Treehouse Foods Intrinsic Value Calculator – Investors Optimistic About TreeHouse Foods’ Future Prospects

June 11, 2023

☀️Trending News

TREEHOUSE ($NYSE:THS): Investors have been optimistic about TreeHouse Foods, Inc. as the company continues to demonstrate strong growth potential. TreeHouse Foods is a leading manufacturer and distributor of packaged foods and beverages across the United States and Canada. The company offers a wide variety of products, including granola bars, macaroni and cheese, snacks, and frozen meals.

In addition, TreeHouse Foods specializes in private label food products, offering superior quality at a lower cost than its competitors. TreeHouse Food’s stock has been steadily rising over the last year, reflecting the company’s strong performance. Earnings per share have increased by double-digits in the last year, as the company has achieved significant growth in both revenue and profits. Investors have also been pleased with TreeHouse Foods’ commitment to innovation, with the company actively researching new products for its portfolio. The company has also made strategic investments in its operations to ensure continued efficient production. TreeHouse Foods is well-positioned for future growth, as its products remain popular among consumers. The company’s broad portfolio will be further bolstered by its continued focus on innovation and efficiency. With a strong financial position and an experienced management team, TreeHouse Foods is expected to remain a market leader for years to come. Investors are optimistic that the company will continue to generate long-term value for shareholders.

Stock Price

Investors are feeling optimistic about the future of TreeHouse Foods (THS) after the company’s stock opened at $48.9 and closed up 1.8% at $49.8 on Friday. This was a rise from its prior closing price of $49.0. Investors are banking on this growth continuing in the future, and have been encouraged by strong positive signals from the company’s quarterly earnings reports. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Treehouse Foods. More…

| Total Revenues | Net Income | Net Margin |

| 3.58k | -128.1 | 1.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Treehouse Foods. More…

| Operations | Investing | Financing |

| -111 | 405.7 | -470.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Treehouse Foods. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.25k | 2.55k | 30.27 |

Key Ratios Snapshot

Some of the financial key ratios for Treehouse Foods are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.0% | -22.0% | 2.9% |

| FCF Margin | ROE | ROA |

| -6.1% | 3.9% | 1.5% |

Analysis – Treehouse Foods Intrinsic Value Calculator

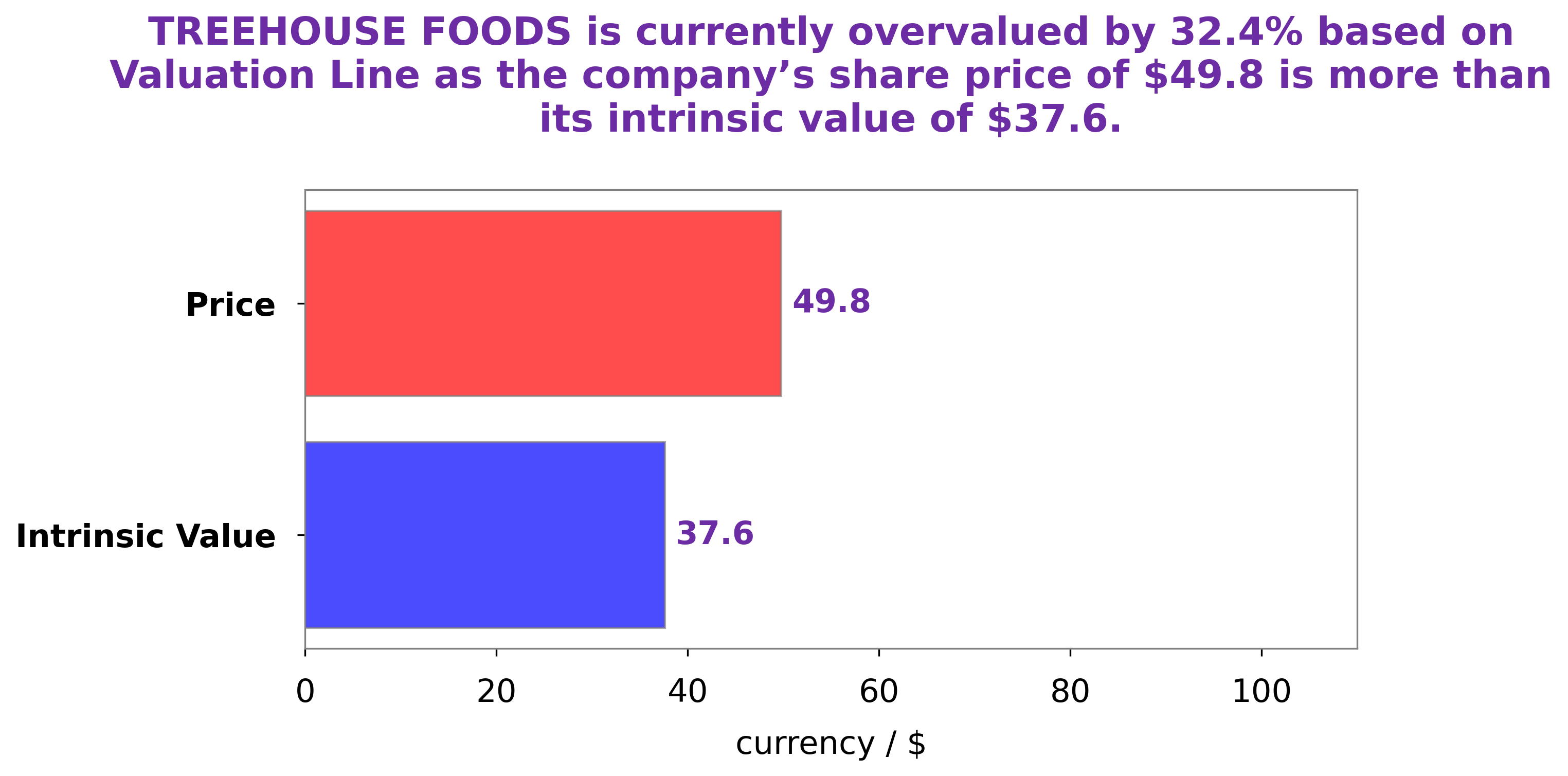

At GoodWhale, we analyze companies’ financials to help investors make informed decisions. One company that we recently took a look at is Treehouse Foods. After analyzing the company’s financials with our proprietary Valuation Line, we determined that the intrinsic value of the shares is about $37.6. Currently, Treehouse Foods’ stock is trading at $49.8, meaning it is overvalued by 32.6%. We believe investors should exercise caution when considering investing in Treehouse Foods’ stock. More…

Peers

The company was founded in 2004 and offers a variety of food products, including condiments, snacks, and meal kits. The company’s products are sold under a number of brand names, including Treehouse, Mrs. Dash, and Orville Redenbacher’s. The company has a number of competitors in the food manufacturing industry, including Bega Cheese Ltd, Post Holdings Inc, and JM Smucker Co.

– Bega Cheese Ltd ($ASX:BGA)

Bega Cheese Ltd is an Australian cheese manufacturer. The company has a market cap of 1.02 billion as of 2022 and a return on equity of 2.08%. The company produces a variety of cheeses, including cheddar, mozzarella, Swiss, and Parmesan. It also produces processed cheese, butter, and cream.

– Post Holdings Inc ($NYSE:POST)

Post Holdings Inc is a food and beverage company that manufactures, markets, and sells branded packaged foods in the United States. The company has a market cap of $5.5 billion and a return on equity of 22.81%. The company’s products include cereal, granola, oatmeal, pancakes, breading, croutons, and condiments. The company’s brands include Post, Shredded Wheat, Great Grains, Honey Bunches of Oats, Raisin Bran, Grape-Nuts, and Honey Comb.

– JM Smucker Co ($NYSE:SJM)

The J.M. Smucker Company has a market capitalization of $15.94 billion as of March 2022 and a return on equity of 7.03%. The company produces and markets food and beverage products, including coffee, peanut butter, shortening and oils, ice cream toppings, frozen juices and drinks, canned fruits and vegetables, condiments, and baking mixes under the following brand names: Smucker’s, Folgers, Dunkin’ Donuts, Jif, Crisco, Pillsbury, R.W. Knudsen Family, Hungry Jack, Café Bustelo, Martha White, truRoots, Sahale Snacks, Robin Hood, and Bick’s.

Summary

TreeHouse Foods, Inc. is a food manufacturing and processing company that has been showing strong performance in the stock market. Recent financial reports have indicated positive results, signaling to investors that the company is on a strong growth trajectory. The company has been focusing on new product development, innovative packaging, and cost containment strategies to improve its competitive position within the industry.

Additionally, recent strategic acquisitions and joint ventures have provided TreeHouse Foods with additional resources that are expected to further strengthen their business. Overall, investors appear satisfied with TreeHouse Foods’ prospects, viewing the company as a sound investment.

Recent Posts