VNO Intrinsic Value – Morgan Stanley Cuts VORNADO REALTY TRUST’s Price Target to $12, Maintains Underweight Rating

June 3, 2023

🌧️Trending News

Morgan Stanley recently announced that it has lowered its price target for Vornado Realty Trust ($NYSE:VNO) from $13 to $12 while maintaining an Underweight rating. It operates in multiple markets across the United States, including New York City, Washington D.C., and San Francisco. It also owns and manages many retail locations such as Whole Foods Market, and recently purchased a stake in JBG Smith, a property management firm. Morgan Stanley’s decision to lower the price target for Vornado Realty Trust is a reflection of the current market conditions and economic uncertainty due to the coronavirus pandemic.

The decision also reflects the fact that the company’s portfolio includes many retail locations, which could see a significant downturn in revenue due to the pandemic. In light of these factors, Morgan Stanley has decided to lower its price target while maintaining an Underweight rating on the stock.

Stock Price

The move sent the stock down by 1.3% from the previous closing price of $13.7 as it opened at $13.6 and closed at the same level. VORNADO REALTY TRUST stock has generally been slipping over the past few months, with this recent move adding more pressure to the stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for VNO. More…

| Total Revenues | Net Income | Net Margin |

| 1.8k | -429.93 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for VNO. More…

| Operations | Investing | Financing |

| 798.94 | -906.86 | -801.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for VNO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.27k | 9.91k | 29.66 |

Key Ratios Snapshot

Some of the financial key ratios for VNO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 16.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – VNO Intrinsic Value

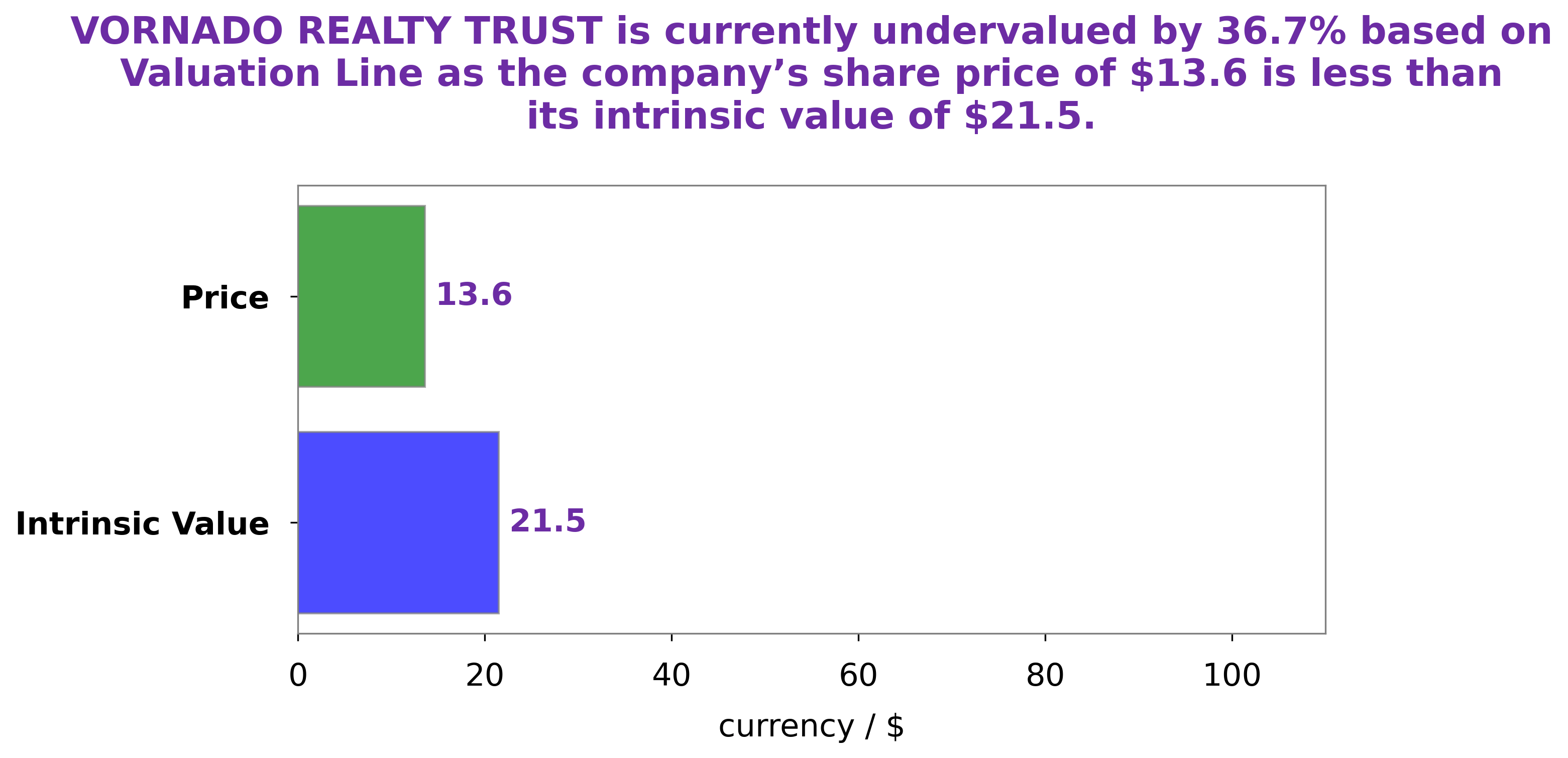

At GoodWhale we conducted an analysis of VORNADO REALTY TRUST’s wellbeing. We used our proprietary Valuation Line to determine the intrinsic value of VORNADO REALTY TRUST share, which we calculated to be around $21.5. By comparison, VORNADO REALTY TRUST stock is currently trading at $13.6, making it significantly undervalued by 36.7%. This presents a great opportunity for investors who are looking to buy VORNADO REALTY TRUST shares at a bargain price. More…

Peers

Vornado owns and operates office, retail, and hotel properties in the United States. The company was founded in 1959 and became a public company in 1971. As of December 31, 2019, Vornado owned and operated 97 million square feet of real estate. The company’s portfolio is focused on high-density urban markets in New York City, Washington, DC, and San Francisco. Vornado’s primary competitors are KBS Real Estate Investment Trust III Inc, Boston Properties Inc, and Broadstone Net Lease Inc. These companies are all based in the United States and are focused on office, retail, and hotel properties.

– KBS Real Estate Investment Trust III Inc ($OTCPK:KBSR)

KBS Real Estate Investment Trust III Inc is a real estate investment trust that owns and operates a portfolio of properties in the United States. The company’s portfolio includes office, retail, industrial, and hotel properties. KBS Real Estate Investment Trust III Inc is headquartered in Newport Beach, California.

– Boston Properties Inc ($NYSE:BXP)

Boston Properties Inc is a real estate investment trust that owns, manages, and develops properties in the United States. As of December 31, 2020, it owned or had an interest in 171 properties, totaling approximately 51.4 million square feet. The company was founded in 1970 and is headquartered in Boston, Massachusetts.

– Broadstone Net Lease Inc ($NYSE:BNL)

The company’s market cap is 2.79B as of 2022. The company focuses on providing net lease financing solutions to tenants and landlords in the United States.

Summary

Morgan Stanley has lowered its price target for Vornado Realty Trust from $13 to $12, maintaining their Underweight rating. Vornado is a real estate investment trust that owns, manages and develops office and retail properties in the United States. Fundamental analysis suggests that Vornado’s stock is currently overvalued. Its earnings per share have decreased in recent years, and there is a lack of growth prospects for the company in the near future.

The real estate market is also volatile due to macroeconomic factors, which adds additional risk to investing in Vornado. As a result, investors should exercise caution when considering investing in Vornado, and consider other stocks with greater potential.

Recent Posts