TPB Intrinsic Value Calculation – InvestorsObserver Gives Turning Point Brands a 44 Rating in the Tobacco Industry

April 9, 2023

Trending News 🌥️

InvestorsObserver recently gave Turning Point Brands ($NYSE:TPB) Inc. a 44 rating in the Tobacco industry. The rating places the company’s stock in the middle range of the industry, leaving many investors to question if it is a good buy. The company specializes in providing an array of tobacco products, including moist snuff, cigarettes, cigars and electronic nicotine delivery systems. The company operates four distinct business units: Zig-Zag, Stoker’s, VaporBeast and Prime Time International.

Each of these units offers different products that are tailored to meet the needs of the company’s customers. The company has a long history of successful growth and operations, and its diverse product offering puts it in a strong position for further growth.

Stock Price

On Monday, the company’s stock opened at $21.0 and closed at $21.2, representing a 1.0% increase from its previous closing price of $21.0. This marks a welcome change from last week’s dip in the stock’s value, indicating that investors are beginning to show more confidence in the company.

However, its impressive performance on Monday is likely a result of more than just its success in the industry. Investors seem to be looking favorably on several of the company’s recent moves, including its decision to expand into new markets and its push to introduce new innovations into its product line. With a 44 rating from InvestorsObserver, Turning Point Brands is well-positioned to take advantage of the current market conditions and grow its business. The company’s stock has been steadily climbing since Monday, proving that investors are confident in the company’s ability to deliver long-term value. With the right strategy and continued success, Turning Point Brands could be a solid investment for the savvy investor. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TPB. More…

| Total Revenues | Net Income | Net Margin |

| 415.01 | 11.64 | 9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TPB. More…

| Operations | Investing | Financing |

| 30.27 | -18.79 | -43.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TPB. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 572.11 | 458.73 | 6.39 |

Key Ratios Snapshot

Some of the financial key ratios for TPB are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.7% | 41.1% | 8.6% |

| FCF Margin | ROE | ROA |

| 5.4% | 18.5% | 3.9% |

Analysis – TPB Intrinsic Value Calculation

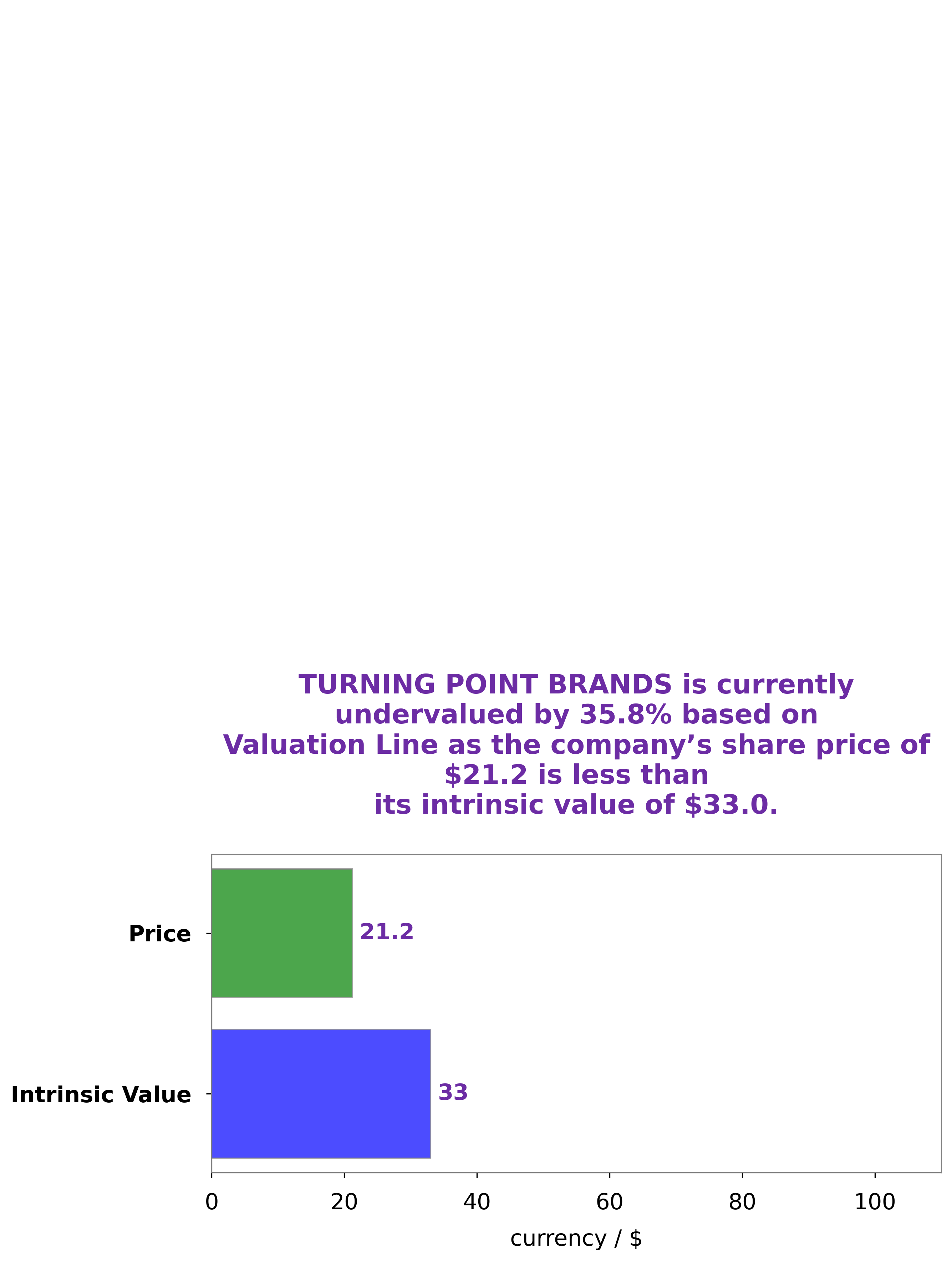

At GoodWhale, we have taken an in-depth look at the financials of Turning Point Brands (TPB). After analyzing the company’s data and comparing it to similar companies in the industry, our proprietary Valuation Line has established a fair value of $33.0 for TPB’s stock. As of now, TPB is trading at $21.2 – a 35.7% discount to its fair value price. This indicates that TPB could be significantly undervalued, making it a potential buy opportunity. More…

Peers

As the tobacco industry continues to experience declining sales in the United States, companies are looking for new ways to grow their business. One area of opportunity is the e-cigarette market. Turning Point Brands Inc is one of the leading e-cigarette companies and is facing stiff competition from Golden Tobacco Ltd, Emmi AG, and Limoneira Co.

– Golden Tobacco Ltd ($BSE:500151)

Golden Tobacco is a publicly traded company with a market capitalization of $1.36 billion as of 2022. The company’s return on equity (ROE) is -5.23%. Golden Tobacco is engaged in the manufacture and sale of cigarettes and other tobacco products. The company’s products are sold in over 50 countries worldwide. Golden Tobacco has a long history, dating back to the early 1800s. The company is headquartered in London, England.

– Emmi AG ($LTS:0QM5)

Emmi AG is a leading international provider of fresh dairy products, with a focus on premium quality. The company has a market cap of 4.1B as of 2022 and a return on equity of 15.21%. Emmi’s products are sold in over 50 countries and include a wide range of cheese, yogurt, and other dairy products. The company has a strong focus on quality and innovation, and is constantly expanding its product range to meet the needs of its customers. Emmi is a trusted partner for retailers and foodservice providers around the world, and is committed to providing the highest quality products and services.

– Limoneira Co ($NASDAQ:LMNR)

Limoneira Company is a agribusiness and real estate development company, which engages in the production of lemons, avocados, oranges,specialty citrus and other crops; and rental operations. The company was founded in 1893 and is headquartered in Santa Paula, CA.

Summary

Turning Point Brands is a publicly traded company in the tobacco industry. This indicates that it is a potentially viable investment for those looking for exposure to this market. Fundamental analysis of the company reveals that it has a high current ratio, indicating strong liquidity, and its debt-to-equity ratio is below the industry average. With a moderate dividend yield and above-average share price performance, Turning Point Brands may be an attractive option for those looking to invest in the tobacco industry.

Recent Posts