Vail Resorts Stock Intrinsic Value – Amalgamated Bank Strengthens Investment in Vail Resorts,

June 12, 2023

☀️Trending News

Vail Resorts ($NYSE:MTN), Inc. is a world-leading mountain resort operator and hospitality company. Its portfolio includes iconic resorts such as Vail, Park City, and Whistler Blackcomb. Recently, Amalgamated Bank has strengthened its investment in Vail Resorts, Inc. by increasing its stake in the company. At Defense World, the bank has diversified its portfolio by investing in Vail Resorts, Inc., a well-known and respected brand in the industry.

The bank’s increasing stake in Vail Resorts, Inc. is a clear indication of its trust in the company’s business model and long-term growth potential. The bank’s additional capital will help the mountain resort operator to explore new opportunities and expand its operations in new markets. This will no doubt be an important step forward for Vail Resorts, Inc. in its effort to become the world’s leading mountain resort operator.

Market Price

The stock opened at $252.1 and closed at $255.1, a 1.0% increase from the previous closing price of 252.5. This strong investment from Amalgamated Bank has highlighted the promising potential of Vail’s stock price in the near future. With the bank’s increased stake in the company, the financial outlook of Vail Resorts, Inc. appears confident and secure.

Investors have expressed their confidence in the company with the steady rise in stock prices over the last few months. It remains to be seen what impact Amalgamated Bank’s increased investment will have on the stock market as a whole. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vail Resorts. More…

| Total Revenues | Net Income | Net Margin |

| 2.89k | 288.03 | 10.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vail Resorts. More…

| Operations | Investing | Financing |

| 664.4 | -313.61 | -843.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vail Resorts. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.2k | 4.6k | 33.04 |

Key Ratios Snapshot

Some of the financial key ratios for Vail Resorts are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.7% | 25.9% | 20.2% |

| FCF Margin | ROE | ROA |

| 12.9% | 26.6% | 5.9% |

Analysis – Vail Resorts Stock Intrinsic Value

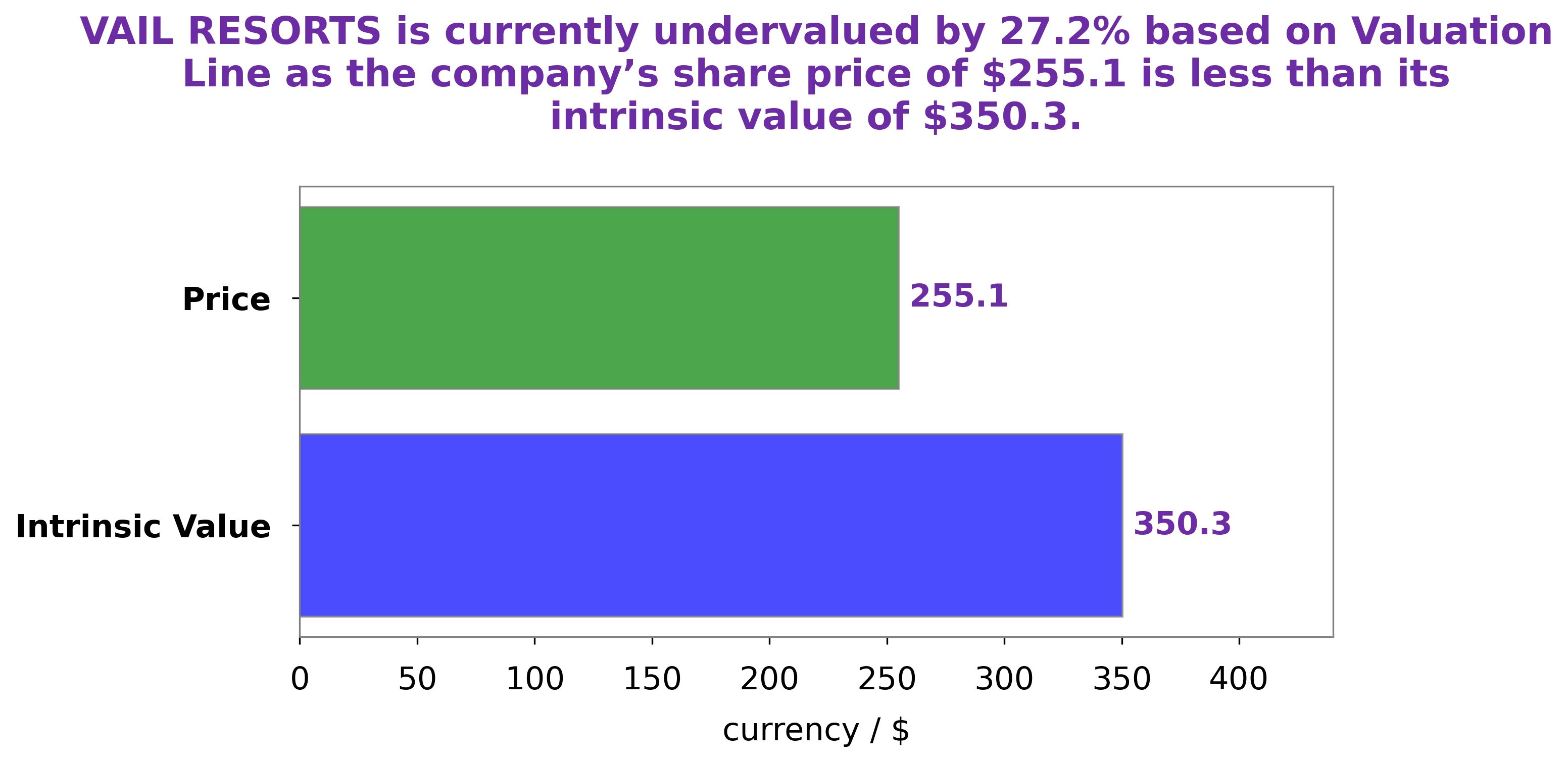

At GoodWhale, we recently conducted an analysis of VAIL RESORTS‘s wellbeing. Our proprietary Valuation Line suggests that the intrinsic value of VAIL RESORTS share is around $350.3. However, the stock is currently traded at $255.1, indicating a 27.2% undervaluation. This could mean that now is the ideal time to invest in VAIL RESORTS, as it could offer good returns in the near future. We recommend keeping track of any developments in the company and its stock performance to be able to make the best decision. More…

Peers

The competition between Vail Resorts Inc and its competitors, Genting Malaysia Bhd, Hilton Grand Vacations Inc, and PT Bukit Uluwatu Villa Tbk, is fierce. Each company is vying for a larger share of the lucrative ski resort market, offering customers an array of services and amenities to attract them to their resorts. As the industry continues to grow, the competition between these companies is expected to increase even more.

– Genting Malaysia Bhd ($KLSE:4715)

Genting Malaysia Bhd is a leading integrated leisure, entertainment and hospitality group in Malaysia. The company is engaged in the development and operation of casinos, resorts, hotels, restaurants and other related businesses. As of 2022, Genting Malaysia Bhd has a market capitalization of 14.96 billion and a Return on Equity of 3.26%. Market capitalization is a measure of the company’s total value, determined by multiplying its total number of shares outstanding by its stock price. Meanwhile, Return on Equity (ROE) is a measure of a company’s profitability that indicates how well it uses the funds it has available to generate profits.

– Hilton Grand Vacations Inc ($NYSE:HGV)

Hilton Grand Vacations Inc is a leading global timeshare company that specializes in the development, marketing, and management of vacation ownership resorts. As of 2022, the company has a market capitalization of 4.74 billion dollars, indicating its strong financial performance and impressive market position. Additionally, it boasts an impressive Return on Equity of 19.1%, demonstrating the company’s successful management of its equity investments. In addition to its size and financial performance, Hilton Grand Vacations Inc is renowned for its excellent customer service and quality products.

– PT Bukit Uluwatu Villa Tbk ($IDX:BUVA)

PT Bukit Uluwatu Villa Tbk is a hospitality company that operates a chain of luxury villas and resorts in Indonesia. The company has a market cap of 408.68B as of 2022, making it one of the largest hospitality companies in the country. Its Return on Equity (ROE) of -2.47% indicates that its current profitability is below the industry average and could be improved upon. The company has been focusing on expanding its presence and improving its services to strengthen its presence in the market, which could help improve its ROE and market cap in the future.

Summary

Amalgamated Bank has recently increased its stock position in Vail Resorts, Inc., a leading global mountain resort operator. The strong performance was attributed to an increase in revenue from ski areas, lodging, and other activities. Analysts are optimistic about the company’s future prospects, citing the successful integration of its new resorts and its ability to capitalize on favorable weather conditions. With increased investor interest and continued positive performance, investors should be optimistic about the company’s long-term prospects.

Recent Posts