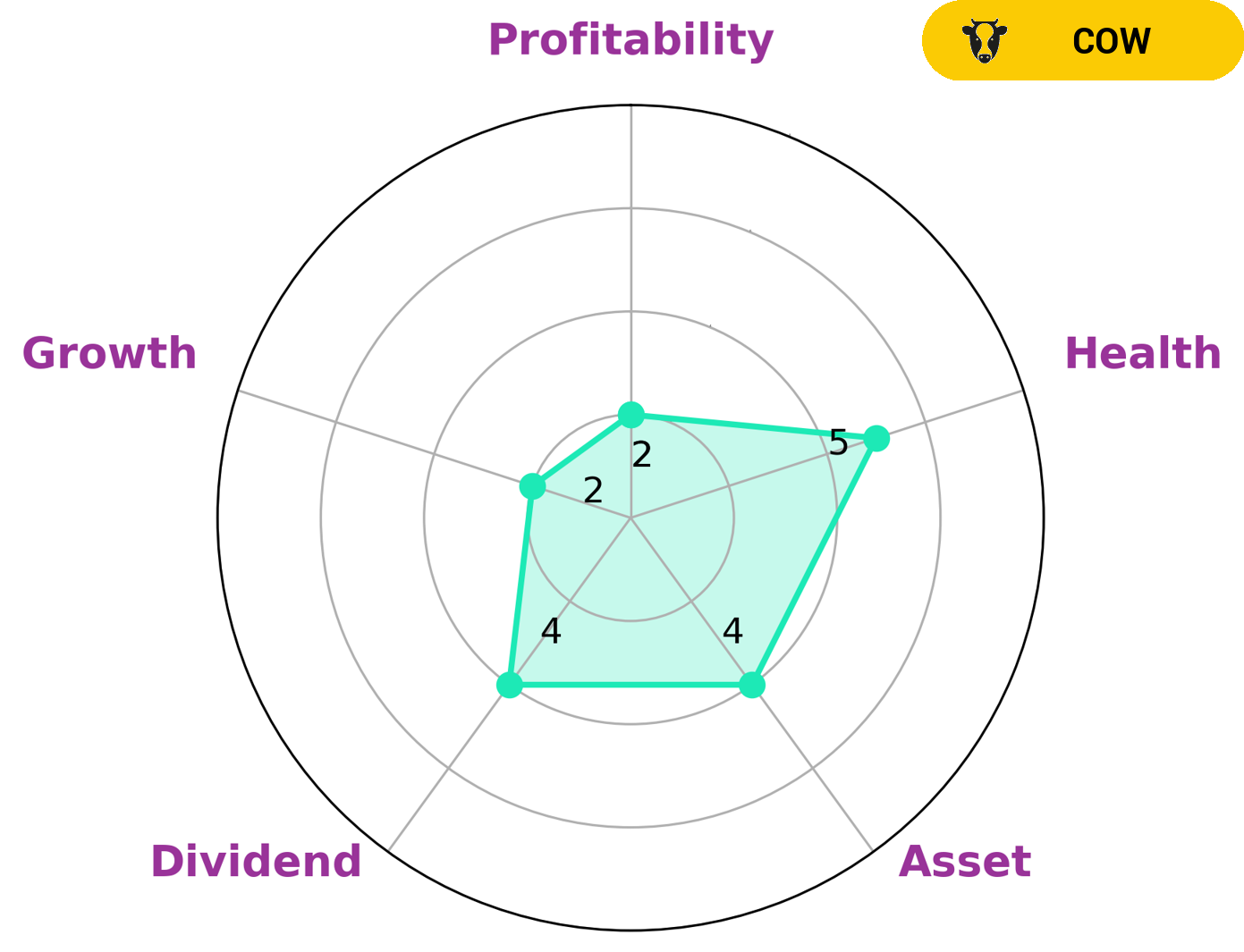

GoodWhale has analyzed SUNSTONE HOTEL INVESTORS’ financials and classified the company as a ‘cow’, meaning it has the track record of paying out consistent and sustainable dividends. This type of company may be of interest to investors looking for reliable income, as well as those looking to diversify their portfolio. Our Star Chart analysis indicates that while SUNSTONE HOTEL INVESTORS is strong in terms of assets and dividends, it is weak in terms of growth and profitability. However, it has an intermediate health score of 5/10 with regard to its cashflows and debt, indicating that it might be able to sustain future operations in times of crisis. More…

Peers

In the hotel industry, Sunstone Hotel Investors Inc is in competition with Summit Hotel Properties Inc, Apple Hospitality REIT Inc, and Service Properties Trust. These companies are all competing for market share in the hotel industry. Its competitors are also well-known and have a strong presence in the market.

– Summit Hotel Properties Inc ($NYSE:INN)

Summit Hotel Properties, Inc. is a real estate investment trust. The Company focuses on owning premium-branded select-service and extended-stay hotels in the U.S. REITs are company’s that own, and in some cases, operate income-producing real estate.

– Apple Hospitality REIT Inc ($NYSE:APLE)

The company’s market cap is 3.66B as of 2022. The company focuses on providing hospitality real estate investment trusts (REITs) in the United States. It operates through two segments, Hotel Operations and Development. The Hotel Operations segment acquires, owns, leases, operates, and disposes of Marriott branded hotels. The Development segment is involved in developing Marriott branded hotels. As of December 31, 2020, the company owned 269 properties with 74,761 rooms.

– Service Properties Trust ($NASDAQ:SVC)

Service Properties Trust is a real estate investment trust that owns, operates, and develops hotels and resorts. The company has a market cap of $1.24 billion as of 2022. Service Properties Trust is headquartered in Boston, Massachusetts.

Summary

Sunstone Hotel Investors Inc. (NYSE: SHO) is a publicly traded real estate investment trust that is focused on acquiring and investing in upper-upscale, full-service hotels located in the United States. Investors interested in the company’s stock should consider the following factors: management team and expertise, dividend yield, financial performance, industry trends, and risk/reward profile. Despite the pandemic, Sunstone’s occupancy rates have remained relatively healthy.

As the hospitality industry recovers from the pandemic, Sunstone stands to benefit from increasing demand for hotel accommodations. Investors should examine the risks associated with investing in Sunstone’s stock before making a decision.

Recent Posts