Zimmer Biomet Stock Fair Value Calculation – Zimmer Biomet Stock Soars After Positive Medicare Update

April 12, 2023

Trending News ☀️

Zimmer Biomet ($NYSE:ZBH) is a leading global medical device company that develops, manufactures, and markets innovative musculoskeletal healthcare products and services. Recently, their stock has seen a major surge after Evercore ISI upgraded the rating for the company, citing the recent Medicare update as the reason. The update will increase the reimbursement rate for certain musculoskeletal implants, giving Zimmer Biomet a much-needed boost. The update will mean more money for Zimmer Biomet and its investors. Evercore ISI has noted that the update could provide a significant margin expansion when it goes into effect.

The positive news was welcomed by investors and analysts alike. Zimmer Biomet’s stock has gained more than twelve percent since the news was announced and is expected to continue to climb as investors take advantage of the boost provided by the Medicare update. With the prospects looking bright, Zimmer Biomet is poised to make a strong comeback in the healthcare industry.

Share Price

On Tuesday, Zimmer Biomet (ZBH) stock soared after an update from the Centers for Medicare & Medicaid Services (CMS) was released. The stock opened at $130.2 and closed at $131.4, an increase of 2.5% from its closing price of $128.2 the day before. This update is expected to provide significant financial relief to the company, allowing them to continue to bring quality products and services to their customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zimmer Biomet. More…

| Total Revenues | Net Income | Net Margin |

| 6.94k | 231.4 | 9.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zimmer Biomet. More…

| Operations | Investing | Financing |

| 1.28k | -529.2 | -843.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zimmer Biomet. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 21.07k | 9.04k | 57.51 |

Key Ratios Snapshot

Some of the financial key ratios for Zimmer Biomet are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.6% | -2.1% | 8.2% |

| FCF Margin | ROE | ROA |

| 15.8% | 2.9% | 1.7% |

Analysis – Zimmer Biomet Stock Fair Value Calculation

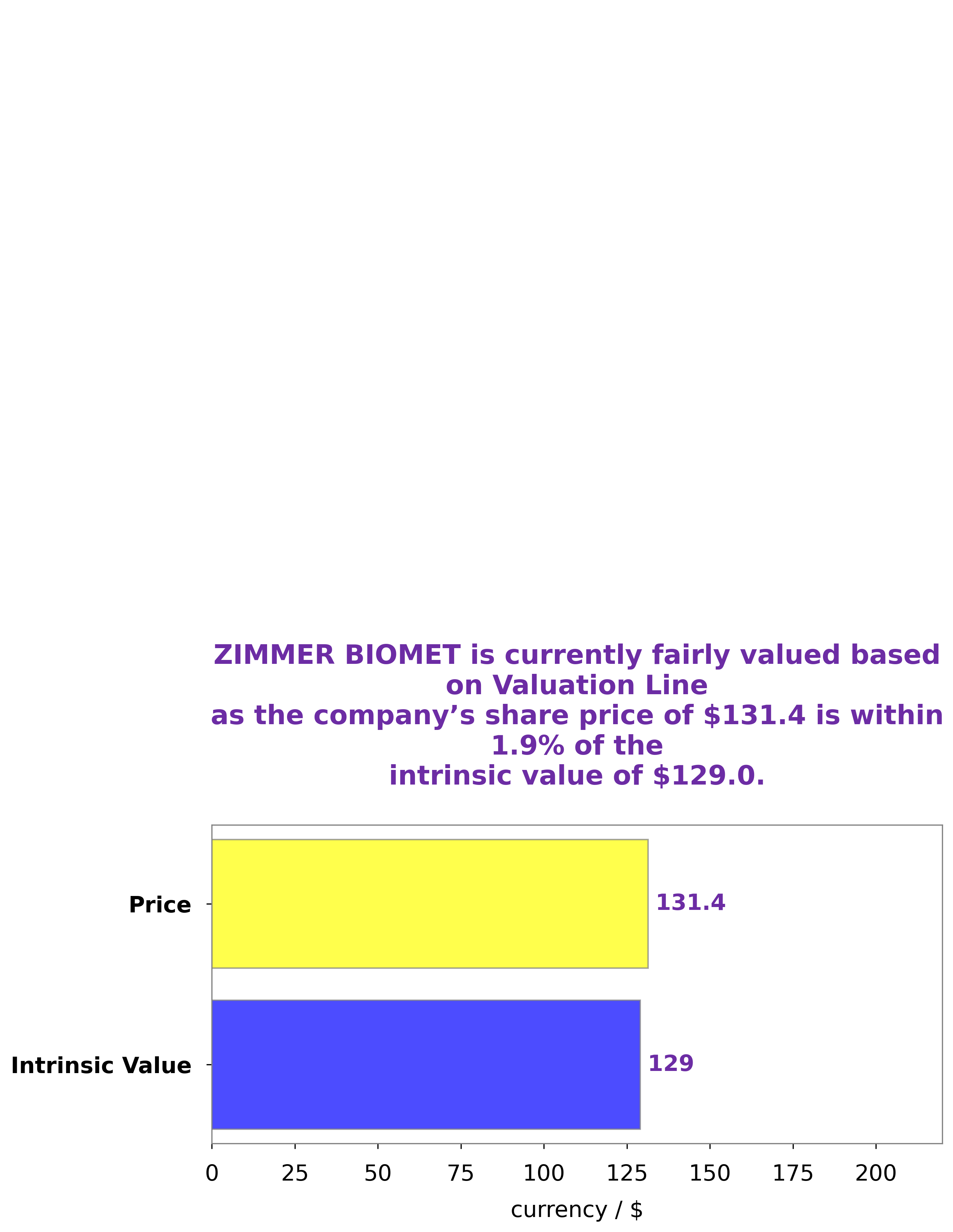

At GoodWhale, we’ve analyzed the financials of ZIMMER BIOMET to determine the company’s intrinsic value. Our proprietary Valuation Line gave us a figure of around $129.0 for the current value of a ZIMMER BIOMET share. The current market price of a share is $131.4, with GoodWhale rating it as a fair price that is overvalued by 1.9%. This suggests that the stock is slightly overpriced, but still a reasonable investment for those interested in ZIMMER BIOMET’s performance. More…

Peers

The company operates in two segments, Reconstructive and Dental. It offers knee, hip, shoulder, elbow, hand and wrist, foot and ankle, and biologics products. The company also provides dental prosthetics, including dental implants and CAD/CAM systems; and digital equipment for dentists and laboratories. Zimmer Biomet has a market cap of $24.4 billion and is headquartered in Warsaw, Indiana.

– Alcon Inc ($LTS:0A0D)

Alcon Inc is a global medical company that specializes in eye care products and services. The company’s market cap as of 2022 is 30.09B, and its return on equity is 1.87%. Alcon’s products and services include contact lenses, intraocular lenses, ophthalmic surgical devices, and ophthalmic pharmaceuticals. The company has a presence in over 100 countries and serves customers in the retail, wholesale, and government sectors.

– Sonova Holding AG ($LTS:0QPY)

Sonova Holding AG is a Swiss manufacturer of hearing aids. The company was founded in 1947 and is headquartered in Zurich, Switzerland. As of 2020, Sonova Holding AG had a market cap of 15.37 billion Swiss francs and a return on equity of 18.9%. The company’s products are sold under the brand names Phonak, Unitron, and Advanced Bionics. Sonova Holding AG’s products are available in more than 100 countries.

– Tandem Diabetes Care Inc ($NASDAQ:TNDM)

Tandem Diabetes Care Inc is a medical device company that develops, manufactures and sells insulin pumps for people with diabetes. The company has a market cap of $2.56 billion and a return on equity of -8.79%. Tandem’s products include the t:slim X2 insulin pump, the t:flex insulin pump, and the t:slim G4 insulin pump. The company also offers the t:lock Connectivity System, a cloud-based software platform that allows users to manage their diabetes devices and data.

Summary

Evercore ISI recently upgraded its stock rating for Zimmer Biomet, citing an update in Medicare reimbursement rates. The analysts believe that the increase in rates will have a positive effect on the company’s operations, resulting in higher revenues and increased profitability. Investment analysts have also pointed to Zimmer Biomet’s market-leading position in orthopedic products as well as its strong product pipeline as potential catalysts for growth.

In addition, the analysts noted that the company’s strategy of focusing on cost-cutting measures, capital efficiency, and M&A activities should help it to achieve long-term success. Overall, it is expected that Zimmer Biomet’s stock should benefit from the Medicare reimbursement rate increase and other factors in the near future.

Recent Posts