Vici Properties Intrinsic Value Calculator – (NYSE:VICI) by 2.0% during the fourth quarter, according to its most recent Form 13F filing with the SEC

May 2, 2023

Trending News ☀️

VICI ($NYSE:VICI) Properties Inc. (NYSE: VICI) is a real estate investment trust that owns one of the largest portfolios of gaming, hospitality, and entertainment destinations in the United States. Oppenheimer Asset Management Inc. is an institutional asset manager that provides a variety of services including equity, fixed income, and alternative investments to individuals, institutions, and government clients. The company has a long history of investing in real estate and other investments that offer the potential for attractive returns and a diversified portfolio. VICI Properties Inc. owns some of the most recognizable gaming, hospitality, and entertainment venues in the United States and its portfolio of properties is well-positioned to benefit from the continued growth in these sectors.

Share Price

VICI Properties Inc. opened at $33.7 and closed at $33.8 on Monday, representing a 0.5% decrease from its previous closing price of $33.9. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vici Properties. More…

| Total Revenues | Net Income | Net Margin |

| 2.6k | 1.12k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vici Properties. More…

| Operations | Investing | Financing |

| 1.94k | -9.3k | 6.83k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vici Properties. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 37.58k | 15.29k | 21.21 |

Key Ratios Snapshot

Some of the financial key ratios for Vici Properties are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 62.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – Vici Properties Intrinsic Value Calculator

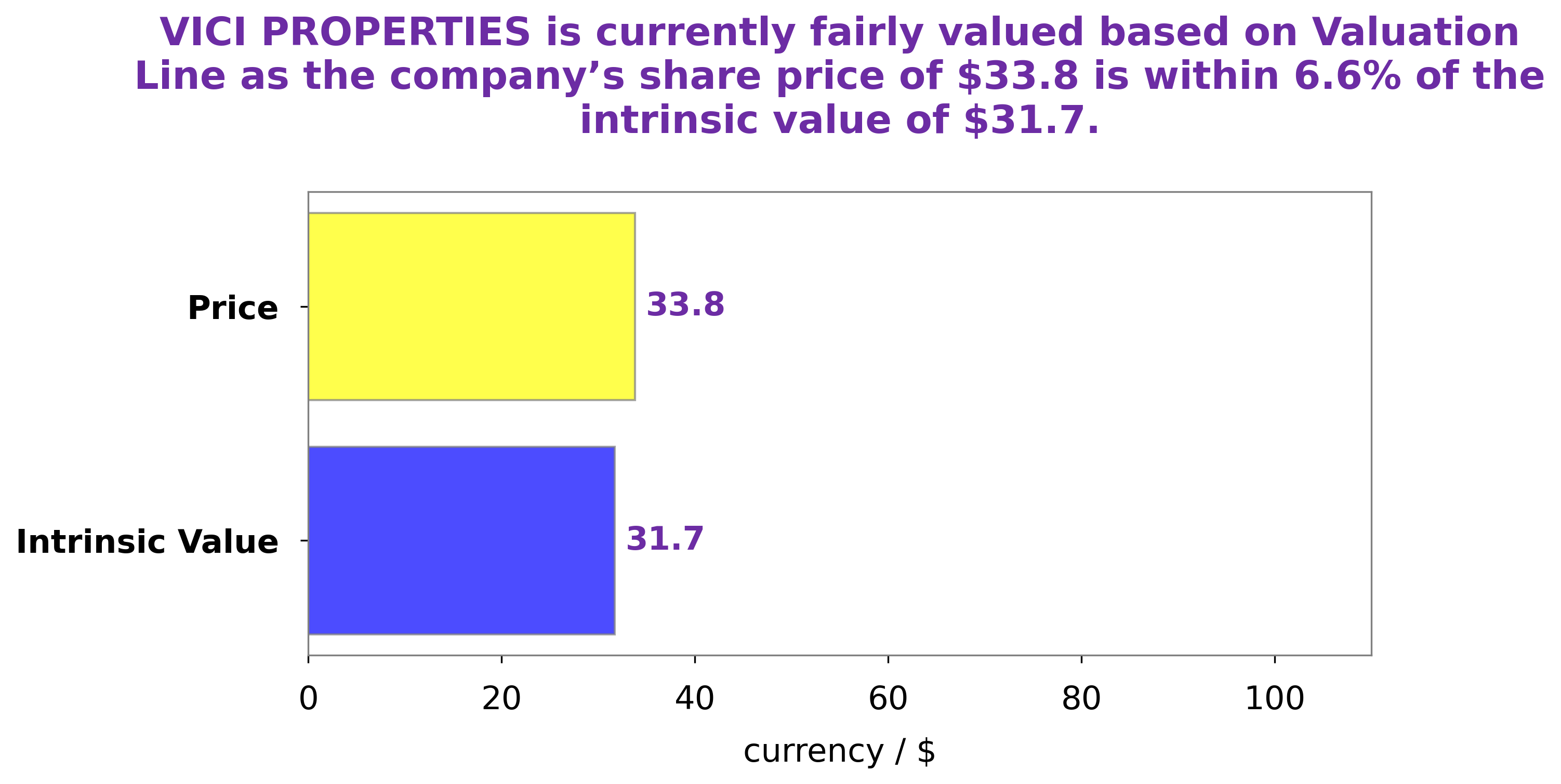

At GoodWhale, we have conducted a comprehensive analysis of VICI PROPERTIES‘ fundamentals. Our proprietary Valuation Line suggests that the fair value of VICI PROPERTIES share is around $31.7. Currently, VICI PROPERTIES stock is traded at $33.8, which means that the stock is slightly overvalued by 6.7%. More…

Peers

The commercial real estate market is highly competitive. Its main competitors are Realty Income Corp, W.P. Carey Inc, and STORE Capital Corp. All of these companies are well-established and have a significant presence in the market. VICI Properties Inc has a competitive advantage in terms of its size and scale, as well as its experience and expertise.

– Realty Income Corp ($NYSE:O)

Realty Income Corporation, together with its wholly-owned subsidiaries, is a real estate investment trust that focuses on the acquisition of net-leased commercial properties in the United States. As of December 31, 2020, the Company’s portfolio consisted of 5,741 properties leased to 492 commercial tenants in 48 states.

– W.P. Carey Inc ($NYSE:WPC)

W.P. Carey Inc is a real estate investment trust that owns and operates a diversified portfolio of properties across the United States. The company has a market cap of 15.41B as of 2022. The company’s portfolio consists of office buildings, warehouses, retail properties, and hotels. The company’s properties are leased to a variety of tenants, including Fortune 500 companies, government agencies, and non-profit organizations.

– STORE Capital Corp ($NYSE:STOR)

As of 2022, STORE Capital Corporation has a market capitalization of $8.94 billion. The company is a real estate investment trust that primarily invests in single-tenant net-leased properties across the United States.

Summary

VICI Properties Inc has seen an increase in investor interest, with Oppenheimer Asset Management Inc. boosting their stake in the company. Analysts have noted VICI’s strong performance in the real estate investment trust (REIT) sector, and their diverse portfolio of gaming, hospitality and entertainment assets. VICI has been successful in their investments, as seen by their focused strategy and careful capital management.

The company is committed to generating reliable income and maximizing shareholder value, making it an attractive option for investors. As a result, analysts remain optimistic about VICI’s growth potential in the coming years.

Recent Posts