Waste Management Intrinsic Value Calculation – Waste Management, Receives Major Upgrade from Analysts, Sparking Optimism for Shareholders

November 8, 2024

☀️Trending News

Waste Management ($NYSE:WM), Inc. is a leading waste management company in North America, providing comprehensive waste and environmental services to residential, commercial, industrial, and municipal customers. Over the years, Waste Management, Inc. has consistently delivered strong financial results, making it a popular choice among investors.

However, this week, the company received a major upgrade from analysts, sparking optimism among shareholders. This upgrade comes as a result of the company’s recent performance and promising future prospects. Analysts have predicted that Waste Management, Inc. will see a significant increase in its earnings and profitability in the coming months. This is due to the company’s focus on sustainability and its investments in advanced waste-to-energy technologies. These initiatives not only align with the growing global demand for environmentally friendly solutions but also have the potential to drive long-term growth and profitability for the company. The analysts’ upgrade also takes into consideration Waste Management, Inc.’s strong financial position and its ability to generate consistent cash flow. This provides the company with enough resources to continue investing in new technologies and expanding its operations.

Additionally, the company’s efficient cost management practices have helped improve its margins and overall financial performance. With a strong track record of delivering returns to investors, this upgrade adds to their confidence in the company’s future prospects. The company’s commitment to sustainability, strong financial position, and efficient cost management practices make it a promising investment option for shareholders. As the world becomes more environmentally conscious, Waste Management, Inc.’s innovative solutions position it as a leader in the waste management industry, making it a valuable addition to any investment portfolio.

Price History

The stock opened at $219.01 and closed at $220.52, representing a 0.93% increase from the previous day’s closing price of $218.48. This upgrade came after several analysts revised their ratings and price targets for WM, following the company’s strong financial performance in the past quarter. This news has sparked positivity among investors, who are now anticipating even stronger growth for Waste Management in the coming months. Moreover, Waste Management has been making strategic investments in technology and sustainability initiatives, which have resulted in improved efficiency and cost savings for the company. These efforts have not only positively impacted the company’s financial performance but have also positioned Waste Management as a leader in the waste management industry. The upgraded ratings and price targets from analysts reflect their confidence in Waste Management’s future prospects.

They believe that the company’s strong fundamentals and strategic investments will continue to drive growth and profitability, making it an attractive investment option for shareholders. In addition to the analyst upgrade, Waste Management has also been receiving positive attention from investors due to its commitment to sustainability and environmental stewardship. These initiatives not only align with the growing global focus on sustainability but also showcase Waste Management’s dedication to responsible business practices. In conclusion, Waste Management’s recent major upgrade from analysts has sparked optimism among shareholders, as the company continues to deliver strong financial performance and make strategic investments in technology and sustainability. With a positive outlook and a commitment to responsible business practices, Waste Management is well-positioned for future growth and success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Waste Management. More…

| Total Revenues | Net Income | Net Margin |

| 20.43k | 2.3k | 12.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Waste Management. More…

| Operations | Investing | Financing |

| 4.72k | -3.09k | -1.52k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Waste Management. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 32.82k | 25.93k | 17.19 |

Key Ratios Snapshot

Some of the financial key ratios for Waste Management are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | 15.5% | 17.2% |

| FCF Margin | ROE | ROA |

| 8.9% | 31.8% | 6.7% |

Analysis – Waste Management Intrinsic Value Calculation

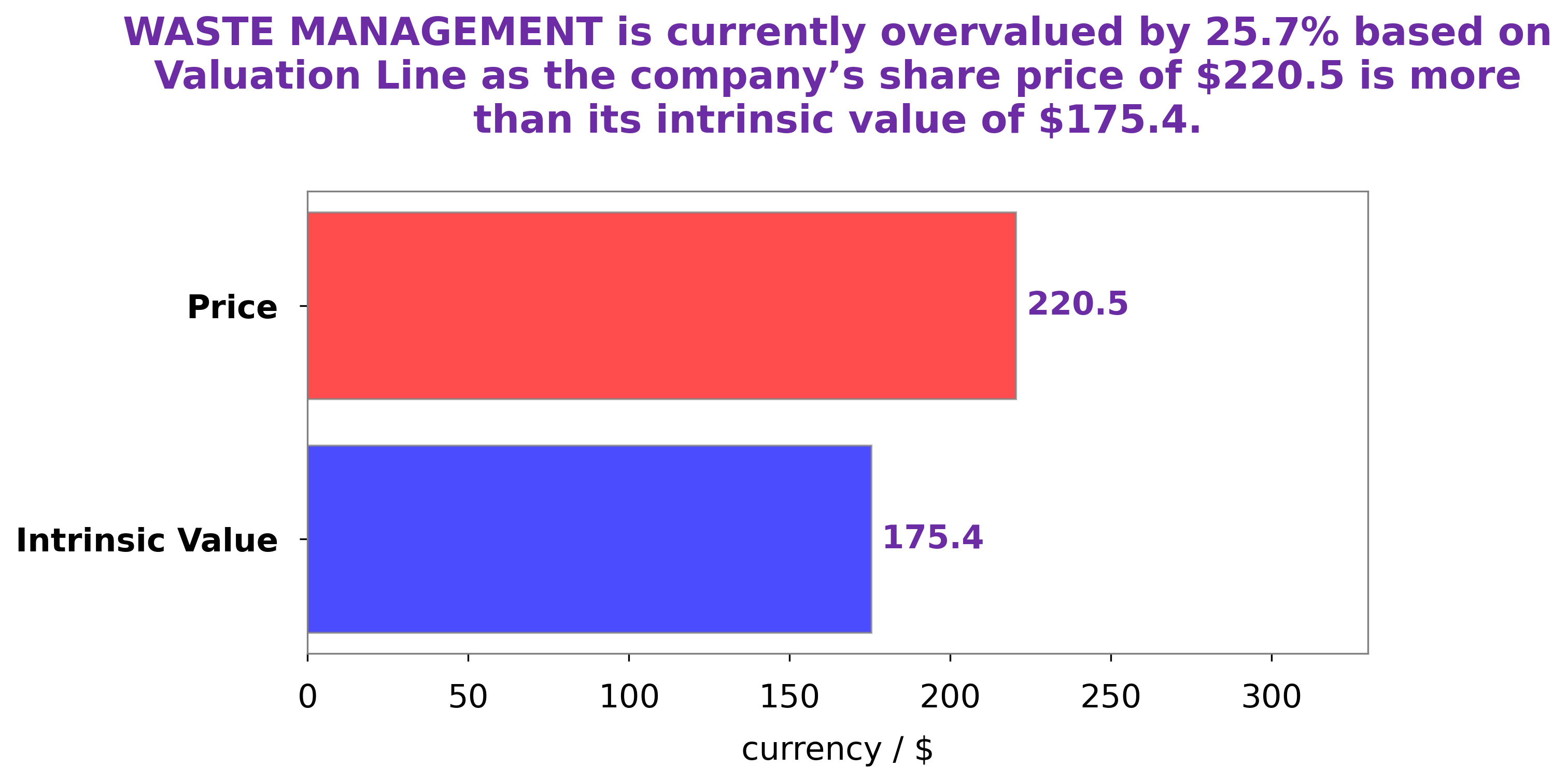

After conducting an in-depth analysis of WASTE MANAGEMENT‘s fundamentals, I have come to the conclusion that the company’s fair value is around $175.4. This calculation was based on our proprietary Valuation Line, which takes into account various financial metrics such as revenue, earnings, and cash flow. Currently, WASTE MANAGEMENT’s stock is trading at $220.52, which is a 25.7% premium to its fair value. This indicates that the stock is overvalued and may not be a good investment opportunity at its current price. One of the key factors driving this overvaluation is the company’s strong financial performance. WASTE MANAGEMENT has consistently posted solid revenue and earnings growth, and its cash flow has been stable. This has attracted investors and led to a higher demand for the stock, driving up its price. However, there are also some potential risks that investors should be aware of. One concern is the company’s reliance on government contracts for a significant portion of its revenue. Changes in government policies or budget cuts could impact WASTE MANAGEMENT’s financials. In conclusion, while WASTE MANAGEMENT is a solid company with a strong financial track record, its stock is currently overvalued. Investors should carefully consider their options before investing in the stock at its current price. More…

Peers

It has many competitors, including Republic Services Inc, Waste Connections Inc, and Macau Capital Investments Inc.

– Republic Services Inc ($NYSE:RSG)

Republic Services is an American trash and recycling company. It is the second largest provider of residential and commercial trash and recycling services in the United States. The company’s revenue for 2020 was $9.75 billion. The company’s ROE for 2020 was 13.97%.

– Waste Connections Inc ($NYSE:WCN)

Waste Connections Inc is a provider of waste management services in North America. The company has a market cap of 34.1B as of 2022 and a return on equity of 9.38%. Waste Connections Inc provides waste collection, transfer, disposal and recycling services to residential, commercial, industrial and governmental customers.

Summary

Analysts have upgraded their recommendation for Waste Management, Inc. this week, which is good news for shareholders. The company has received a substantial boost from the analysts, indicating positive prospects for investors. This upgrade may lead to an increase in stock prices and could be viewed as a strong indication of the company’s potential. Investors may see this as a good opportunity to invest in Waste Management, Inc. and expect a positive return on their investment.

This upgrade also suggests that the analysts have reviewed the company’s financial performance and have confidence in its future growth. Overall, this upgrade is a positive sign for Waste Management, Inc. and its investors.

Recent Posts