Werner Enterprises Stock Fair Value – HRT Financial LP Reduces Position in Werner Enterprises,

June 12, 2023

🌥️Trending News

HRT Financial LP, a financial services provider with significant influence in the stock market, has recently announced that it has taken the decision to reduce its holding in Werner Enterprises ($NASDAQ:WERN), Inc. Werner Enterprises is a well-established transportation and logistics company based in Omaha, Nebraska. It also provides dedicated contract and maintenance services for its clients. Werner Enterprises is one of the largest publicly traded truckload carriers in the United States and serves customers throughout North America and Mexico.

In addition, the company also runs hundreds of tractors and trailers that are designed to carry various cargo types. HRT Financial LP’s announcement to reduce its stake in Werner Enterprises, Inc is an important move in the truckload carrier industry and could have a significant impact on the company’s future performance. Investors will be closely watching this development and will be eager to learn how this decision may affect Werner Enterprises’ stock price in the coming months.

Stock Price

On Friday, WERNER ENTERPRISES, Inc. saw a decline in its stock price, opening at $44.7 and closing at $43.8, a 2.5% drop from the previous closing price of $44.8. HRT Financial LP, a large shareholder in the company, reduced its stake in the company by selling some of its shares. WERNER ENTERPRISES is a leading transportation and logistics service provider that offers transportation solutions such as truckload transportation, logistics services, and other value-added services.

It serves customers in the retail, manufacturing, consumer products, energy, and government sectors. Despite the stock’s decline, analysts remain positive about the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Werner Enterprises. More…

| Total Revenues | Net Income | Net Margin |

| 3.36k | 222.73 | 6.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Werner Enterprises. More…

| Operations | Investing | Financing |

| 448.71 | -514.33 | 118.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Werner Enterprises. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.12k | 1.61k | 23.2 |

Key Ratios Snapshot

Some of the financial key ratios for Werner Enterprises are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.9% | 12.0% | 9.5% |

| FCF Margin | ROE | ROA |

| -1.7% | 13.6% | 6.4% |

Analysis – Werner Enterprises Stock Fair Value

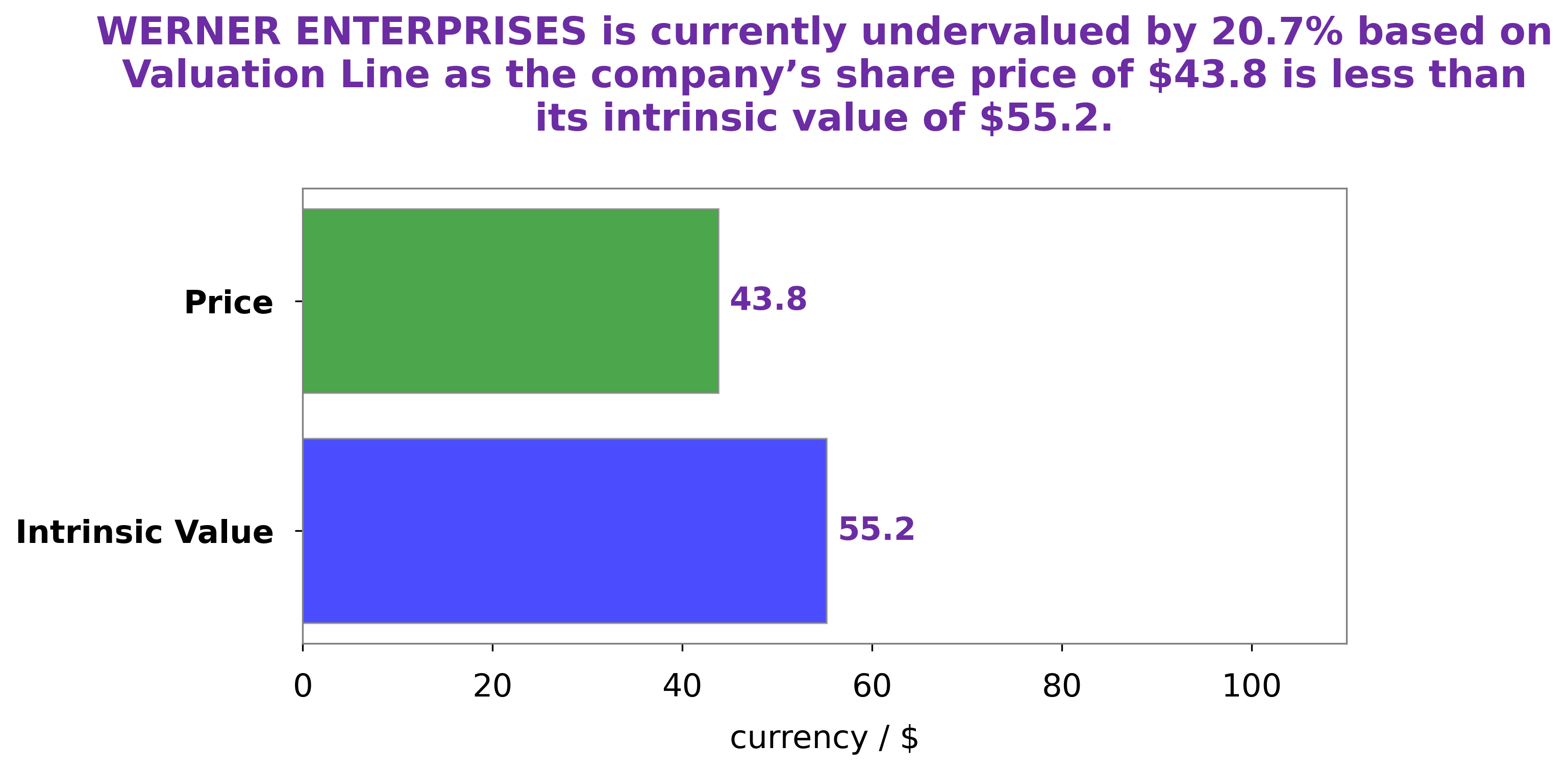

At GoodWhale, we have analyzed the fundamentals of WERNER ENTERPRISES and our proprietary Valuation Line has determined the fair value of their share to be around $55.2. Currently, the stock is trading at $43.8, meaning it is undervalued by 20.6%. This makes it an ideal opportunity for investors to purchase the stock and potentially benefit from future price appreciation. More…

Peers

The trucking industry is extremely competitive. Companies are always vying for new customers and new contracts. Werner Enterprises Inc is no different. It competes against some of the largest trucking companies in the world, including Knight-Swift Transportation Holdings Inc, ArcBest Corp, and XPO Logistics Inc. These companies are all fighting for a piece of the pie, and each one has its own unique advantages and disadvantages.

– Knight-Swift Transportation Holdings Inc ($NYSE:KNX)

Knight-Swift Transportation is one of the largest trucking companies in North America. It has a market cap of 7.76B as of 2022 and a ROE of 11.12%. The company operates in the United States, Mexico, and Canada. It has a fleet of over 16,000 trucks and trailers. Knight-Swift Transportation provides truckload, intermodal, and logistics services.

– ArcBest Corp ($NASDAQ:ARCB)

ArcBest Corporation is an American logistics company with operations in North America, Europe, and Asia. The company was founded in 1923 and is headquartered in Fort Smith, Arkansas. ArcBest provides a range of logistics services, including transportation, warehousing, and supply chain management. The company has a market cap of 1.8 billion as of 2022 and a return on equity of 24.79%.

– XPO Logistics Inc ($NYSE:XPO)

XPO Logistics Inc is a transportation and logistics company with a market cap of 3.87B as of 2022. The company has a return on equity of 44.59%. XPO Logistics Inc provides transportation and logistics services to customers in a variety of industries, including retail, e-commerce, food and beverage, manufacturing, and energy. The company operates a network of over 1,400 locations in more than 30 countries.

Summary

HRT Financial LP has recently announced that it has decreased its stake in Werner Enterprises, Inc., a publicly-traded transportation and logistics company. Analysts recommend studying potential investments in Werner Enterprises carefully, as the stock price has been volatile in the past. Examining the company’s financial statements, competitive landscape, customer base, and current trends in the industry can help determine whether an investment in Werner Enterprises is a wise decision. Additionally, investors should be aware of any short-term factors that could affect the stock price and remember to diversify their investments to reduce risk.

Recent Posts