Toast Stock Fair Value Calculator – Bank of America Sees Upside in Toast’s Stock, Gains Follow

June 2, 2023

☀️Trending News

Bank of America recently gave a positive outlook for Toast ($NYSE:TOST)’s stock, and the market responded quickly. Toast is a rapidly growing restaurant technology company that provides restaurants with an all-in-one platform for managing their operations, from guest and employee engagement to back-of-house management. The company has seen immense success in recent years as its products have become increasingly popular with restaurants around the world. Following Bank of America’s positive outlook for Toast’s stock, the market reacted favorably with immediate gains.

Investors have noted that the company’s valuation is poised to rise in the coming months, and they are taking advantage of the opportunity to buy low and sell high. The optimism surrounding Toast’s stock has also been driven by a strong financial quarter, which yielded impressive growth in both revenue and profits. As Toast continues to expand its market share, investors are betting that its stock will only continue to rise.

Price History

On Thursday, Bank of America analysts upgraded their outlook on TOAST stock to “buy” from “hold”, citing upside potential in the company. Following this upgrade, TOAST stock opened at $21.2 and closed at $21.6, representing an increase of 2.9% from the previous closing price of $21.0. Market analysts attribute this rise in stock price to the improved outlook on the company’s prospects and the positive sentiment generated by the Bank of America upgrade. Toasts_Stock_Gains_Follow”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Toast. More…

| Total Revenues | Net Income | Net Margin |

| 3.02k | -333 | -11.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Toast. More…

| Operations | Investing | Financing |

| -164 | -137 | 57 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Toast. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.79k | 697 | 2.08 |

Key Ratios Snapshot

Some of the financial key ratios for Toast are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 60.1% | – | -12.4% |

| FCF Margin | ROE | ROA |

| -6.8% | -21.3% | -13.1% |

Analysis – Toast Stock Fair Value Calculator

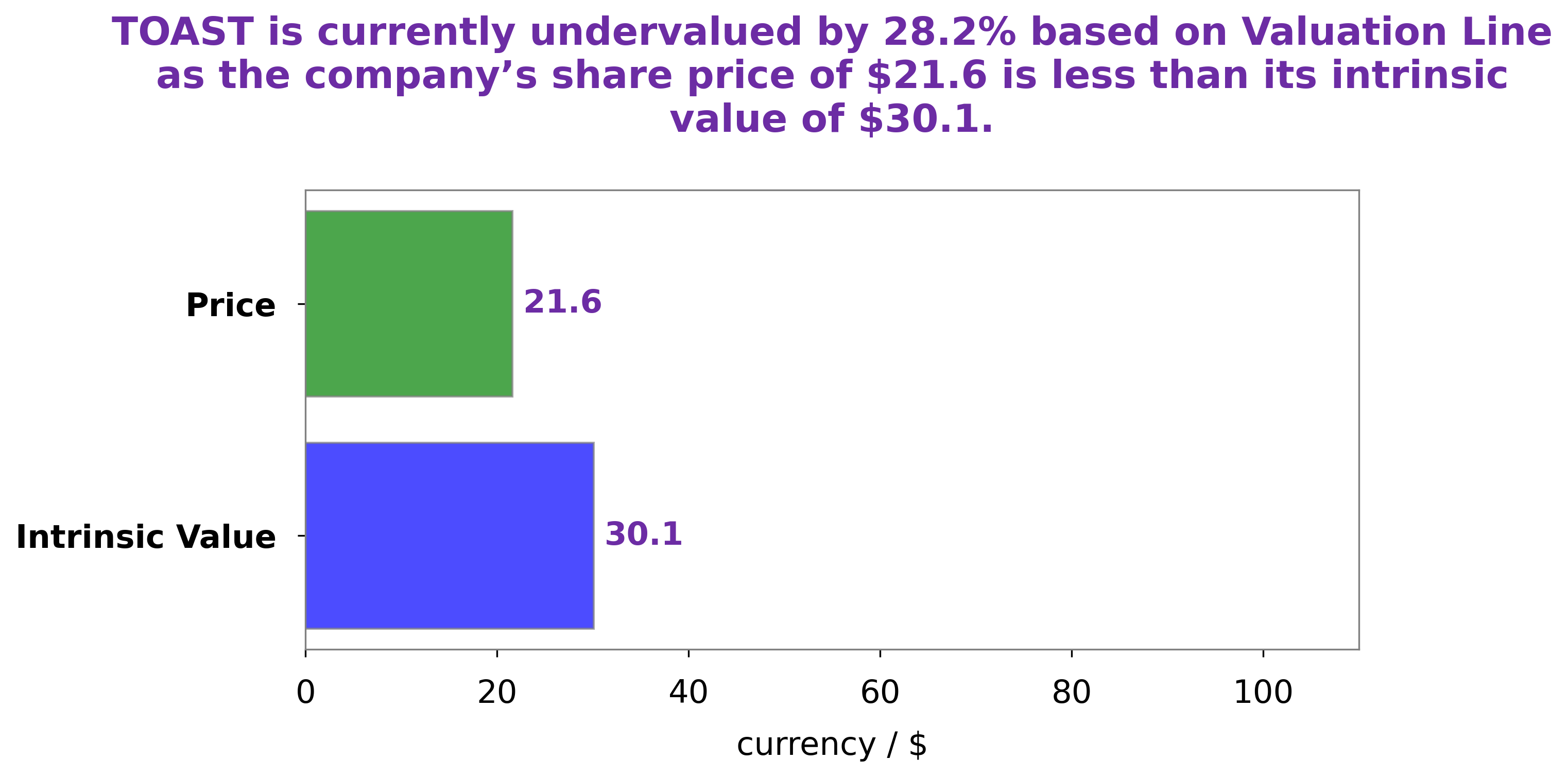

At GoodWhale, we have conducted an in-depth analysis of TOAST to determine its fair value. Our proprietary Valuation Line indicates that the fair value of each TOAST share is around $30.1. Currently, TOAST shares are being traded at $21.6, indicating that the stock is undervalued by 28.2%. Investing in a stock that is undervalued provides the opportunity to make tremendous profits when the stock price returns to its fair value. We recommend investors to closely monitor the fundamentals of TOAST with the analysis provided by GoodWhale and take advantage of the opportunities when the stock is undervalued. Toasts_Stock_Gains_Follow”>More…

Peers

In the market for point-of-sale (POS) systems, there is intense competition among a few major players. Toast Inc, GreenBox POS, Rs2 Software PLC, and Hank Payments Corp are all vying for a share of the market. All of these companies offer POS systems that are feature-rich and competitively priced.

– GreenBox POS ($NASDAQ:GBOX)

PLC is a publicly traded company with a market capitalization of 266.3 million as of 2022. It has a return on equity of 6.98%. PLC is engaged in the development, manufacture and sale of software products and services. The company’s products and services are used by businesses and organizations of all sizes, in a variety of industries, including healthcare, financial services, manufacturing, retail, and education.

– Rs2 Software PLC ($LTS:0MVH)

Hank Payments Corp is a publicly traded company that provides mobile payment solutions. The company has a market capitalization of 4.02 million as of 2022. Hank Payments Corp’s primary product is Hanko, a mobile payment application that allows users to make payments using their smartphone. Hanko is available for both Android and iOS devices.

Summary

TOAST is a public company whose stock has recently been on the rise as Bank of America has provided favorable analysis and pointed to further upside potential. The company offers strong fundamentals and has seen steady growth in both revenue and earnings, making it an attractive long-term investment. Additionally, low debt levels and a generous dividend make it a more secure choice in volatile markets. Investors should assess their personal risk tolerance and financial goals before deciding if investing in TOAST is right for them.

Recent Posts