Ugi Corporation Stock Fair Value – Investors: Now Is The Time To Buy UGI Corporation Stock!

May 23, 2023

Trending News 🌥️

Now is the time to buy UGI ($NYSE:UGI) Corporation stock! With a diversified portfolio of energy-related businesses, UGI Corporation is well positioned to deliver consistent returns for its shareholders. This strong performance has been driven by UGI Corporation’s strategic investments in new technologies and innovation, allowing them to stay ahead of the competition. The company has also taken steps to strengthen its balance sheet and reduce its debt level, setting the stage for future growth.

Share Price

On Monday, the company opened at $28.2 and closed at $28.4, representing a 1.2% increase from the previous closing price of $28.0. This shows a marked improvement in the company’s stock performance compared to the previous day. This upward trend in stock performance is encouraging and suggests that the company’s value may continue to increase as the days pass. Given its current stock performance, UGI Corporation is a viable option for investors looking for a potentially profitable investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ugi Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 9.83k | -607 | -6.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ugi Corporation. More…

| Operations | Investing | Financing |

| 1.07k | -1.01k | -51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ugi Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.13k | 11.94k | 28.94 |

Key Ratios Snapshot

Some of the financial key ratios for Ugi Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.4% | 3.4% | -5.5% |

| FCF Margin | ROE | ROA |

| 2.5% | -6.6% | -2.0% |

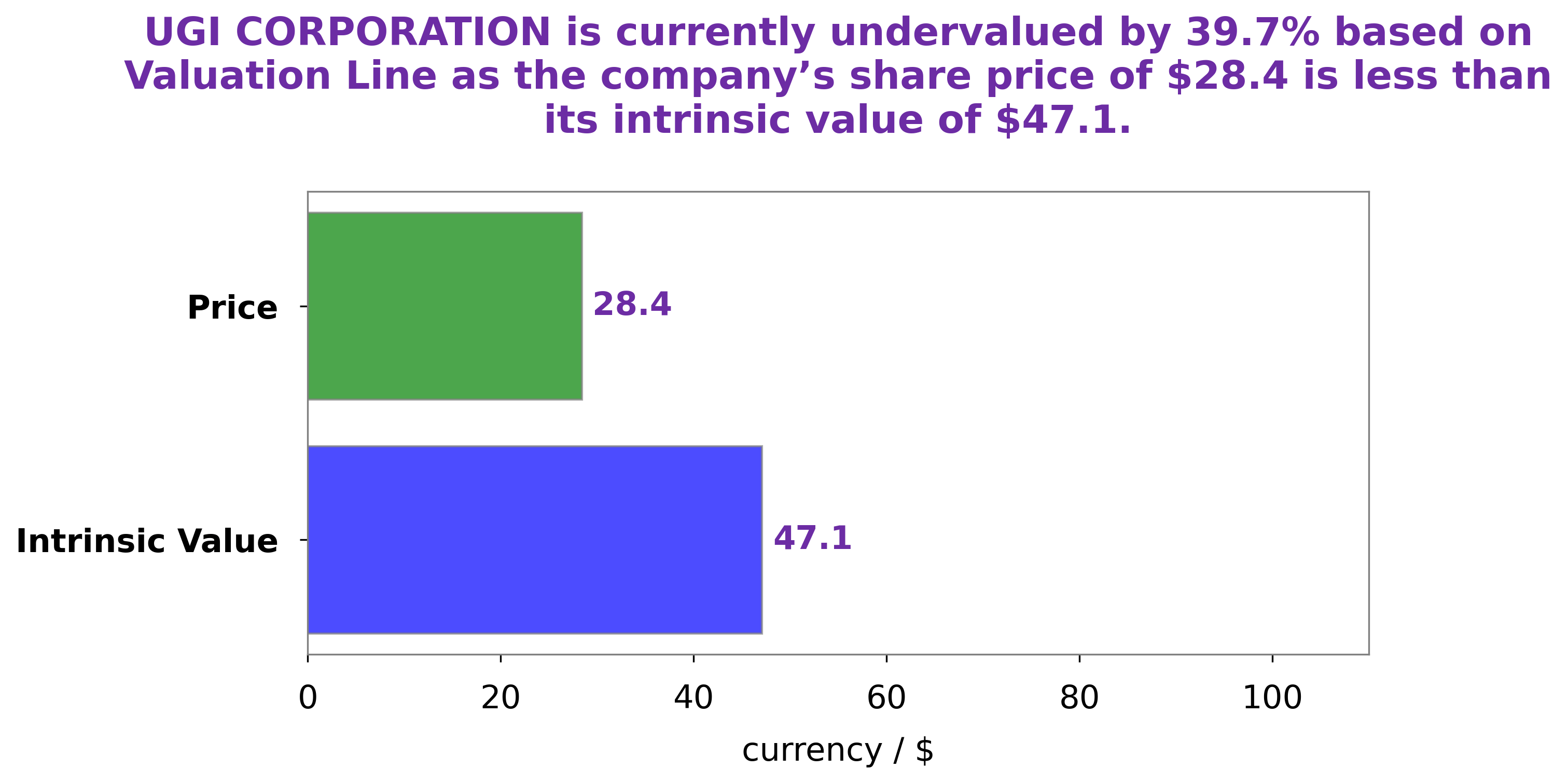

Analysis – Ugi Corporation Stock Fair Value

GoodWhale has conducted an analysis of UGI Corporation’s fundamentals and has found that its intrinsic value is around $47.1, as determined by our proprietary Valuation Line. This means that the current share price of $28.4 is undervalued by 39.8%. It is our belief that investors should consider UGI CORPORATION stock as a sound investment opportunity. More…

Peers

UGI Corp competes with Chesapeake Utilities Corp, SSE PLC, and Spire Inc in the energy sector. All four companies are engaged in the business of providing energy services, including natural gas, electricity, and propane. All four companies have a presence in the United States, with UGI Corp and Chesapeake Utilities Corp having their headquarters in the US. SSE PLC is headquartered in the UK, while Spire Inc is headquartered in Missouri, US.

– Chesapeake Utilities Corp ($NYSE:CPK)

The company’s market cap is 2.17B as of 2022 and its ROE is 10.92%. The company is a diversified energy delivery company that provides natural gas and electricity to customers in Delaware, Maryland, and Virginia. The company also provides propane gas service in Maryland and Delaware.

– SSE PLC ($LSE:SSE)

SSE PLC is a Scottish electricity company that is headquartered in Perth. The company has a market cap of 16.48B as of 2022 and a Return on Equity of 29.62%. SSE PLC is involved in the generation, transmission, distribution and supply of electricity. The company also has a retail division which supplies gas and electricity to customers in the UK.

– Spire Inc ($NYSE:SR)

Spire Inc. is a publicly traded energy services holding company based in St. Louis, Missouri. The Company, through its subsidiaries, engages in the purchase, sale, and transportation of natural gas in the United States. It operates through two segments: Gas Utility and Gas Marketing. The Gas Utility segment provides retail natural gas service to approximately 547,200 residential, commercial, and industrial customers in Missouri, Alabama, and Mississippi. The Gas Marketing segment purchases, sells, and transports natural gas to electric utilities, local distribution companies, interstate pipelines, producers, and other market participants.

Summary

UGI Corporation is a leading international distributor and marketer of energy and related products and services with operations in the United States, Canada, the United Kingdom and Continental Europe. The company has a strong balance sheet and a solid dividend history. Recent financial performance has been strong, with revenue and earnings up significantly in the last three quarters. UGI also has a strong share price performance, with a total return of over 40 percent year-to-date.

UGI’s competitive advantages include its strong customer relationships, diverse product offering, well-established infrastructure, and management’s focus on cost-efficiency. The stock is attractively priced relative to its peers and offers a good risk/reward ratio for investors.

Recent Posts