Transocean Ltd Stock Fair Value – Transocean LTD Fleet Status Report Unlikely to Offer Share Price Boost

April 21, 2023

Trending News ☀️

Despite the new report, analysts predict that it is unlikely that the stock price of Transocean ($NYSE:RIG) will be boosted by the report. Transocean is a leading provider of offshore contract drilling services for oil and gas wells. The company owns and operates one of the world’s most modern and versatile fleets of offshore drilling rigs. The company is listed on the New York Stock Exchange and its stock price has been volatile over the past few months. The updated Fleet Status Report provides details on the utilization rate and performance of each rig in the fleet, including maintenance activities and details of any contracts that have been cancelled or extended.

However, despite the release of this report, analysts believe that it is unlikely to have a direct effect on the stock price. This is because the fleet performance is only one part of the overall performance of the company, which also depends on factors such as demand for oil and gas, pricing and geopolitical events.

Price History

On Wednesday, TRANSOCEAN LTD stock opened at $6.4 and closed at $6.3, down by 4.4% from its prior closing price of 6.6. The decrease in share price was likely a reaction to the company’s fleet status report which showed a mixed picture of its fleet operations. The report indicated that while the company had added new rigs, it had also seen an increase in idle rigs, but the overall impact on share price was relatively muted. The company has seen a slight increase in its dayrates, which is reflective of a global recovery in oil prices, however, the lack of any major developments in the report meant that the share price was unlikely to be boosted by the results.

While the report showed that the company is making gradual progress, it was not enough to inspire increased investor confidence and optimism. Overall, despite some encouraging signs from the fleet status report, TRANSOCEAN LTD stock is unlikely to experience any major gains in the near future. The company will need to continue to show positive results in its upcoming reports in order to attract more investors and restore confidence in the stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transocean Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 2.58k | -621 | -24.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transocean Ltd. More…

| Operations | Investing | Financing |

| 448 | -757 | -112 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transocean Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.44k | 9.64k | 14.95 |

Key Ratios Snapshot

Some of the financial key ratios for Transocean Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.9% | -32.0% | -0.0% |

| FCF Margin | ROE | ROA |

| -10.4% | -0.0% | -0.0% |

Analysis – Transocean Ltd Stock Fair Value

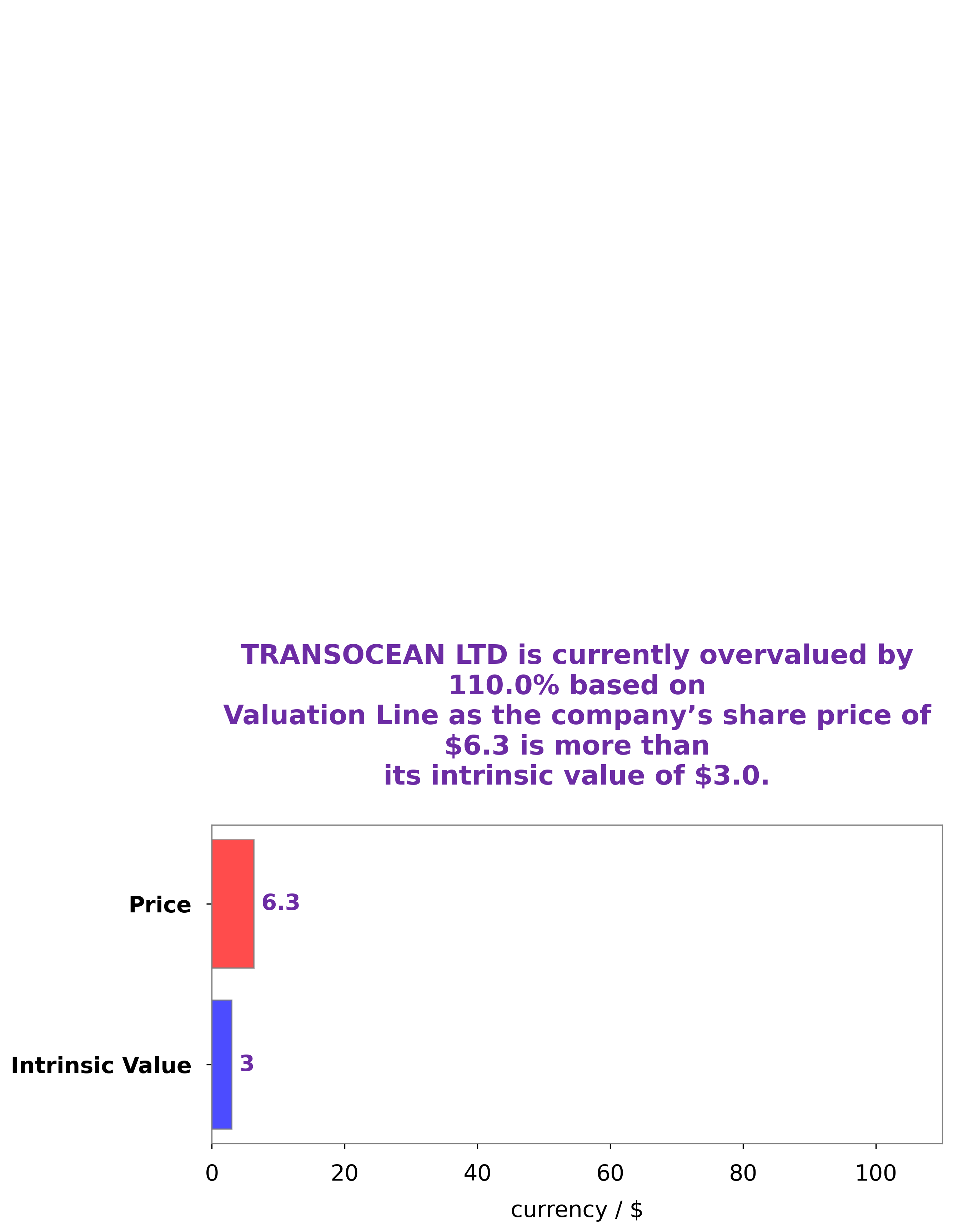

At GoodWhale, we have conducted an in-depth analysis of TRANSOCEAN LTD‘s financials. Our proprietary Valuation Line has determined that the intrinsic value of TRANSOCEAN LTD share is around $3.0. However, the current market price for the stock is $6.3, representing an overvaluation of 108.2%. Given this discrepancy between the intrinsic value and the current market price, we believe that investors should take caution when considering an investment in TRANSOCEAN LTD. More…

Peers

The company operates a fleet of 79 rigs, including 47 ultra-deepwater rigs, 19 harsh-environment rigs, and 13 midwater rigs. Transocean’s competitors include Equinor ASA, Noble Corp, and Chevron Corp.

– Equinor ASA ($OTCPK:STOHF)

Equinor ASA is a Norwegian multinational oil and gas company headquartered in Stavanger, Norway. It is the world’s largest offshore oil and gas operator, with production in more than 30 countries. The company has a market cap of 119.29B as of 2022 and a Return on Equity of 116.26%. Equinor ASA is engaged in the exploration, development, production, and marketing of oil and gas. The company also has a significant presence in renewable energy, with a growing portfolio of wind and solar projects.

– Noble Corp ($NYSE:NE)

Noble Corp is a leading offshore drilling contractor for the oil and gas industry. The company has a market cap of 4.85B as of 2022 and a Return on Equity of -152.13%. Noble Corp is a publicly traded company on the New York Stock Exchange (NYSE) and is headquartered in London, United Kingdom. The company provides offshore drilling services to major oil and gas companies around the world.

– Chevron Corp ($NYSE:CVX)

Chevron Corp is an American oil and gas company with a market cap of 347.59B as of 2022. The company has a Return on Equity of 18.98%. Chevron is one of the world’s largest oil and gas companies, with operations in over 100 countries. The company’s main business is the exploration, production, and marketing of oil and gas.

Summary

Transocean Ltd., a Swiss provider of offshore drilling services and equipment, is a company that has seen its stock price move down in recent days following the release of a fleet status report. Investors have been concerned that the report could be an indication of a lack of new business for the company, which has put pressure on Transocean’s stock. Analysts have recommended investors to closely monitor the company’s finances to gain a better understanding of what direction the shares may take in the coming months and years. Despite the current negative sentiment, some investors remain optimistic about Transocean’s long-term prospects, as the company continues to invest in new technologies and services that could help it gain market share in the future.

Recent Posts