Ufp Industries Stock Intrinsic Value – UFP Industries Expands Presence in Mexico with Consolidation of Two Packaging Companies

December 8, 2023

☀️Trending News

UFP ($NASDAQ:UFPI) Industries, Inc. is a leading global producer and distributor of engineered wood products, lumber, and other building materials with an extensive portfolio of brands serving customers around the world. The company recently announced the consolidation of two packaging businesses located in Mexico to expand its presence in the region. The consolidation of the two companies, CajaMexico and Pro Cartón, is part of UFP Industries’ ongoing efforts to expand its global footprint and diversify its product offerings. The merger was completed earlier this year and will allow UFP Industries to better serve its customers in the region by providing a more comprehensive range of packaging solutions.

Additionally, UFP Industries will benefit from the increased efficiency that comes from having two companies operate under one roof. The company plans to streamline its production process by leveraging technology and automation to further increase efficiency. This cost savings will be reinvested in research and development to ensure UFP Industries remains at the forefront of the packaging industry. This merger is part of UFP Industries’ larger strategy to expand its presence in Mexico and Latin America. The company now operates nine facilities in Mexico and is looking to continue to grow in the region. These investments are expected to generate additional jobs and provide a boost to the local economy. UFP Industries’ expansion into Mexico is another example of the company’s commitment to providing high-quality products and services to its customers around the world. With this latest move, UFP Industries is sure to remain a leader in the packaging industry for years to come.

Price History

On Tuesday, UFP Industries made headlines as their stock opened at $113.6 before closing at $113.7. This surge marks the beginning of the company’s strategic expansion into Mexico, as it recently announced their consolidation of two Mexican packaging companies. UFP Industries will also be able to expand their range of packaging materials, including corrugated paperboard and plastic containers. This wide variety of materials will make it easier for customers to find the perfect packaging solution for their product needs.

UFP Industries is dedicated to providing quality services and products to customers around the world. With their consolidation of two Mexican companies, they have taken a significant step forward in their mission to deliver superior products and services globally. UFP Industries is confident that their strategic expansion into Mexico will allow them to reach even more customers and increase their global presence. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ufp Industries. More…

| Total Revenues | Net Income | Net Margin |

| 7.61k | 537.94 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ufp Industries. More…

| Operations | Investing | Financing |

| 1.01k | -318.77 | -184.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ufp Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.02k | 1.05k | 47.99 |

Key Ratios Snapshot

Some of the financial key ratios for Ufp Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.9% | 30.8% | 9.2% |

| FCF Margin | ROE | ROA |

| 10.8% | 15.0% | 10.8% |

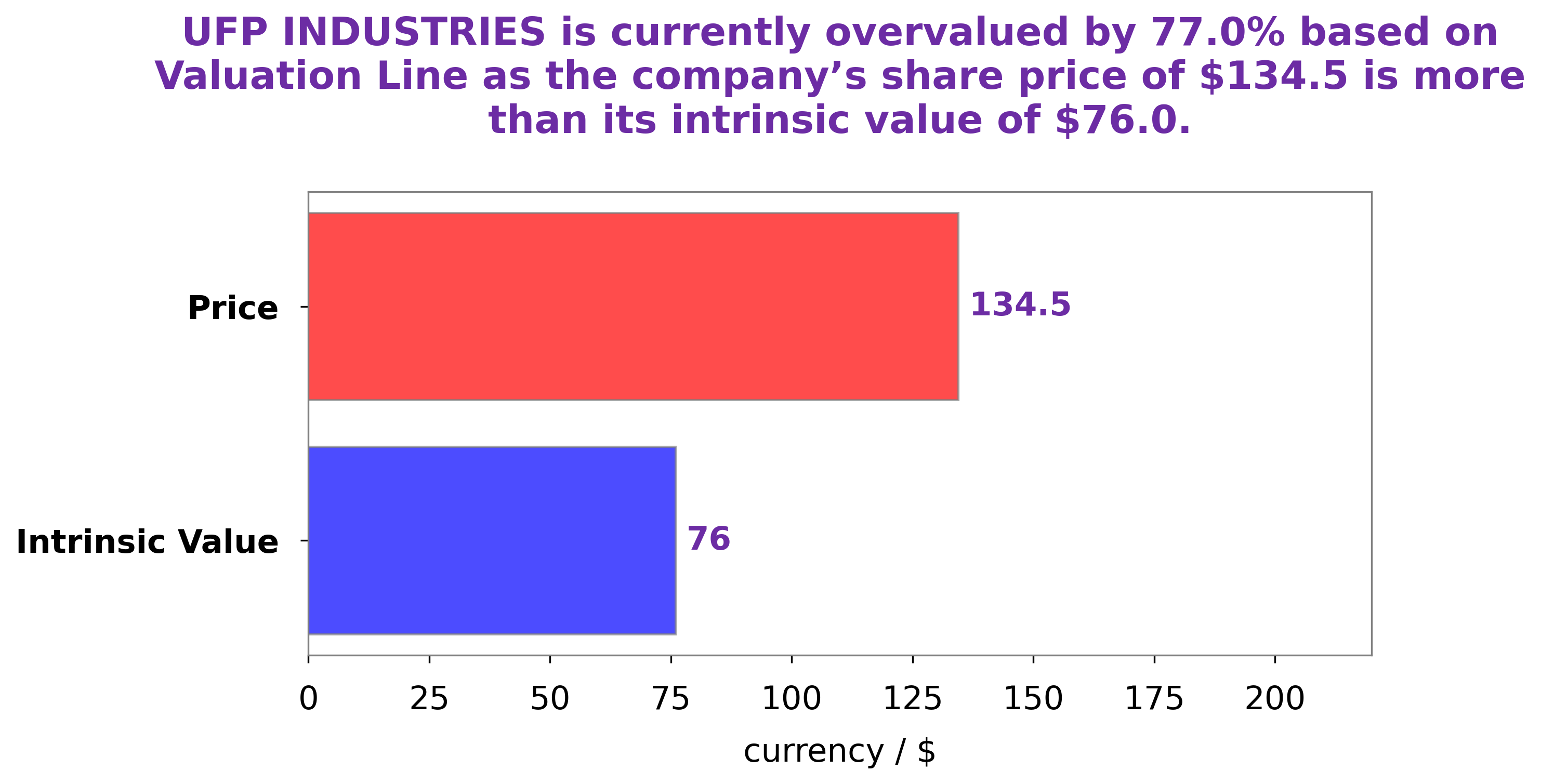

Analysis – Ufp Industries Stock Intrinsic Value

At GoodWhale, we recently performed an analysis of UFP INDUSTRIES‘s wellbeing. Our proprietary Valuation Line was used to calculate the fair value of UFP INDUSTRIES share to be around $75.3. However, the stock is currently being traded at $113.7, which is overvalued by 51.0%. This suggests that now might be a good time to consider buying UFP INDUSTRIES stock. More…

Peers

UFP Industries Inc is one of the largest producers of wood products in North America. The company’s competitors include Blue Star Opportunities Corp, Interfor Corp, and West Fraser Timber Co. Ltd.

– Blue Star Opportunities Corp ($OTCPK:BSTO)

Interfor Corp is a Canadian forestry company with operations in British Columbia, Washington state, and Oregon. The company has a market cap of 1.23 billion Canadian dollars as of 2022. The company’s return on equity is 34.77%. Interfor Corp is engaged in the business of growing and harvesting trees, and manufacturing and selling lumber and wood products. The company’s products are used in the construction, industrial, and retail markets.

– Interfor Corp ($TSX:IFP)

As of 2022, West Fraser Timber Co. Ltd. had a market capitalization of $8.54 billion. The company had a return on equity of 26.74%. West Fraser Timber Co. Ltd. is a forest products company that produces lumber, wood chips, and other forest products. The company was founded in 1955 and is headquartered in Vancouver, Canada.

Summary

UFP Industries is a leading producer of packaging and building materials, recently having consolidated two Mexico-based packaging firms to become a more diversified global leader in the space. Investors should take note of UFP Industries due to its strong track record of financial performance and successful acquisitions. The company has reported steady growth across various key metrics such as revenue, net income, gross profit, and operating income.

Additionally, UFP Industries has displayed strong pricing power as evidenced by its consistently increasing prices and gross margins. The company’s strategic acquisitions have also helped it to expand its customer base and geographic reach, positioning it for further growth. With a low debt-to-equity ratio and no significant liabilities, UFP Industries looks well-positioned to continue its strong performance into the future.

Recent Posts