Waste Management Intrinsic Value Calculator – Shares of Waste Management Dip 0.46% Despite Mixed Trading Session

May 26, 2023

Trending News 🌧️

Waste Management ($NYSE:WM) Inc. had a mixed trading session on Thursday as their stock price dipped 0.46% to $161.88. Waste Management Inc. is a leading provider of comprehensive waste and environmental services in North America. Despite their commitment to waste management, their shares experienced some volatility in the market.

Investors remain uncertain if the stock will continue to dip or if the share price will rebound in the coming days. The outlook for Waste Management Inc. is unclear, but they remain dedicated to their commitment to sustainability and providing quality services to customers.

Analysis – Waste Management Intrinsic Value Calculator

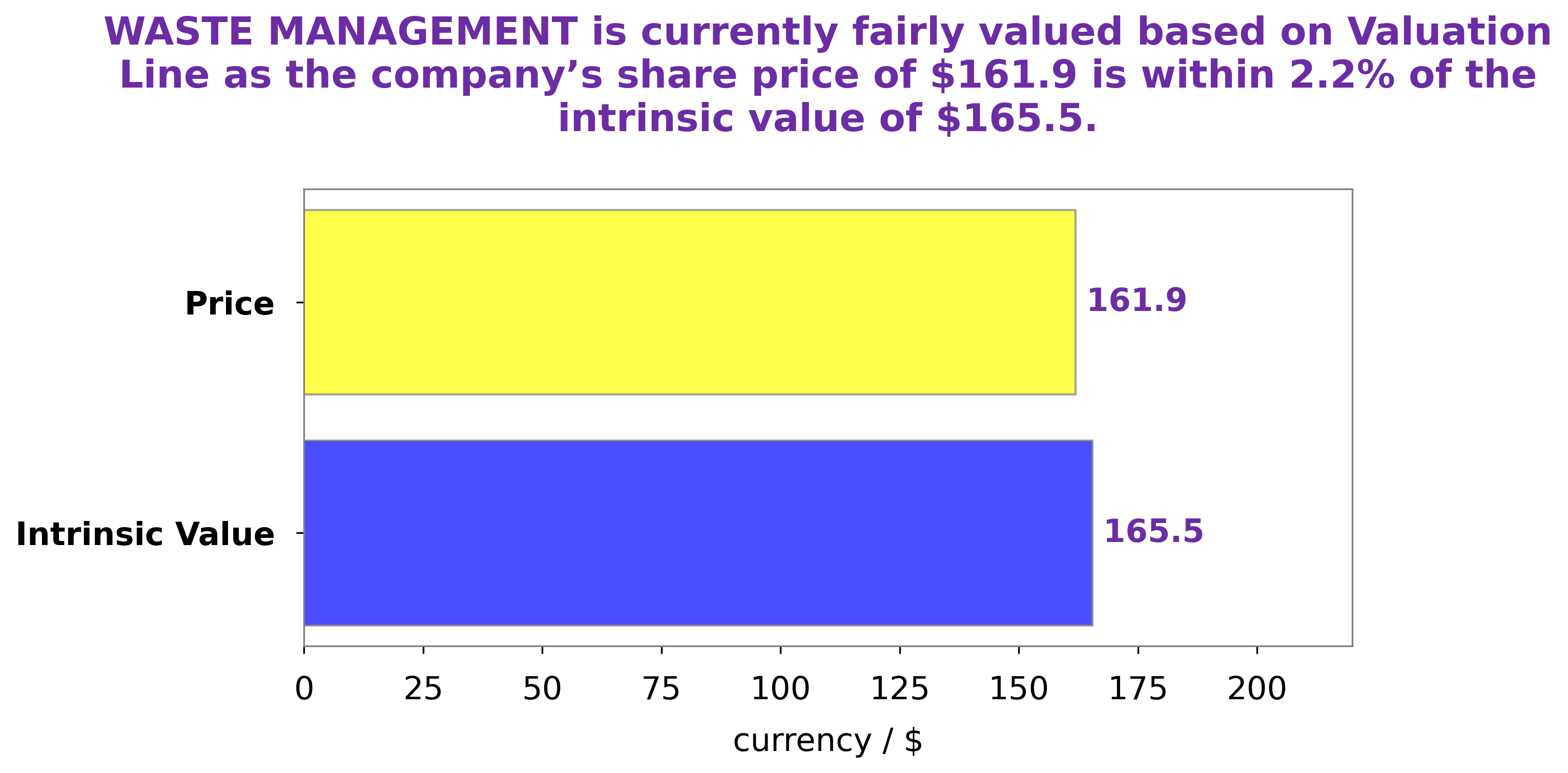

At GoodWhale, our team of experts has conducted a careful analysis of the fundamentals of WASTE MANAGEMENT. Using our proprietary Valuation Line, we have concluded that the fair value of the WASTE MANAGEMENT share is around $165.5. At the time of writing, the stock is being traded at $161.9, which is a fair price that is slightly undervalued by 2.2%. This provides an interesting opportunity to investors looking to buy a quality stock at a discount. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Waste Management. More…

| Total Revenues | Net Income | Net Margin |

| 19.93k | 2.26k | 11.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Waste Management. More…

| Operations | Investing | Financing |

| 4.32k | -3.27k | -900 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Waste Management. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 31.29k | 24.48k | 16.7 |

Key Ratios Snapshot

Some of the financial key ratios for Waste Management are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.8% | 8.6% | 16.8% |

| FCF Margin | ROE | ROA |

| 7.5% | 30.7% | 6.7% |

Peers

It has many competitors, including Republic Services Inc, Waste Connections Inc, and Macau Capital Investments Inc.

– Republic Services Inc ($NYSE:RSG)

Republic Services is an American trash and recycling company. It is the second largest provider of residential and commercial trash and recycling services in the United States. The company’s revenue for 2020 was $9.75 billion. The company’s ROE for 2020 was 13.97%.

– Waste Connections Inc ($NYSE:WCN)

Waste Connections Inc is a provider of waste management services in North America. The company has a market cap of 34.1B as of 2022 and a return on equity of 9.38%. Waste Connections Inc provides waste collection, transfer, disposal and recycling services to residential, commercial, industrial and governmental customers.

Summary

Waste Management Inc. had a mixed day on the stock market, slipping 0.46% to $161.88. Investors should analyze the company’s performance in context of the industry, as well as its financials, competitive positioning, and management strategy. Additionally, factors such as macroeconomic conditions, industry trends, and political events should be considered when making informed investing decisions. Analysts should also take into account Waste Management’s growth potential and ability to leverage capital in order to identify further opportunities for potential investors.

Recent Posts