Unitil Corporation Stock Intrinsic Value – Unitil Corporation Receives Major Boost from Institutional Investors in 2023

March 31, 2023

Trending News ☀️

In 2023, Unitil Corporation ($NYSE:UTL) (NYSE:UTL), a leading provider of energy services, received a major boost from institutional investors. The company has strong institutional backing, with over 75% of its shares owned by investors such as pension funds and banks. This steady investor support has enabled Unitil to pursue its strategic goals more effectively, enhancing its business and financial performance. It operates in both the electric and natural gas sectors, delivering reliable energy solutions to customers while meeting strict safety and environmental requirements. Unitil’s commitment to customer service and innovative technology has enabled the company to expand its reach and become one of the leading energy providers in the region. Unitil’s long-term success is largely attributable to its ability to attract high caliber investors.

Its portfolio has been bolstered by major investments from institutions like Goldman Sachs, JPMorgan Chase, and Morgan Stanley. Such support from top names in the financial industry has been invaluable for the company’s continued growth and success. The major influx of institutional investors in 2023 reflects Unitil Corporation’s reputation for providing excellent service and value to its customers. By investing in the company, these institutions have provided Unitil with the resources it needs to continue its mission of providing reliable energy solutions to households and businesses in New England. With the support of these institutions, Unitil looks forward to continued growth and sophistication in the years ahead.

Price History

On Thursday, UNITIL CORPORATION saw a major boost in institutional investor support, as the company’s stock opened at $56.3 and closed at $56.4, up 0.6% from its last closing price of 56.1. This marks a notable increase in investor confidence in the company, and suggests that the company is in a good financial standing. UNITIL CORPORATION has experienced significant growth since 2023, and the recent uptick in institutional investor support indicates that the company is headed in the right direction.

With this latest investment, UNITIL CORPORATION is well positioned to capitalize on opportunities for future growth and stability. Furthermore, this increase in investor confidence is likely to positively impact the company’s share value going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Unitil Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 563.2 | 41.4 | 7.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Unitil Corporation. More…

| Operations | Investing | Financing |

| 97.7 | -122.1 | 26.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Unitil Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.59k | 1.12k | 29.15 |

Key Ratios Snapshot

Some of the financial key ratios for Unitil Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.7% | 3.3% | 14.4% |

| FCF Margin | ROE | ROA |

| -4.3% | 10.9% | 3.2% |

Analysis – Unitil Corporation Stock Intrinsic Value

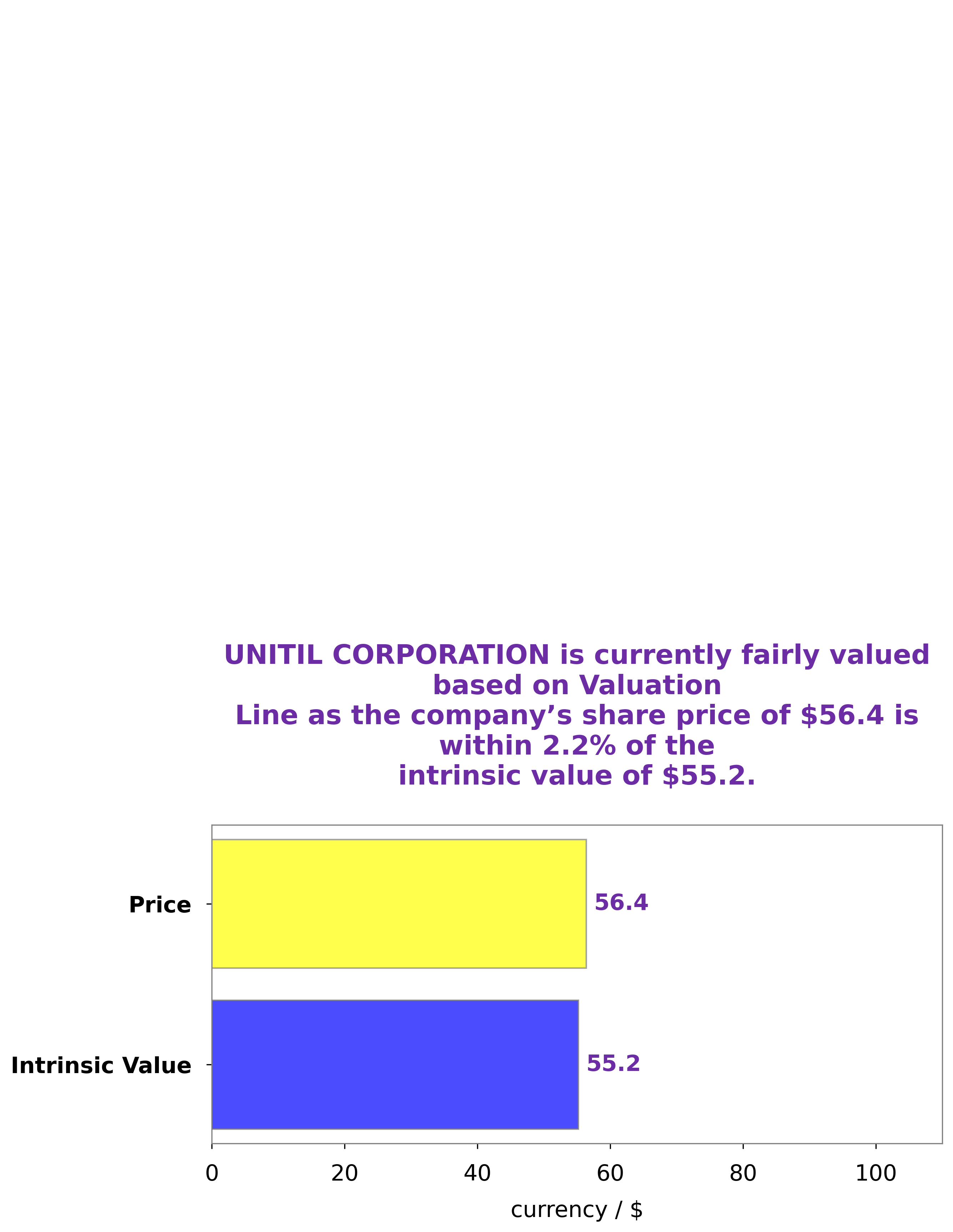

At GoodWhale, we’ve been analyzing UNITIL CORPORATION’s financials to come up with a fair value of its stock. Our proprietary Valuation Line puts UNITIL CORPORATION’s fair value at around $55.2. However, the stock is currently trading at $56.4, making it overvalued by 2.2%. That said, investors should still consider UNITIL CORPORATION as a potential investment opportunity, as its stock could still be undervalued. We recommend that investors do their own due diligence and research into UNITIL CORPORATION’s financials before making a decision. More…

Peers

Unitil provides electricity and natural gas service to over 206,000 customers in New Hampshire, Massachusetts, and Maine, and natural gas service to approximately 5,000 customers in southeastern New Hampshire. The Company’s operating utilities include Fitchburg Gas and Electric Light Company, Granite State Gas Transmission, Inc., Unitil Energy Systems, Inc., and Unitil Service Corp. Avista Corp, NorthWestern Corp, MGE Energy Inc are all competitors of Unitil Corp.

– Avista Corp ($NYSE:AVA)

Avista Corp is a publicly traded company that provides energy services to customers in the Pacific Northwest. The company has a market capitalization of $2.94 billion and a return on equity of 6.4%. Avista Corp is headquartered in Spokane, Washington and has approximately 2,700 employees. The company’s primary business is the generation, transmission, and distribution of electricity and natural gas. In addition to its energy services, Avista Corp also provides water service to customers in Washington and Idaho.

– NorthWestern Corp ($NASDAQ:NWE)

NorthWestern Corp is a US based power delivery company. The company has a market cap of 3.29B as of 2022 and a Return on Equity of 6.65%. The company is engaged in the business of providing electric and natural gas service to customers in Montana, South Dakota and Nebraska.

– MGE Energy Inc ($NASDAQ:MGEE)

MGE Energy Inc is a public utility holding company, which engages in the generation, purchase, transmission, distribution, and sale of electricity. It also generates and sells steam to customers in downtown Madison, Wisconsin. The company was founded in 1896 and is headquartered in Madison, WI.

Summary

UNITIL Corporation, an energy delivery company, has seen a remarkable surge in institutional investor confidence in 2023. This is demonstrated by the significant increase in capital investment and overall interest that these investors have shown. The shift in investor sentiment has been attributed to UNITIL’s aggressive strategies of expanding their market share. This has been achieved through the implementation of innovative strategies and investments in state-of-the-art infrastructure, which has enabled them to remain competitive despite challenging market conditions.

Additionally, UNITIL’s strong balance sheet has allowed them to capitalize on opportunities and increase shareholder value. With strong fundamentals and solid investment prospects, UNITIL is well positioned for sustained success and future growth.

Recent Posts