Tongkun Group Intrinsic Value Calculator – Tongkun Group Poised to Benefit from Booming Polyester Fiber Industry

June 4, 2023

☀️Trending News

The Tongkun Group ($SHSE:601233) is well-positioned to take advantage of the boom in the polyester fiber industry. According to market research, the polyester fiber industry is anticipated to experience the greatest growth in the near term. This expected growth is driven by increased demand for synthetic fabrics in the fashion and apparel industries. It is engaged in the production, distribution, and sale of polyester, nylon, spandex, and other fibers. The company also manufactures and sells fabrics, apparel, and chemical products.

The company’s experienced management team is familiar with the industry dynamics and is well-equipped to take swift action to capitalize on the opportunities presented by this boom. Furthermore, Tongkun Group has built strong relationships with its suppliers, allowing it to take advantage of favorable deals. Overall, with its strong fundamentals and strategic positioning, Tongkun Group is well-poised to leverage the expected growth in the polyester fiber industry.

Share Price

On Monday, the company’s stock opened at CNY12.2 and closed at CNY12.1, down by 0.5% from the previous closing price of 12.2. This could be seen as a sign of the company’s strength, as other stocks in the same industry have been hit hard by the ongoing fluctuation in the global economy. The polyester fiber industry is expected to continue to grow in the near future, driven by increasing demand from the apparel, automotive, and other industries. The demand for polyester fibers is expected to increase as more companies shift to sustainable and eco-friendly materials. The company has a wide range of products catering to different industries and has a strong presence in both domestic and international markets. It has a diversified portfolio with products ranging from conventional polyester fibers to specialized fibers for automotive applications.

Additionally, Tongkun Group has also established a strong technology base for manufacturing and research capabilities that have enabled it to stay ahead of its competition. All these factors position Tongkun Group as one of the most promising companies in the polyester fiber industry. With its expansive product portfolio and strong technology base, it is well-poised to capitalize on the expected growth of the industry and benefit from the booming global market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tongkun Group. More…

| Total Revenues | Net Income | Net Margin |

| 64.91k | -1.86k | -2.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tongkun Group. More…

| Operations | Investing | Financing |

| 2.51k | -16.15k | 13.88k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tongkun Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 91.83k | 57.31k | 14.39 |

Key Ratios Snapshot

Some of the financial key ratios for Tongkun Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | 2.8% | -2.6% |

| FCF Margin | ROE | ROA |

| -19.2% | -3.1% | -1.1% |

Analysis – Tongkun Group Intrinsic Value Calculator

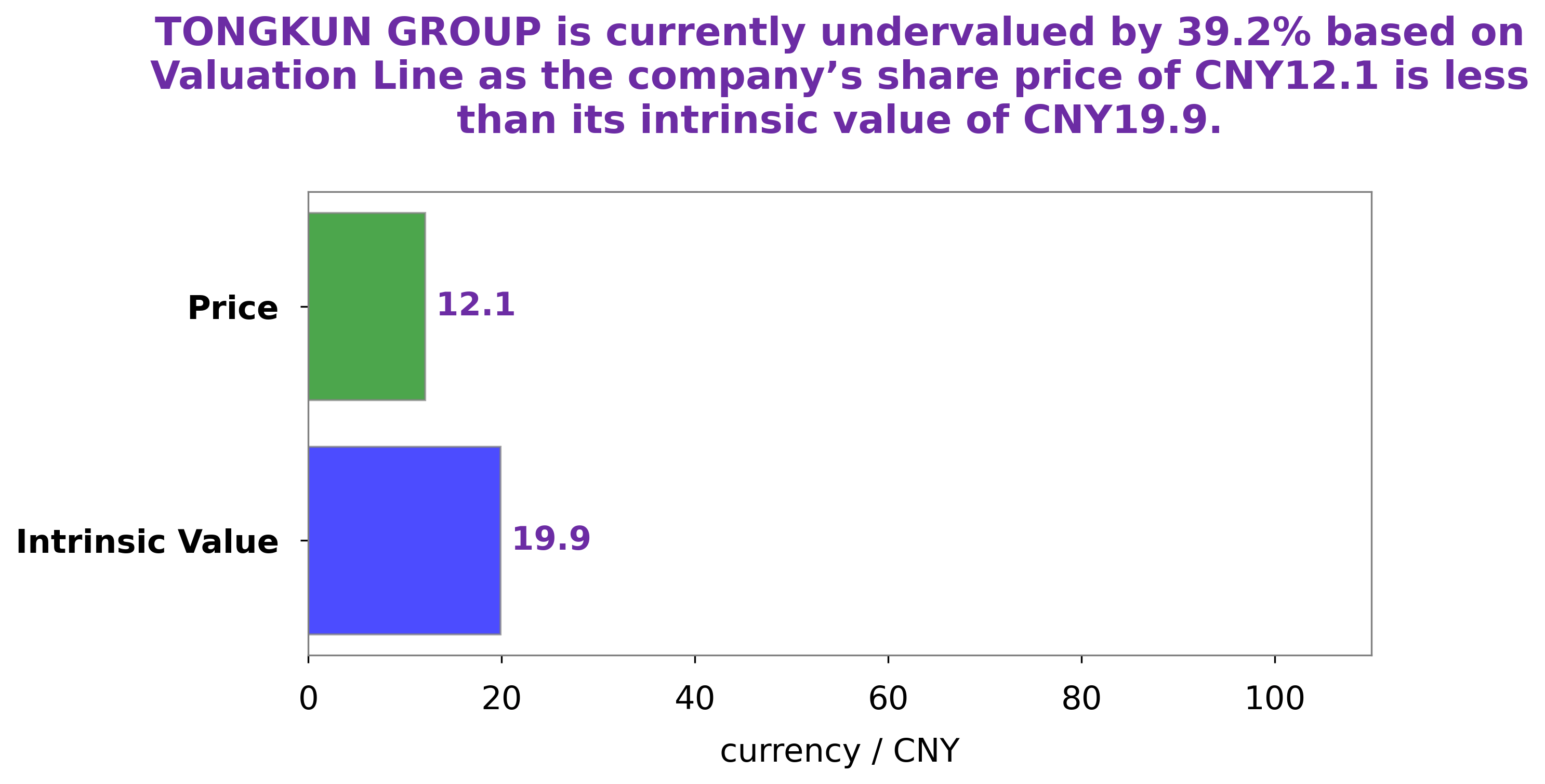

At GoodWhale, we recently conducted an analysis of TONGKUN GROUP‘s wellbeing. We determined that the fair value of TONGKUN GROUP share is around CNY19.9, which was calculated using our proprietary Valuation Line. Currently, TONGKUN GROUP stock is being traded at CNY12.1, which represents a significant undervaluation of 39.1%. As such, we believe that now may be a great opportunity for investors to purchase shares in TONGKUN GROUP. More…

Peers

It operates in a highly competitive industry, with major competitors such as Huafu Fashion Co Ltd, Anhui Huamao Textile Co Ltd, and Rishab Special Yarns Ltd. With operations in several countries around the world, Tongkun Group Co Ltd is well positioned to continue its global expansion and remain a leader in the textile and apparel industry.

– Huafu Fashion Co Ltd ($SZSE:002042)

Huafu Fashion Co Ltd is a well-established Chinese fashion and retail company. With a market cap of 5.2B as of 2023, it is one of the leading fashion companies in the country. The company also has a strong Return on Equity (ROE) of 7.41%, which indicates that it is performing well relative to its peers in the industry. The company provides customers with a wide range of products, including footwear, apparel, accessories, and other fashion items. It has also established a strong presence in the international market, offering products to customers in China and abroad. As such, Huafu Fashion Co Ltd is well-positioned to benefit from the growing demand for fashion retail and apparel in China.

– Anhui Huamao Textile Co Ltd ($SZSE:000850)

Anhui Huamao Textile Co Ltd is a Chinese textile company that produces a variety of fabrics, apparel, and accessories. The company has a market capitalization of 3.55B as of 2023, indicating the value of the company’s outstanding shares. Additionally, Anhui Huamao Textile Co Ltd has a Return on Equity of -0.05%, which measures the level of profitability relative to the amount of equity held by shareholders. This suggests that the company is not generating enough profits to cover the cost of its equity.

– Rishab Special Yarns Ltd ($BSE:514177)

Rishab Special Yarns Ltd is a textile company, specializing in the production of high-quality yarn products. As of 2023, the company has a market cap of 116.97M, and a Return on Equity of -20.01%. This indicates that the company’s current stock price is lower than its book value and is not generating satisfactory returns on its investments. The market cap of Rishab Special Yarns Ltd reflects the overall performance of the company, and the negative ROE highlights potential risks associated with investing in the company.

Summary

Tongkun Group is a leading Chinese polyester fiber manufacturer. The company has experienced steady growth over the last few years, posting strong profits and increasing its market share. The company is well-positioned in terms of technology, resources, and competitive advantages, making it a great investment opportunity for those wanting to capitalize on the booming polyester fiber industry.

Analysts have projected that the industry will experience significant growth in the near future, particularly with China continuing to be a major producer of polyester fiber. With its established infrastructure and resources, Tongkun Group is expected to benefit from this growth, delivering attractive returns to investors.

Recent Posts