Winnebago Industries Intrinsic Value Calculation – Invest in Winnebago Industries for a Secure Financial Future

April 22, 2023

Trending News ☀️

Investing in Winnebago Industries ($NYSE:WGO) can provide a secure financial future with high long-term returns. With an unparalleled focus on quality and customer service, the company has grown to become a leader in the RV industry, with thousands of dealers worldwide. Their products range from affordable RVs for weekend adventurers, to luxury vehicles for a permanent lifestyle.

Moreover, their long-term outlook has been consistently positive, with steady growth in earnings and sales over the past decade. With their commitment to quality, customer service, and innovation, Winnebago Industries is sure to remain an industry leader for years to come.

Stock Price

On Thursday, Winnebago Industries stock opened at an impressive $58.8 and closed at $59.3, just 0.5% lower than the previous day’s closing price of $59.6. Despite this minor dip, Winnebago Industries remains a strong and reliable stock in the market, and one that is sure to yield good returns for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Winnebago Industries. More…

| Total Revenues | Net Income | Net Margin |

| 4.46k | 312.84 | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Winnebago Industries. More…

| Operations | Investing | Financing |

| 371.32 | -92.47 | -184.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Winnebago Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.45k | 1.11k | 43.7 |

Key Ratios Snapshot

Some of the financial key ratios for Winnebago Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.1% | 46.5% | 10.0% |

| FCF Margin | ROE | ROA |

| 6.2% | 21.2% | 11.4% |

Analysis – Winnebago Industries Intrinsic Value Calculation

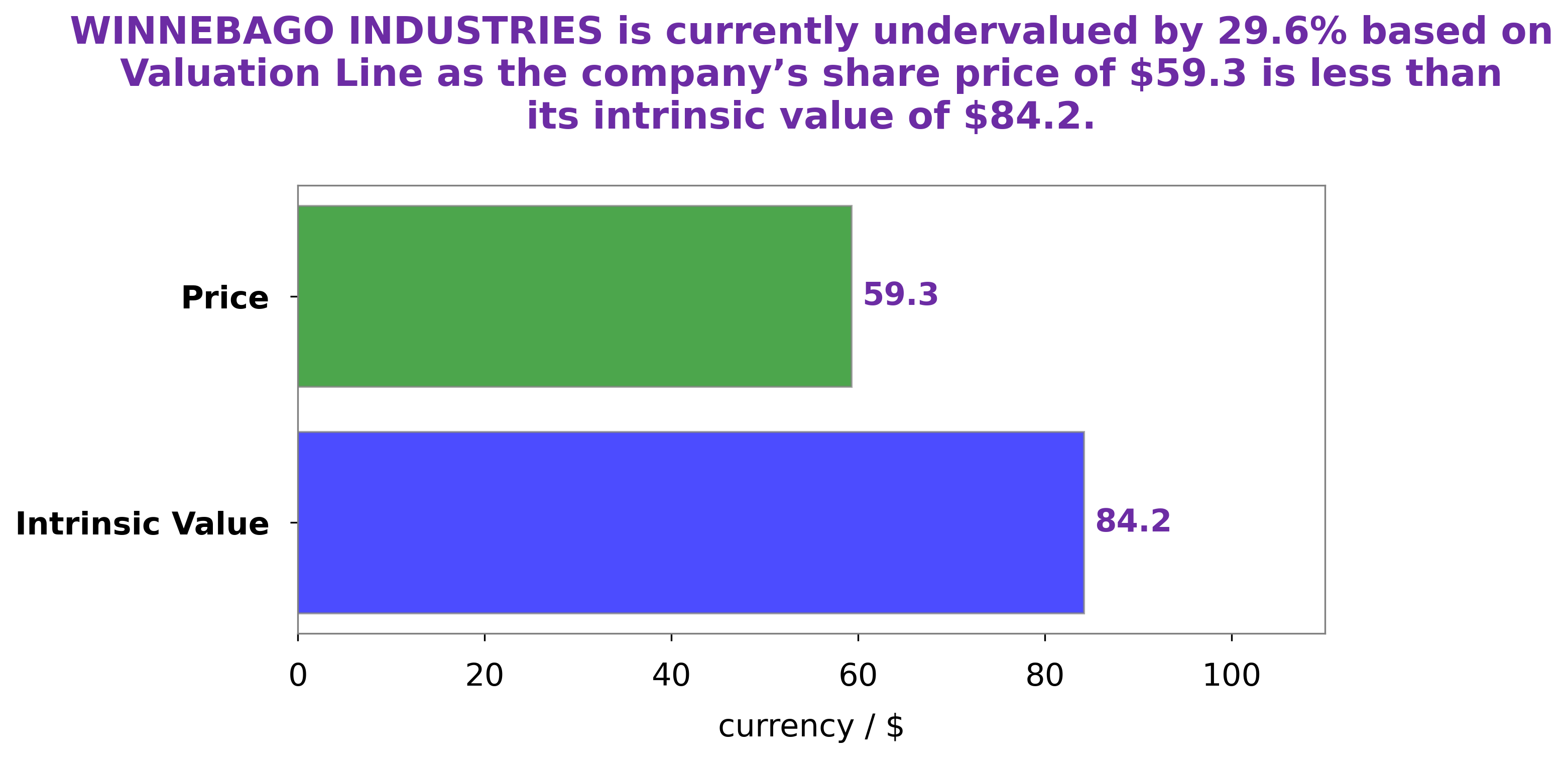

At GoodWhale, we have conducted an analysis of WINNEBAGO INDUSTRIES‘ wellbeing. After a thorough evaluation of their financials, our proprietary Valuation Line has calculated the fair value of WINNEBAGO INDUSTRIES’ share to be around $84.2. However, at the current market rate, the stock is trading at $59.3, which is undervalued by 29.6%. This could present an opportunity for investors to benefit from buying the stock at a discounted price. More…

Peers

The competition between Winnebago Industries Inc and its competitors is fierce. Each company is striving to be the best in the industry and to provide the best products and services to their customers. This competition is good for the consumer because it allows them to choose from a variety of products and companies that are all trying to be the best. It also keeps the prices of the products and services down because the companies are always trying to outdo each other.

– Polaris Inc ($NYSE:PII)

Polaris Inc is a global company with a market cap of 5.58B as of 2022. It designs, engineers, and manufactures powersports vehicles, including motorcycles, snowmobiles, and ATVs. The company also manufactures related parts and accessories. Polaris has a strong focus on innovation and is constantly introducing new products to the market. The company’s return on equity is 32.56%.

– Hino Motors Ltd ($TSE:7205)

Hino Motors Ltd is a Japanese manufacturer of commercial vehicles and diesel engines. The company is a leading producer of medium and heavy-duty trucks in Japan, and is a part of the Toyota Group. Hino Motors Ltd has a market cap of 343.84B as of 2022, and a Return on Equity of -4.8%. The company manufactures a wide range of commercial vehicles, including trucks, buses, and engines. Hino Motors Ltd also has a strong presence in the global market, with exports to over 100 countries.

– Vaksons Automobiles Ltd ($BSE:539402)

Vaksons Automobiles Ltd is an Indian company that manufactures and sells automobiles. As of 2022, the company had a market capitalization of 215.14 million and a return on equity of -0.15%. The company’s products include cars, trucks, and buses.

Summary

Winnebago Industries is a leading manufacturer of recreational vehicles (RVs) and motorhomes. The company has a strong track record of delivering high long-term returns to investors with its robust product offerings and knowledgeable management team. Its strong brand presence, competitive pricing, and well-designed products have enabled it to stay ahead of the competition. The company has a diversified product line, including motorhomes, travel trailers, and fifth wheels.

It also offers parts and service for its vehicles, as well as financing options to customers. Winnebago Industries’ focus on innovation and customer service has enabled it to be a leader in the RV industry for many years. Investing in Winnebago Industries has the potential to deliver excellent long-term returns to investors over the long-term.

Recent Posts