VNO Stock Fair Value Calculator – Vornado Realty: Get the Best Deals on Real Estate Now!

April 20, 2023

Trending News ☀️

Vornado Realty Trust ($NYSE:VNO) is one of the leading real estate companies in the United States. As a premier real estate trust, Vornado provides an extensive portfolio of quality commercial, retail and residential real estate properties at an affordable price. With over forty years of experience in the real estate industry, Vornado is well-suited to help you find the perfect property that meets your needs. Their extensive network of properties includes office buildings, industrial spaces, apartment complexes and shopping centers. Vornado offers leasing and purchasing options for all types of properties.

They also have a wide selection of residential real estate available, ranging from single-family homes to luxury condos. Vornado has an excellent track record for providing high-quality real estate solutions. Their professional team is dedicated to providing the best customer service and ensuring quality throughout the entire process. Whether you’re looking to purchase, lease or invest in a property, Vornado is committed to helping you get the best deals on real estate now.

Market Price

When it comes to getting the best deals on real estate, investors should look no further than VORNADO REALTY TRUST. On Tuesday, VORNADO REALTY TRUST stock opened at $15.4 and closed at $15.2, down by 0.6% from the prior closing price of 15.3. This presents a great opportunity to get in on the ground floor of a company that is well-positioned to benefit from the current market trends and potentially provide investors with a good return. With Vornado Realty Trust, you can be sure that your real estate investments are safe and secure. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for VNO. More…

| Total Revenues | Net Income | Net Margin |

| 1.8k | -408.62 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for VNO. More…

| Operations | Investing | Financing |

| 798.94 | -906.86 | -801.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for VNO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.49k | 9.98k | 24.27 |

Key Ratios Snapshot

Some of the financial key ratios for VNO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 16.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – VNO Stock Fair Value Calculator

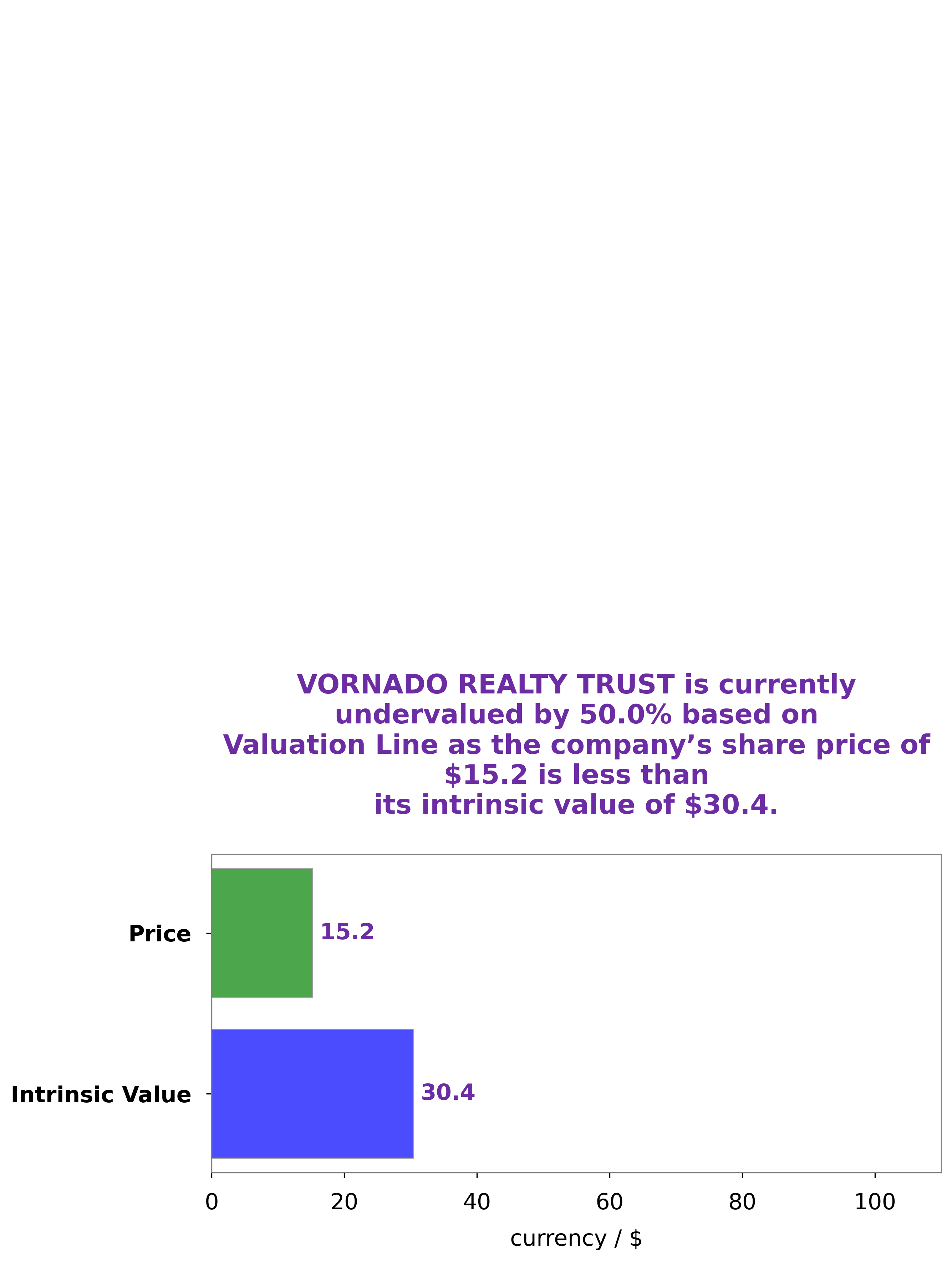

We at GoodWhale recently conducted an analysis of VORNADO REALTY TRUST’s wellbeing. Using our proprietary Valuation Line, we calculated the intrinsic value of VORNADO REALTY TRUST’s share to be around $30.4. However, VORNADO REALTY TRUST’s stock is currently being traded at $15.2, indicating it is undervalued by a whopping 49.9%. This presents an attractive opportunity for investors to buy into the company at a significantly discounted price. More…

Peers

Vornado owns and operates office, retail, and hotel properties in the United States. The company was founded in 1959 and became a public company in 1971. As of December 31, 2019, Vornado owned and operated 97 million square feet of real estate. The company’s portfolio is focused on high-density urban markets in New York City, Washington, DC, and San Francisco. Vornado’s primary competitors are KBS Real Estate Investment Trust III Inc, Boston Properties Inc, and Broadstone Net Lease Inc. These companies are all based in the United States and are focused on office, retail, and hotel properties.

– KBS Real Estate Investment Trust III Inc ($OTCPK:KBSR)

KBS Real Estate Investment Trust III Inc is a real estate investment trust that owns and operates a portfolio of properties in the United States. The company’s portfolio includes office, retail, industrial, and hotel properties. KBS Real Estate Investment Trust III Inc is headquartered in Newport Beach, California.

– Boston Properties Inc ($NYSE:BXP)

Boston Properties Inc is a real estate investment trust that owns, manages, and develops properties in the United States. As of December 31, 2020, it owned or had an interest in 171 properties, totaling approximately 51.4 million square feet. The company was founded in 1970 and is headquartered in Boston, Massachusetts.

– Broadstone Net Lease Inc ($NYSE:BNL)

The company’s market cap is 2.79B as of 2022. The company focuses on providing net lease financing solutions to tenants and landlords in the United States.

Summary

Vornado Realty Trust is a real estate investment trust (REIT) that focuses on acquiring and managing office, retail, and other properties in the United States. Vornado’s stock has been a popular investment option in recent years due to its strong performance and focus on capital preservation. The company offers investors an attractive dividend yield and has a history of consistently increasing its dividend payments.

Its balance sheet is solid, with a strong cash position, low debt, and excellent liquidity. Lastly, Vornado’s management team is highly experienced and knowledgeable in the real estate industry.

Recent Posts