Texas Instruments Stock Fair Value Calculation – Texas Instruments Raises Over $1.6 Billion Through Investment Grade Notes

May 14, 2023

Trending News 🌥️

Texas Instruments ($NASDAQ:TXN) recently announced that it has successfully raised over $1.6 billion dollars through the sale of investment grade notes. The money obtained from this offering will be used to help finance the repurchase of over $2 billion of Texas Instruments’ common stock, as well as other general corporate purposes. Texas Instruments is a global semiconductor company that designs, manufactures and sells analog, embedded and connectivity products for customers in industrial and consumer markets. Texas Instruments is committed to serving its customers with the highest quality products and services, creating value for all shareholders.

Stock Price

The stock opened at $162.1 and closed at $161.9, a 0.4% increase from the last closing price of 161.2. The success of the bond offering is a sign of strong demand for TI’s debt as investors are confident in their long-term growth prospects. The proceeds will be used to finance TI’s general corporate purposes, including repaying existing debt and share repurchases. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Texas Instruments. More…

| Total Revenues | Net Income | Net Margin |

| 19.5k | 8.22k | 43.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Texas Instruments. More…

| Operations | Investing | Financing |

| 7.74k | -1.89k | -4.88k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Texas Instruments. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.22k | 13.98k | 16.8 |

Key Ratios Snapshot

Some of the financial key ratios for Texas Instruments are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.4% | 18.6% | 49.6% |

| FCF Margin | ROE | ROA |

| 22.6% | 40.6% | 20.7% |

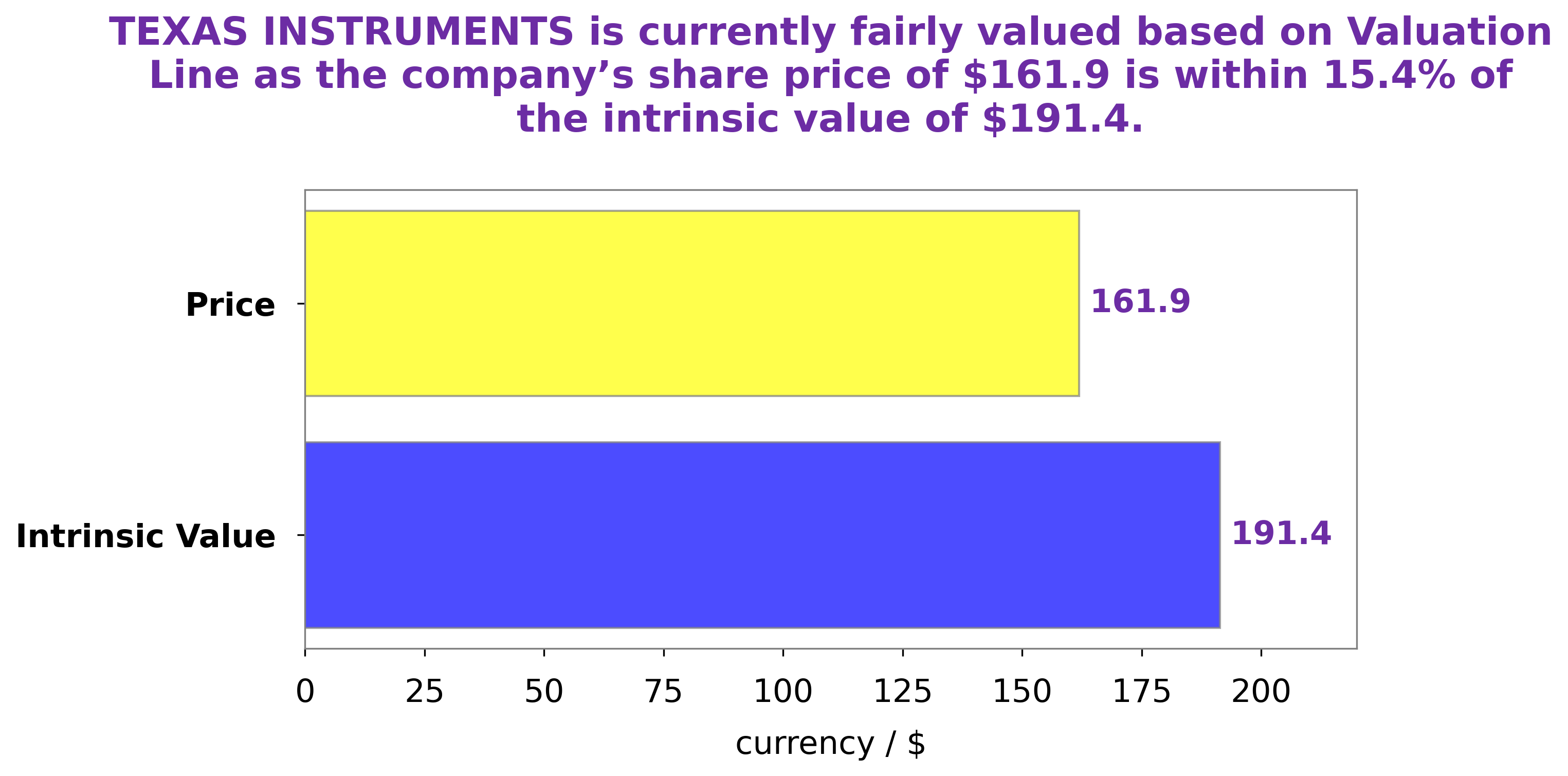

Analysis – Texas Instruments Stock Fair Value Calculation

At GoodWhale, we recently conducted an analysis of TEXAS INSTRUMENTS‘s wellbeing. Our proprietary Valuation Line found that the intrinsic value of TEXAS INSTRUMENTS stock is around $191.4. However, currently TEXAS INSTRUMENTS stock is trading at $161.9, which indicates that it is undervalued by 15.4%. This presents an attractive opportunity for investors to purchase this stock at a discounted price. More…

Peers

Texas Instruments Inc is one of the leading semiconductor companies in the world. Its competitors include SK Hynix Inc, Silergy Corp, and SPEL Semiconductor Ltd. Texas Instruments has a wide range of semiconductor products that are used in a variety of electronic devices.

– SK Hynix Inc ($KOSE:000660)

SK Hynix Inc is a South Korean company that manufactures and markets semiconductor memory products. The company has a market capitalization of $63.88 trillion as of 2022 and a return on equity of 15.68%. SK Hynix is the world’s second-largest manufacturer of dynamic random-access memory (DRAM) chips and the fifth-largest manufacturer of NAND flash memory chips. The company’s products are used in a variety of electronic devices, including computers, mobile phones, digital cameras, and game consoles.

– Silergy Corp ($TWSE:6415)

Silergy Corp is a global leader in the development and manufacture of high-performance, energy-efficient semiconductor solutions. The company’s products are used in a variety of applications, including mobile devices, computing, networking, and storage. Silergy Corp has a market cap of 159.26B as of 2022, a Return on Equity of 18.65%. The company’s products are used in a variety of applications, including mobile devices, computing, networking, and storage.

– SPEL Semiconductor Ltd ($BSE:517166)

SPEL Semiconductor Ltd is a fabless semiconductor company that designs, develops, and markets analog and mixed-signal integrated circuits (ICs) for a range of applications in the automotive, industrial, consumer, and computing markets. The company has a market cap of 2.66B as of 2022 and a Return on Equity of -6.07%. SPEL’s products include power management ICs, audio ICs, motor control ICs, and LED driver ICs. The company was founded in 1995 and is headquartered in Noida, India.

Summary

Texas Instruments (TI) recently raised $1.6 billion through the sale of investment grade notes. The proceeds of the offering are expected to be used for general corporate purposes and to pay down existing debt. The investment grade notes are rated A3 by Moody’s and A- by Standard & Poor’s, indicating a high degree of creditworthiness.

TI has a long-term track record of financial strength and prudent capital management, which will support its ability to repay the notes and other debts when due. TI’s successful note offering is a positive sign for investors, showing confidence in the company’s financial stability and outlook.

Recent Posts