Uipath Inc Intrinsic Value Calculation – UiPath: The AI Revolution Nobody Is Talking About

June 12, 2023

🌥️Trending News

UIPATH ($NYSE:PATH): UiPath is the AI revolution that’s gaining traction without making a sound. UiPath’s products and services are designed to help organizations reduce costs, improve productivity, and increase customer satisfaction. The company is focused on delivering the most innovative technology and the highest quality services to its customers. UiPath has invested heavily in research and development to build a comprehensive portfolio of solutions for businesses of all sizes. Its products are used to automate manual processes, streamline decisions, and increase efficiency.

UiPath’s technology is helping to reshape how people work, think, and interact with machines. It is helping to revolutionize the way businesses operate and is creating new opportunities for growth. Companies are leveraging UiPath’s AI-driven automation solutions to not only increase efficiency but also to gain a competitive edge. UiPath is the AI revolution that’s gaining huge traction without making a sound – making it a leader in the automation industry.

Share Price

UIPATH Inc., a leading enterprise automation software provider, has been quietly revolutionizing the Artificial Intelligence (AI) industry. On Tuesday, UIPATH’s stock opened at $19.0 and closed at $19.5, representing an increase of 0.3% from the prior closing price of 19.4. This slight uptick in share price was a testament to the great potential of UiPath’s AI-driven automation solutions.

UiPath has been working hard to develop innovative and cost-effective products that can help businesses streamline their operations and maximize efficiency. With its cutting-edge technology, UIPATH is leading the charge in ushering in a new era of AI-driven automation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Uipath Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.1k | -237.69 | -21.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Uipath Inc. More…

| Operations | Investing | Financing |

| 110.24 | -409 | -63.11 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Uipath Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.64k | 687.15 | 3.49 |

Key Ratios Snapshot

Some of the financial key ratios for Uipath Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 46.6% | – | -25.3% |

| FCF Margin | ROE | ROA |

| 8.5% | -9.0% | -6.6% |

Analysis – Uipath Inc Intrinsic Value Calculation

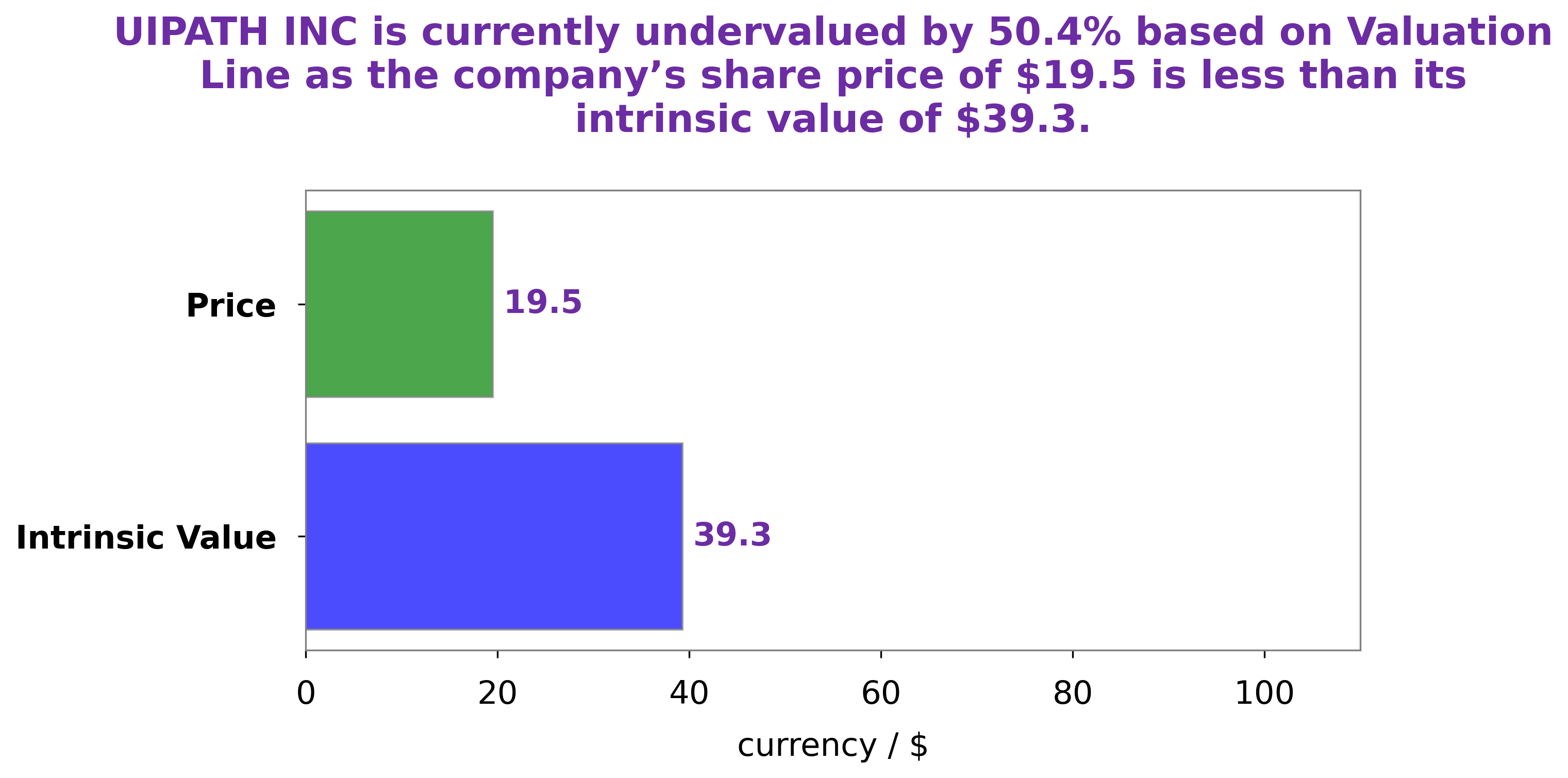

GoodWhale recently conducted an in-depth analysis of UIPATH INC‘s fundamentals. Through our proprietary Valuation Line, we were able to determine a fair value for UIPATH INC’s stock at around $39.3. However, the current trading price of UIPATH INC is only $19.5, indicating that the stock is significantly undervalued by 50.4%. This presents an attractive opportunity for investors who are looking to capitalize on the discrepancy between the fair value and the current price. More…

Peers

In the world of robotic process automation (RPA), there are a few major players. UiPath Inc is one of the largest, and its main competitors are Microsoft Corp, Pegasystems Inc, and Salesforce Inc. While all four companies offer similar products and services, UiPath has managed to set itself apart as a leader in the industry.

– Microsoft Corp ($NASDAQ:MSFT)

Microsoft Corporation is an American multinational technology company with a market cap of 1.78 trillion as of 2021. The company develops, manufactures, licenses, supports, and sells computer software, consumer electronics, personal computers, and related services. Its best known software products are the Microsoft Windows line of operating systems, the Microsoft Office suite, and the Internet Explorer and Edge web browsers. The company’s hardware products include the Xbox video game consoles and the Microsoft Surface lineup of touchscreen personal computers. Microsoft has a Return on Equity of 45.3% as of 2022.

Microsoft was founded by Bill Gates and Paul Allen on April 4, 1975, to develop and sell BASIC interpreters for the Altair 8800. It rose to dominate the personal computer operating system market with MS-DOS in the mid-1980s, followed by Microsoft Windows. The company’s 1986 initial public offering (IPO), and subsequent rise in its share price, created three billionaires and an estimated 12,000 millionaires from Microsoft employees. Since the 1990s, Microsoft has increasingly diversified from the operating system market and has made a number of corporate acquisitions. In May 2011, Microsoft acquired Skype Technologies for $8.5 billion in its largest acquisition to date.

– Pegasystems Inc ($NASDAQ:PEGA)

Pegasystems is a software company that specializes in customer relationship management (CRM) and business process management (BPM) software. The company has a market cap of 2.65B as of 2022 and a return on equity of -51.8%. The company’s products are used by large organizations in a variety of industries, including banking, insurance, healthcare, and manufacturing.

– Salesforce Inc ($NYSE:CRM)

Salesforce is an American cloud-based software company specializing in customer relationship management (CRM) products. As of March 2021, it was the world’s largest CRM company with a market capitalization of over $153 billion. The company’s customer relationship management (CRM) product is called Salesforce CRM.

Salesforce was founded in 1999 by Marc Benioff, Parker Harris, Dave Moellenhoff, and Frank Dominguez as a company specializing in software as a service (SaaS). The company’s initial public offering was in June 2004, raising $110 million. In 2015, Salesforce had annual revenue of $5 billion. In 2016, it was ranked the fastest growing software company in the world with a market capitalization of $50 billion. In 2018, Salesforce was ranked the third most innovative company in the world by Forbes.

Summary

UiPath is an AI-driven Robotic Process Automation (RPA) company that is rapidly gaining traction in the investment world. The company offers an unmatched automation platform that is quickly becoming the industry standard. UiPath has seen its market share skyrocket in recent years, as more companies are recognizing the efficiency gains that RPA can bring. The company’s AI-driven platform can help companies automate mundane tasks and significantly improve operational efficiency.

With a variety of offerings, from process automation to system integration, UiPath provides a comprehensive solution for businesses of any size. Financial analysts are bullish on UiPath as its revenues and margins are expected to grow significantly in the near future. UiPath’s high-quality products, innovative platform, and customer service make it a compelling investment opportunity.

Recent Posts