Targa Resources Stock Intrinsic Value – Analysts Unanimous in Recommending Targa Resources Corp. Stock as a Buy

July 7, 2023

🌥️Trending News

Targa Resources ($NYSE:TRGP) Corp. is a publicly traded company that focuses on the gathering, processing, and transportation of natural gas, oil, and refined products. Recently, fourteen analysts have unanimously chosen to recommend its stock as a buy. These analysts have cited several reasons for their consensus rating, such as the company’s strong financial performance, the value of its assets, and its potential for future growth. It has consistently delivered strong financial results and achieved robust earnings growth. Its balance sheet is also very strong, with healthy ratios of debt-to-equity and debt-to-capital. Furthermore, the company has a diversified portfolio of assets that provides it with significant cash flow.

Finally, Targa Resources Corp. has significant upside potential for future growth. Its shares are currently trading at a discount to their peers’, providing investors with an opportunity to purchase the stock at an attractive price. The company is also looking to expand its business in new markets and acquire additional assets that can generate greater profits. Investors should take note of this positive sentiment and consider investing in the company’s shares.

Stock Price

Analysts have been unanimous in their recommendation that investors should buy the stock of Targa Resources Corp. On Monday, the stock opened at $76.2 and closed at $77.0, an increase of 1.2% from its previous closing price of 76.1. This is the latest in a series of positive indications from analysts that the stock of the company is showing signs of growth and should be seen as a viable investment option. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Targa Resources. More…

| Total Revenues | Net Income | Net Margin |

| 20.49k | 890 | 5.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Targa Resources. More…

| Operations | Investing | Financing |

| 2.8k | -4.43k | 1.71k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Targa Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.03k | 14.61k | 11.28 |

Key Ratios Snapshot

Some of the financial key ratios for Targa Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 34.5% | 45.3% | 12.9% |

| FCF Margin | ROE | ROA |

| 5.8% | 63.5% | 8.7% |

Analysis – Targa Resources Stock Intrinsic Value

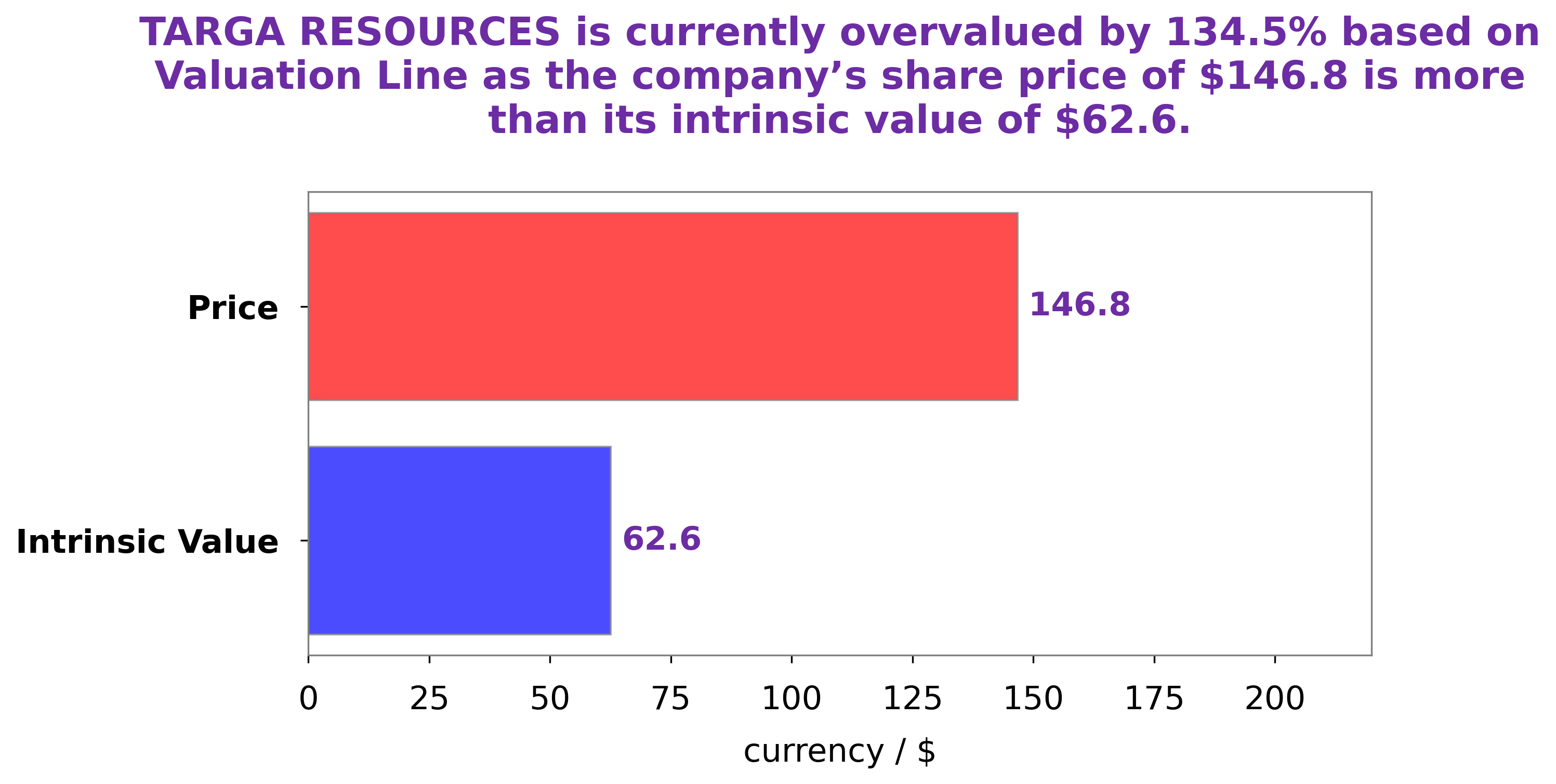

At GoodWhale, we have conducted an in-depth analysis of the wellbeing of TARGA RESOURCES. After our thorough research and proprietary Valuation Line, we have come to the conclusion that a fair value of TARGA RESOURCES share is around $65.2. Despite this, the stock is currently traded at $77.0 – which means it is significantly overvalued, by 18.2%. We hope that our research will help investors make more informed decisions and achieve better returns. More…

Peers

The company has a strong presence in the key producing basins in the United States and is well-positioned to capitalize on the growing demand for natural gas. Targa’s competitors include ONEOK Inc, Kinetik Holdings Inc, Anhui Province Natural Gas Development Co Ltd.

– ONEOK Inc ($NYSE:OKE)

ONEOK Inc is a leading midstream service provider in the United States. It has a market cap of 24.61B as of 2022 and a Return on Equity of 28.78%. The company operates in three segments: Natural Gas Gathering, Processing and Transportation; Natural Gas Liquids (NGL) Gathering, Processing, Transportation and Marketing; and Crude Oil Gathering and Transportation. ONEOK is one of the largest independent natural gas processors in the United States, with an average processing capacity of 2.6 billion cubic feet per day in 2020. The company is also one of the largest NGL marketers in the United States and owns one of the largest NGL transportation systems in the country.

– Kinetik Holdings Inc ($NASDAQ:KNTK)

Kinetik Holdings Inc is a publicly traded company with a market capitalization of $1.49 billion as of 2022. The company has a return on equity of 5.46%. Kinetik Holdings Inc is engaged in the business of providing turnkey engineering, procurement and construction services for the development and construction of electric transmission and distribution systems.

– Anhui Province Natural Gas Development Co Ltd ($SHSE:603689)

Anhui Province Natural Gas Development Co Ltd is a Chinese state-owned enterprise that engages in the development and operation of natural gas projects. The company has a market cap of 3.45 billion as of 2022 and a return on equity of 7.42%. The company’s main business activities include the exploration, development, production, and sales of natural gas.

Summary

Targa Resources Corp. is a stock that has been met with positive investor sentiment. Analysts that have evaluated the stock have given it a consensus rating of “Buy”. Many investors view it as a great opportunity to add to their portfolio. The company operates in the energy infrastructure sector and is known for its midstream services such as natural gas gathering, processing, and transportation, as well as storage, fractionation, and marketing of natural gas liquids.

With an established foothold in its industry, Targa Resources has potential for solid growth in the future. Its stock price has been trending upwards and many investors see it as a good long-term investment.

Recent Posts