Wendy’s Company Intrinsic Stock Value – Wendy’s Company Names New Executive Leaders in Key Roles

September 18, 2024

🌥️Trending News

In addition to its popular menu items, Wendy’s is also known for its commitment to quality ingredients and innovative marketing strategies. Investors and shareholders can also be reassured by these new appointments as they demonstrate Wendy’s commitment to strong leadership and strategic decision-making. The company’s stock has seen steady growth in recent years, with its innovative menu offerings and focus on digital sales contributing to its success despite the challenging market conditions.

In conclusion, Wendy’s Company ($NASDAQ:WEN)’s new executive leaders bring a wealth of experience and expertise to their respective roles, positioning the company for continued growth and success. With a strong brand and a dedicated team, Wendy’s is well-positioned to maintain its position as a top player in the fast-food industry.

Stock Price

Wendy’s Company, a renowned fast food chain, recently announced the appointment of new executive leaders in key roles. This news was released on Tuesday, when the company’s stock opened at $17.8542 and closed at $17.77, showing an increase of 0.23% from its previous closing price of $17.73. The company has been undergoing significant changes in its leadership team, with the latest being the appointment of two new executives to key positions. Todd Penegor, the President and CEO of Wendy’s Company, emphasized that these appointments are crucial for the company’s growth and success in the long run. One of the key roles that saw a new appointment is the Chief Growth Officer position, which has been filled by Liliana Esposito. She will be responsible for driving Wendy’s global growth strategies, including marketing, menu innovation, and customer experience.

In addition, the company also named Kevin Vasconi as its new Chief Information Officer (CIO). He has previously held various leadership roles in companies like Domino’s Pizza and Honeywell International. This announcement comes at a crucial time for Wendy’s as it looks to expand its global presence and keep up with the rapidly changing consumer preferences. With the addition of these two highly experienced executives, the company is confident that it will be able to drive growth and enhance its digital capabilities to better serve its customers. Overall, Wendy’s Company’s decision to appoint new executive leaders in key roles reflects its commitment to staying at the forefront of the fast food industry. As the company continues to evolve and adapt to the changing market dynamics, these key appointments are expected to contribute significantly to its success in the years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wendy’s Company. More…

| Total Revenues | Net Income | Net Margin |

| 2.18k | 204.44 | 10.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wendy’s Company. More…

| Operations | Investing | Financing |

| 345.42 | -86.55 | -504.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wendy’s Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.18k | 4.87k | 1.51 |

Key Ratios Snapshot

Some of the financial key ratios for Wendy’s Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.0% | 10.5% | 18.5% |

| FCF Margin | ROE | ROA |

| 11.9% | 77.3% | 4.9% |

Analysis – Wendy’s Company Intrinsic Stock Value

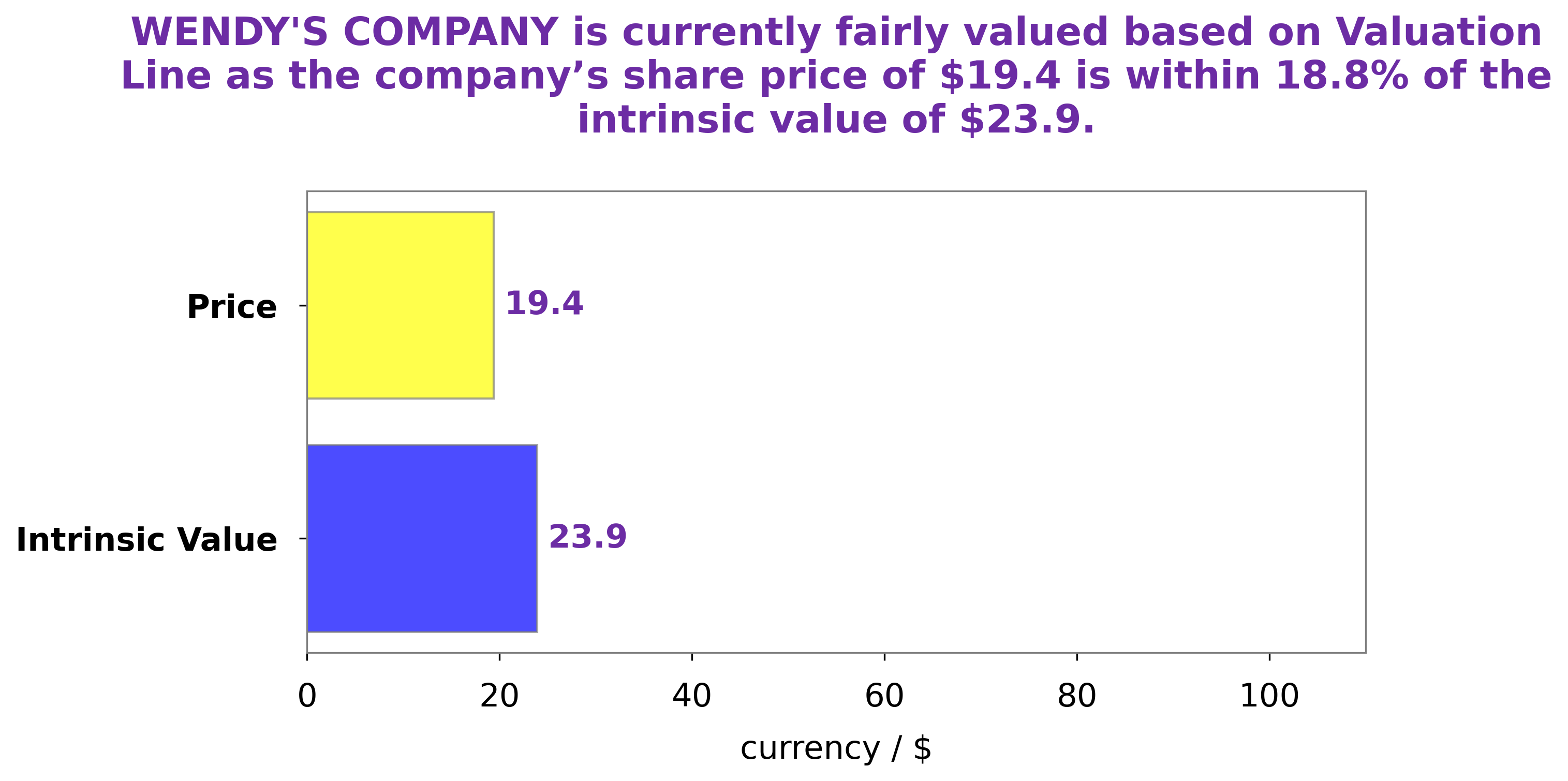

First, let’s take a look at the fundamentals of WENDY’S COMPANY using our advanced tool, GoodWhale. We analyzed various aspects of the company, including its financial performance, market position, and future growth potential. Based on our analysis, we have determined that the intrinsic value of WENDY’S COMPANY share is approximately $23.9. This valuation is calculated using our proprietary Valuation Line, which takes into account multiple factors such as earnings growth, cash flow, and risk. Currently, WENDY’S COMPANY stock is trading at $17.77, which indicates that it is undervalued by 25.6%. This presents a potential buying opportunity for investors who are looking to add this stock to their portfolio. One of the key factors contributing to this undervaluation is the company’s strong financial performance. WENDY’S COMPANY has consistently reported solid earnings and revenue growth over the years, indicating its stable and profitable business operations. Additionally, WENDY’S COMPANY has a strong market position in the fast-food industry, with a well-established brand and a loyal customer base. This provides the company with a competitive advantage and further supports its future growth potential. In conclusion, our analysis using GoodWhale shows that WENDY’S COMPANY is currently trading at a significant discount to its intrinsic value. As such, it may be a good opportunity for investors to consider adding this stock to their portfolio for potential long-term gains. More…

Peers

In the quick-service restaurant industry, the Wendy’s Co. competes with McDonald’s Corp, Chipotle Mexican Grill Inc, and Yum Brands Inc. All of these companies are trying to attract customers with fresh, high-quality food at a reasonable price. Wendy’s Co. has an advantage over its competitors because it is a smaller company and can be more nimble in its response to customer trends.

– McDonald’s Corp ($NYSE:MCD)

McDonald’s Corp has a market cap of 187.28B as of 2022, a Return on Equity of -90.17%. McDonald’s Corporation is an American fast food company, founded in 1940 as a restaurant operated by Richard and Maurice McDonald, in San Bernardino, California, United States. They rechristened their business as a hamburger stand. The first McDonald’s franchise using the arches logo opened in Phoenix, Arizona in 1953. Businessman Ray Kroc joined the company as a franchise agent in 1955. He subsequently purchased the chain from the McDonald brothers and oversaw its worldwide growth.

– Chipotle Mexican Grill Inc ($NYSE:CMG)

Founded in 1993, Chipotle Mexican Grill is a chain of restaurants that primarily serves Mexican-style cuisine, including tacos and burritos. As of December 31, 2020, there were 2,724 Chipotle restaurants in the United States, Canada, the United Kingdom, France, and Germany. The company has a market cap of $43.03B as of 2022 and a return on equity of 27.52%.

– Yum Brands Inc ($NYSE:YUM)

Yum Brands Inc is a publicly traded American fast food company with more than 40,000 locations in over 140 countries. The company operates the brands KFC, Pizza Hut, and Taco Bell. Yum Brands is headquartered in Louisville, Kentucky.

Yum Brands Inc has a market cap of 31.59B as of 2022. The company has a Return on Equity of -15.87%. Yum Brands Inc is a publicly traded American fast food company with more than 40,000 locations in over 140 countries. The company operates the brands KFC, Pizza Hut, and Taco Bell. Yum Brands is headquartered in Louisville, Kentucky.

Summary

The Wendy’s Company has announced new executive leadership appointments, with John Min being named as the Chief Legal Officer and Secretary and Mary Greenlee as the Senior Vice President. These appointments reflect the company’s focus on strengthening its legal and operational leadership. These changes are expected to have a positive impact on the company’s performance and growth in the future. As an investor, it is important to monitor these developments as they can provide insights into the company’s strategic direction and potential for financial success.

Additionally, it is important to stay informed about any changes in leadership or management, as these can greatly impact the company’s overall performance and stock value.

Recent Posts